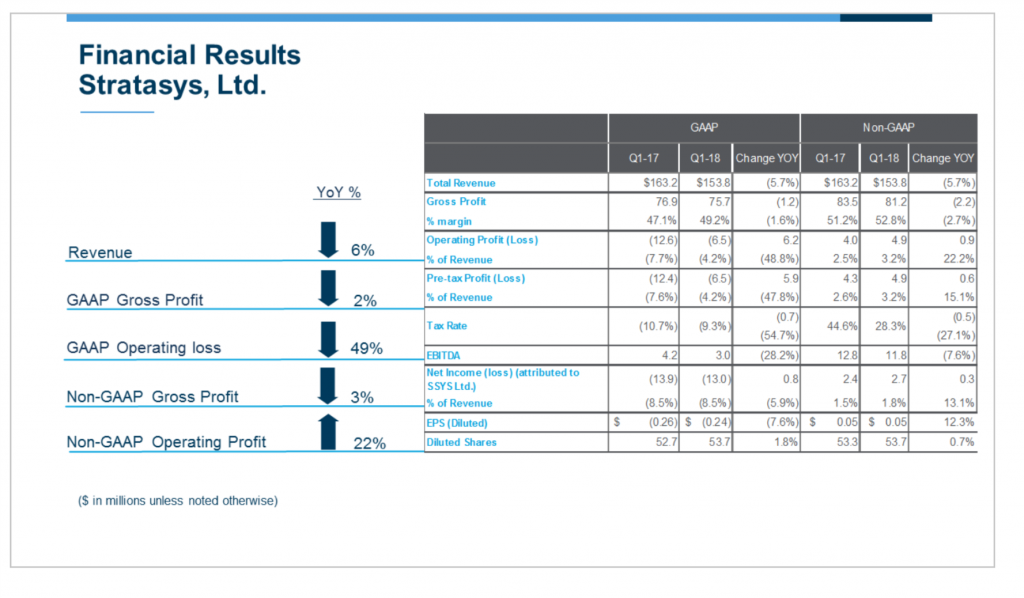

Headline revenue for Q1 2018 at Stratasys (NASDAQ: SSYS) fell by 6% to $153.8 million versus $163.2 million for the comparative period in 2017.

On today’s call with investors and analysts, CEO Ilan Levin faced a series of challenging questions. “We are disappointed with our revenue for the first quarter, which is primarily attributed to underperformance in North America related to high end system orders, specifically from customers in government and other key verticals such as aerospace and automotive,” said Levin.

In pre-market trading the share price of Stratasys was down by 10%. The market value of other listed 3D printing enterprises, including 3D Systems who report Q1 numbers later today, also fell. With one of the global 3D printing leaders reporting weaker performance, does the performance Stratasys reflect the wider 3D printing industry?

3D printing now strategic

Levin made the point several times during the call that the additive manufacturing market is strong, and that a growing number of enterprises view industrial 3D printing as a strategic necessity.

