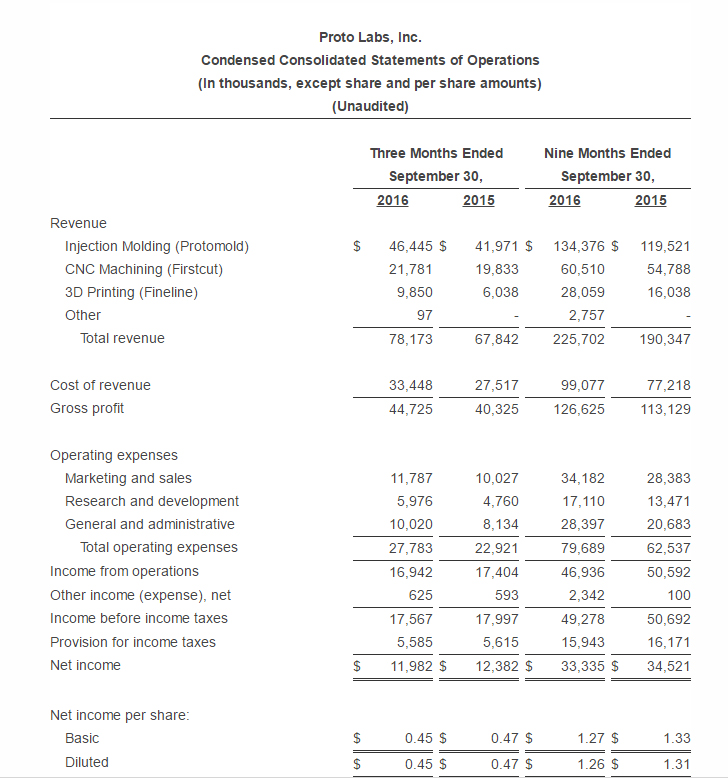

On their Q3 earnings call with investors this morning Proto Labs (NYSE:PRLB) reported an increase in sales and revenue. Total revenue was $78.1 million for the three months ending 30 September 2016 and earned the “world’s fastest digital manufacturing source” $44.7 million in gross profit and $11.9 million net income.

Product on demand and prototyping bureau Proto Labs report revenue across three segments, Injection Molding (under the brand Protomold), CNC Machining (Firstcut) and 3D Printing (Fineline). All segments increased revenue in comparison to the prior year period. 3D Printing services generated $9.9 million (Q3’15 $6.0 m) in sales and across all segments gross margins improved by improved by 80 basis points.

In early trading Proto Labs stock was down to $46.50 from yesterdays close of $51.40, a 10% fall.

Vicki Holt, Proto Labs’ President and CEO, was joined by John Way from investor relations on a call with analysts and investors to discuss the results.

3D printing trends at Proto Labs

“There is uncertainty in the market right now due to the election in the United States and Brexit in Europe and that uncertainty is impacting the economy. Our business is not immune to that impact,” said the CEO.

Furthermore, the company explained they were seeing the affect of holidays taken in Europe during August in the Q3 results. October orders have been slow across the board, but generally customers are coming from “the same end markets as seen before.”

However, 3D printing, while a smaller percentage of the business than traditional CNC manufacturing and injection molding is growing. Some customers are trading “down to 3D printing” from Proto Labs CNC plastic services explained Holt on the call. In the CNC milling business the plastics versus metal mix is “skewed more heavily towards metals than plastics” with metals making up two thirds of the business. As we previously reported, 3D printing in the desktop market is also enjoying strong performance.

The company anticipate long term gross margins “in the high 50s to low 60s” and net margins of 20%. On the analyst call they cautioned that due to changes in the operating expense there “might be a short term uptick in sales cost” but advised they looking at controlling costs of R&D and other expenses.

Building a sales team to grow the business

Holt gave an update on the search for a CRO and spoke about changes in the sales organization. “The CRO search is going really well. It’s a great business model we have. We’re in the final stages of whittling down the candidate. We’re changing the skill profile of the rep we are looking for. We’re also using a more disciplined sales tracking process, using salesforce.com and have started a 7 modules sales training process.” The CRO will be announced in early 2017.

When asked about selling and marketing as a percentage of sales John Way from Proto Labs investor relations said “We are continuing to invest, a little bit will depend on the timing of when we bring people in but we are expecting this to increase.” Way confirmed the selling and marketing costs would be between “16%-17% of sales.“

“With the high margin and on-demand nature of business there are limited short term costs to eliminate without damaging the long term,” explained Way.

The financial statements for Proto Labs in Q3 can be found here.

Be sure to subscribe to our newsletter and be the first to receive updates on the 3D printing industry.