The nominations for the 2021 3D Printing Industry Awards are now open. Who do you think should make the shortlists for this year’s show? Have your say now.

Sam O’Leary, CEO of German 3D printer manufacturer SLM Solutions (AM3D), has said that he expects “business to continue to pick up” during H2 2021, after the firm reported flat revenue growth within its H1 2021 financials.

Over the first half of 2021, the company brought in €31.7 million, just €0.5 million more than the €31.2 million it reported in H1 2020. According to the firm, this figure is “in line with expectations,” but given that three months ago it projected “at least” 15% annual growth for FY 2021, its flat H1 performance now potentially leaves it with a mountain to climb.

For his part, O’Leary has highlighted SLM Solutions’ €30.2 million order backlog, which is 57% larger than the €19.2 million it reported after H1 2020, as a reason for optimism, and he retains that the easing of COVID restrictions could make it easier to translate into installations into sales, and ultimately attain significant growth.

“The easing of COVID-19-related meeting, travel and other restrictions due to increasing vaccination levels globally have improved overall operating conditions considerably,” said O’Leary. “The easier interaction with our customers compared to the first half of 2020, is well-reflected in the increase in our order intake and order backlog. We expect our business to continue to pick up over the coming months.”

SLM Solutions’ H1 2021

SLM Solutions broadly reports its revenue across two core segments: Machines and After Sales, with the former accounting for the majority of its income. During Q2 2021, the firm’s Machine division brought in €12.1 million, 21% more than the €10 million reported in Q2 2020, and this drove its overall quarterly revenue towards annual growth of 23%.

Likewise, SLM Solutions’ After Sales business grew from €3.3 million to €4.2 million over the same period, but the firm’s Q1 2021 revenue decline flattened its growth for H1 2021. Over the second quarter, the company actually reported “a continuation of the upturn in its business,” and while this isn’t yet visible in its revenue, its order intake rose by 80% to €24.7 million between H1 2020 and H1 2021.

In terms of EBITDA, however, SLM Solutions performed slightly better in H1 2020 than H1 2021, something it has attributed to ‘one-offs effects’ like loans, shorter working hours and the release of accruals. Due to supply chain challenges posed by the pandemic, the company has also decided to increase its inventory of critical parts, thus it concedes this could impact on its operating cash flow in H2 2021.

To raise further capital, SLM Solutions completed an oversubscribed stock offering during H1 2021, in which it issued €15 million worth of bonds, strengthening its balance sheet, and leaving it with €35.8 million in cash at the end of Q2 2021.

| SLM Solutions (€) | H1 2020 | H1 2021 | Difference (%) | H1 2019 | H1 2021 | Difference (%) |

| Revenue | 31.2m | 31.7m | +2 | 16.3m | 31.7m | +95 |

| EBITDA | -6m | -6.2m | -3 | -18.9m | -6.2m | +67 |

| Order Intake | 13.7m | 24.7m | +80 | 20.8m | 24.7m | +19 |

| Order Backlog | 19.2m | 30.2m | +57 | 14.6m | 30.2m | +107 |

An NXG-centric backlog

In addition to driving order growth during Q2 2021, SLM Solutions also widened its portfolio in a way that could help it continue to attract clients moving forwards. On the IP front, the firm patented its proprietary ‘multi-laser overlap’ technology in Europe, while its newly-launched ‘Free Float’ software has now been made available to its entire user base, allowing them to engage in enhanced support-free printing.

