Prodways has reported financial results for the third quarter of 2018. Headline figures show, sales have increased by 95.3% fo the quarter – reaching €13.9M versus €7.1M in 2017.

For the first nine months of the year, Prodways sales were €41.5M. This is a significant increase of 90.5% over the same period last year. While the company does not publish the growth rate on the comparable basis, 3D Printing Industry approached Raphael Gorge, CEO of parent company Groupe Gorgé for comment. Gorge explained that the extraordinary performance of the was due to, “strong organic growth […] significantly reinforced by acquisitions.”

Prodways is an integrated European player operating with two divisions. The Systems division, comprises 3D software, 3D printers and related materials, and the Products division, comprising the design of parts on demand and medical applications. In the third quarter of 2018, the Systems division grew by 240% following the acquisition in the quarter of Solidscape and the contribution of the acquisition of Avenao.

Prodways revised upwards its 2018 sales target – plans further acquisitions

With strong revenue growth for the first nine months of 2018, and with the Solidscape acquisition in July 2018, Prodways is now expecting revenue to exceed €58M in 2018 compared with €53M previously announced.

As of end June 2018, total net cash was €32.2M. Since then the company used funds for the acquisition of Solidscape. Raphael Gorge, the executive chairman, is confident in the capacity of the group to acquire further businesses. This will help Prodways reach revenue close to €100M by 2020.

Prodays new CEO, appointed in October 2018, will need to convince shareholders

On the 10th of October 2018, Prodways announced the appointment of Olivier Strebelle as Chief Executive Officer. Strebelle previously occupied the position of Deputy CEO at Groupe Gorge, the parent company of the Prodways Group. Olivier has a strong background in engineering having graduated from Ecole Centrale Paris. He spent 10 years at McKinsey from 2004 until 2014 when he joined the Groupe Gorge. Raphael Gorge remains Executive Chairman.

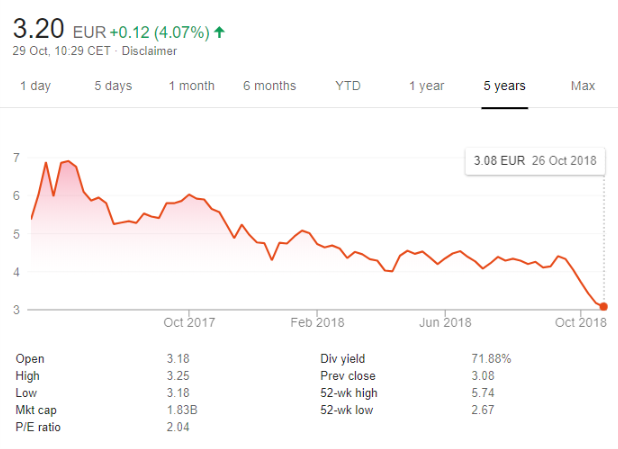

Since its IPO at €4.8 in May 2017, when the company raised €51M, the share price has lost 40% to stand just over €3 at the closing price on Friday the 26th of October 2018. The market capitalisation stands now at €150M.

Over the last 18 months, the company has made many acquisitions that need to be properly integrated to reassure the shareholders that this is the right strategy of growth. The acquisitions have brought the total of Intangibles and Goodwill to €42M at end June 2018, a level that could be nearing €50M with the consolidation of Solidscape in July 2018.

Prodways is 57% owned by public listed Groupe Gorge, a group founded 30 years ago by Jean-Pierre Gorgé, father of Raphael Gorge. Groupe Gorge is a diversified group operating in high tech industries. Over the last twelve months its share price has halved to a level not seen since end 2013. It’s reasonable to think that shareholders have expectations that Raphael Gorge, CEO at Groupe Gorge and Executive Chairman at Prodways will restructure Groupe Gorge and at the same time to fastly integrate all the 3D printing companies recently acquired by Prodways. Investors will be hoping that Olivier Strebelle, the new CEO, also brings focus, energy and a clear direction.

For more news on 3D printing, subscribe to our 3D printing newsletter. Also follow us on Twitter and Facebook.

If you are looking for a new career, please visit our 3D Printing Jobs.

Featured image shows Prodways high precision 3D printing. Photo by Michael Petch.