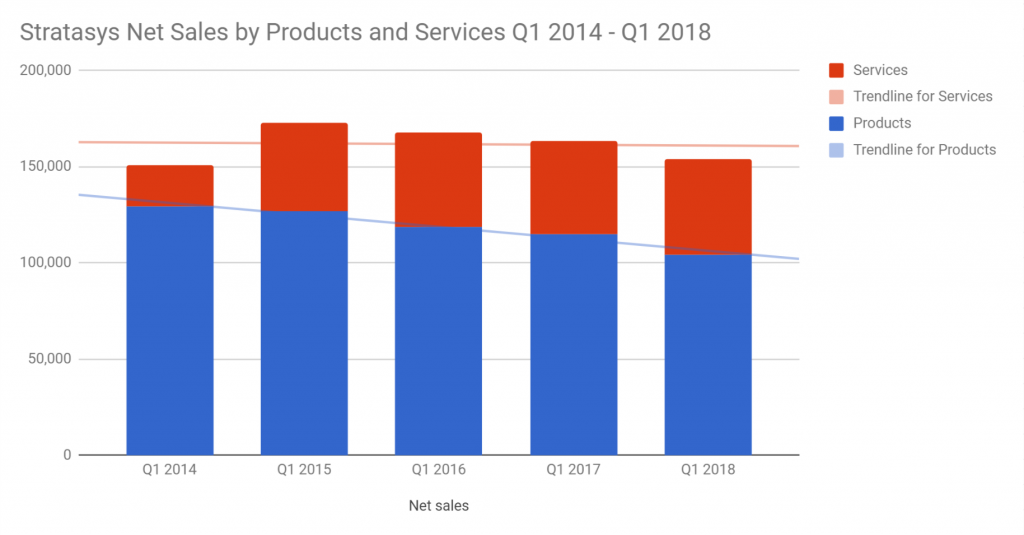

Yet despite these factors, net sales at Stratasys continue to fall, and rather than a blip on an otherwise upward trajectory – the reverse appears to be the case. First quarter data for product sales has declined in every period since 2014.

There is speculation as to whether the most recent decline was due to macro economic factors, for example the brewing tariff war with China that could potentially hit aerospace hard. Other factors include the growing sophistication of the end user.

Responses offered by Levin included that the slowdown was not related to pace of orders, but more question of timing. The CEO remains confident can regain the high-end aerospace and automotive sales, but would not be drawn on whether Q2 numbers would reflect this.

For high-end sales Stratasys must invest a significant amount of time in working with the customer, and success on any eventual deal will be a result of combined direct and channel sales.

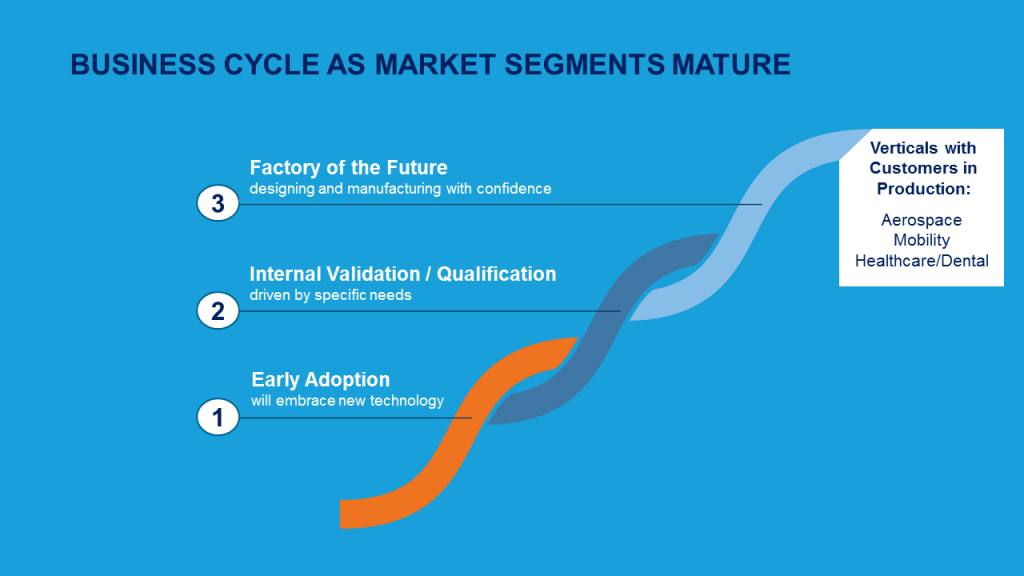

Levin noted that half of systems go to existing customers, plus these existing customers spend more. This statement reflects the progress in the AM adoption cycle as customers move through qualification and certification process, whereby once customers for high-end systems have completed testing they will return to purchase machines – and consumables- at a higher volume.

However, “There are only so many repeat customers for FDM and Material Jetting systems for prototyping applications, making that part of Stratasys’ business the weakest link in terms of year-over-year recurring revenue,” commented industry analyst and consultant Dayton Horvath.

An increasingly competitive landscape

The qualification and certification process can span many years, and as this is specific to the additive manufacturing system used a certain amount of lock-in exists, meaning that major aerospace or automotive customers would not be quick to move to other system manufacturers. However, there are certainly a growing number of enterprises addressing the the industrial 3D printing sector. Levin noted that the competitive landscape now has a wider variety of manufacturers, but pointed out that these newer entrants are less understood by potential customers who may still be trying to understand what their 3D printing “toolbox” should look like.