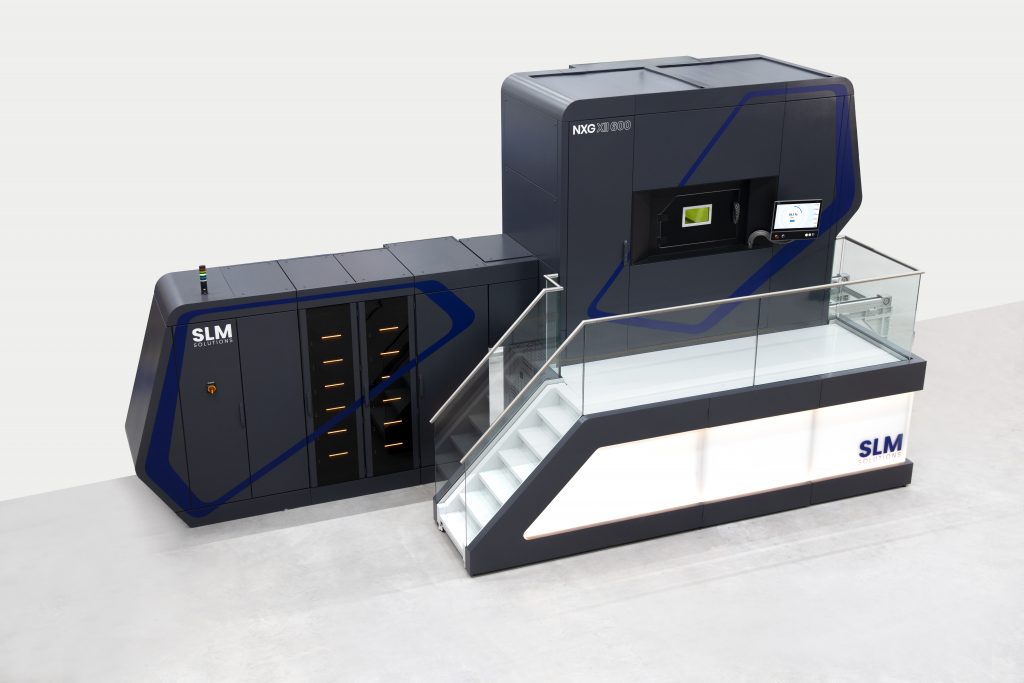

In the U.S, meanwhile, the company is preparing to open a new West Coast facility, which will house NXG XII 600, SLM 500 and SLM 280 systems, and focus on nickel-based aerospace superalloy R&D. Once operational in Q4 2021, the facility will also offer rapid spare part printing services, in a U.S. market that makes up 30% of the firm’s demand, and its sales there are now expected to triple by 2025.

With regards to SLM Solutions’ backlog, much of its demand has depended on its flagship NXG XII 600 3D printer, and it signed a Memorandum of Understanding (MoU) for a machine sale with a U.S. aerospace firm last quarter. The company also received a repeat order from a longstanding automotive client, and is engaged in MoU negotiations with two other clients, that it hopes to wrap-up in Q3 2021.

In total, Q2 saw the firm receive four purchase orders, one of which has been fulfilled, as well as installing a beta system, signing six more MoUs and receiving three reservation payments, which haven’t yet been included in its backlog. As a result, O’Leary has hailed the NXG XII 600’s success, saying that it has passed key “technical and commercial milestones,” as well as driving strong client demand.

“For the years after 2021, the NXG XII 600 is evolving as intended as the important driver of SLM’s further growth,” added O’Leary. “From our point of view, these encouraging dynamics on the sales side illustrate that the NXG XII 600 is well underway to become the laser powder bed fusion system of choice for key players in the aerospace, automotive and energy sectors.”

Still on-track for annual growth?

Looking ahead to H2 2021, SLM Solutions expects to convert €21 million of its backlog into sales and generate around €8 million in After Sales. When these orders are added to the €31.7 million the firm reported for H1 2021, it therefore only needs to bring in another €10 million in sales, to reach its annual revenue target of €71 million, which would constitute annual growth of 15%.

Given that the company also anticipates completing “multiple larger projects” during H2 2021, O’Leary says that it’s now not only well-positioned to achieve its FY 2021 targets, but to attract enough orders to fill its 2022 production capacity by the end of the year.

“We only require around €10 million of convertible orders in the second half of 2021 to achieve the low end of our guidance,” concluded O’Leary. “If we look at our orders pipeline for the second half, and also consider our historical performances, we remain confident of meeting our guidance… and expect to have a level of backlog by the end of the current year that covers the entire capacity for 2022.”

The nominations for the 2021 3D Printing Industry Awards are now open. Who do you think should make the shortlists for this year’s show? Have your say now.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper-dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, de-briefs and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows SLM Solutions’ world headquarters. Photo via SLM Solutions.