Only a short time ago the range of industrial 3D printing solutions was limited. Now, a prospective Stratasys customer may now look at 3D printers from AON3D, INTAMSYS, Roboze, or forthcoming products from Essentium and others. “Potential new customers are now getting a taste for lower cost production-oriented systems, a trend that will continue as even more high quality low cost industrial systems reach the market with short-run production as the goal,” notes Horvath.

Experience versus agility

It may seem harsh, but while Stratasys has long blazed a trail – first bringing the technology to market, then educating users about applications and essentially laying the groundwork – as is often the case the first mover does not always triumph.

Having been in the industry from day-one means that in addition to the depth of experience at Stratasys, the company also carries baggage. While expenses and margins are relatively stable and represent continued attention to “operational discipline”, what unifies the more recent crop of market entrants (Carbon, Desktop Metal, HP) is a focus on only one or two top-level products.

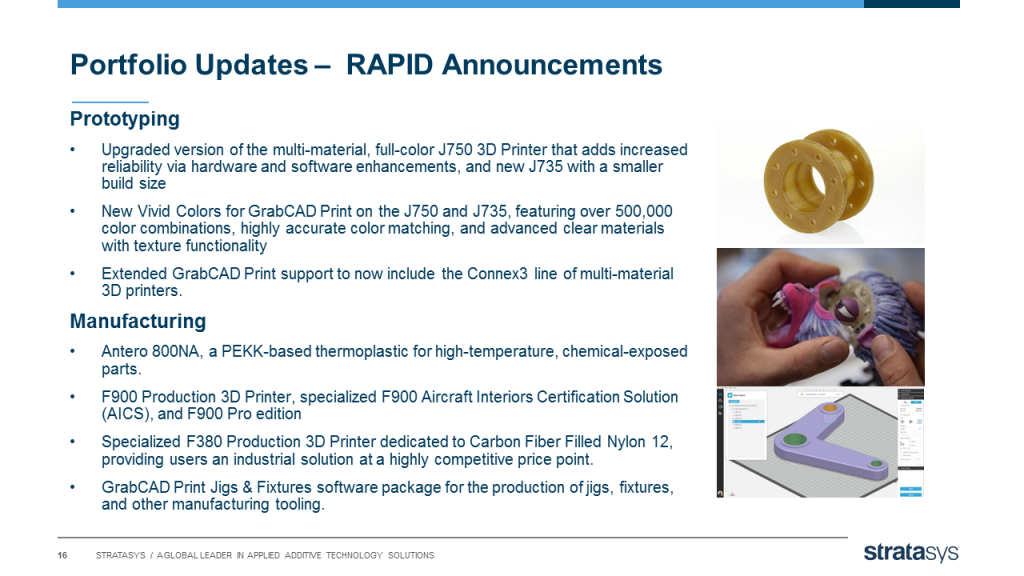

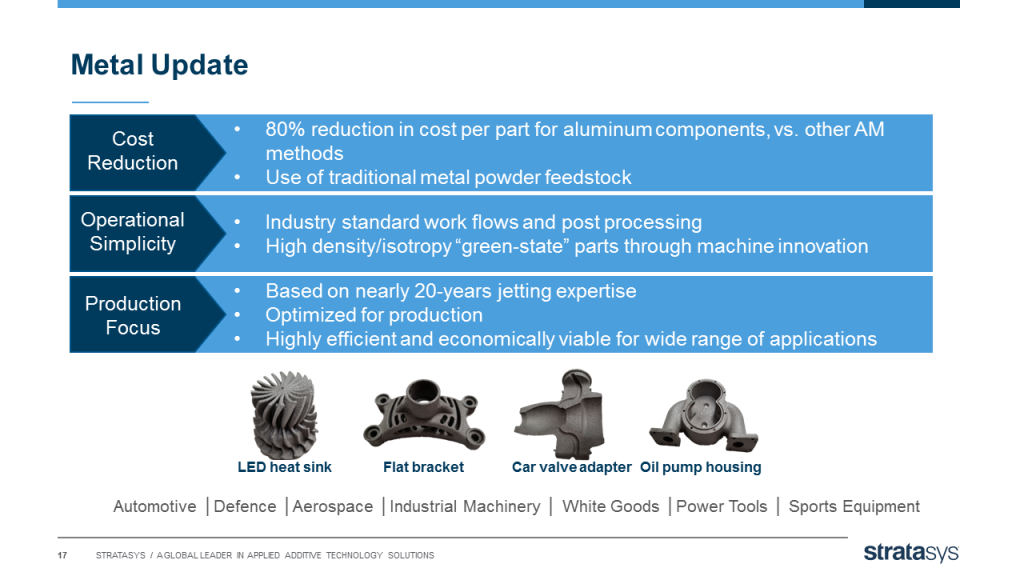

Stratasys R&D spend was $25.1 million, up 1.9% on the comparative. The results of this investment in the future are both new products (e.g. metal AM), improvements to existing lines (a wider color palette for GrabCAD/J750 and J735, Jigs & Fixtures software) and the recent announced spin-out of Evolve Additive Solutions.

No update on the H2000 aka infinite build was given on today’s call, however Levin did appear to hint at a possible update to the MakerBot product line.

Whether leaner, more agile companies are able to carve out a position in the expanding 3D printing industry without eating into Stratasys’ sales remains to be seen. One potential hurdle for such newcomers is the well established sales channel developed by Stratasys.

While the bottom-line of any accounting data can contain a host of estimations, adjustments and general obfustication, cursory analysis does highlight some interesting points. From total sales in Q1 2014 of $150.9 million, Stratasys made a gross profit of $77.7 million and net income of $4.1 million. In 2018, sales show a 1.88% increase on the 2014 comparative and gross profit is down by 2.75%. However it the net income position that has shifted the most during that time, with the 2018 figure $17.2 milion lower than the figure in 2014.

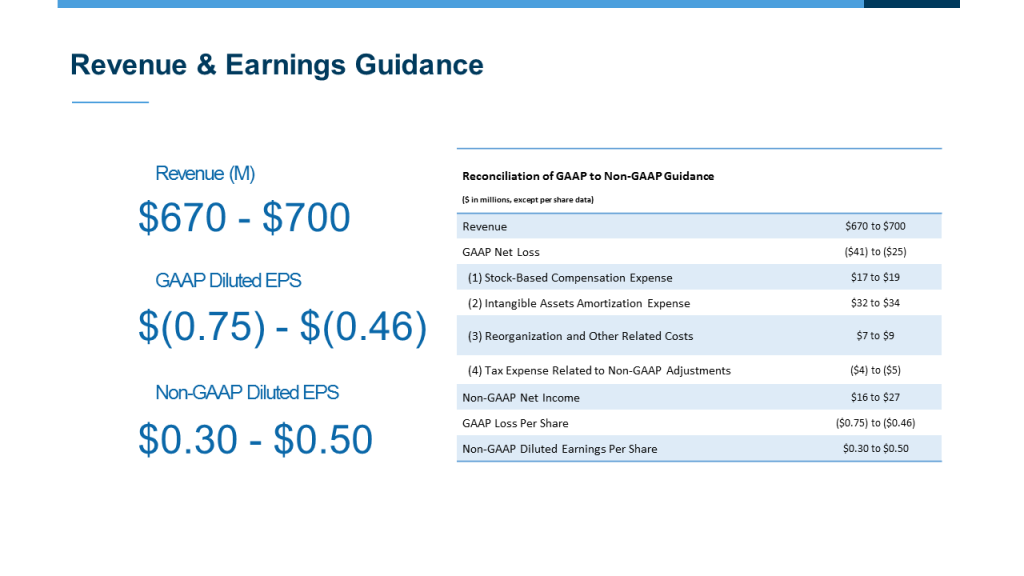

Stratasys remains confident and re-iterated financial guidance for year with full year 2018 revenue in the range $670 to $700 million, a GAAP net loss of $41 to $25 million, and Non-GAAP net income of $16 to $27 million.

Full details of Stratasys’ first quarter 2018 financial results are available here.

For more of the latest additive manufacturing insights subscribe to our daily 3D Printing Industry newsletter, follow us on Twitter, and like us on Facebook.

Find talent for a project, or advance your career in 3D printing. The 3D Printing Jobs board is live – registration is free for employers and job seekers.

Vote now for the leading industrial additive manufacturing systems in the 2018 3D Printing Industry Awards.

Featured image shows a metal 3D printed sample by Stratasys. Photo by Beau Jackson