Nominations for the 2022 3D Printing Industry Awards are now open. Who do you think should make the shortlists for this year’s show? Let us know by casting your vote now.

French 3D printer manufacturer the Prodways Group (PWG) has reaffirmed its FY 2022 revenue guidance after seeing continued strong demand from within the dental 3D printing sector in Q3 2022.

As reported in its Q3 2022 financial results, Prodways brought in €17.2 million during the quarter, 4.9% more than it generated in Q3 2021 but €1.7 million less than it reported in Q2 2022. The firm’s year-on-year growth was driven by a large volume of orders from dental customers, while its quarter-on-quarter revenue decline was caused in part by delayed shipments, which will now happen in Q4.

“The third quarter was marked by a significant number of orders for 3D printers, some of which will be used for the orthodontics market and others in the production process of dental prostheses of all types,” reads a Prodways statement. “These latest orders are the first steps towards a wider application of 3D printing in the dental sector, beyond clear aligners. Thanks to its commercial successes Prodways confirms its 2022 guidance, both in terms of revenues and profitability.”

| Financials (€) | Q3 2021 | Q3 2022 | Difference (€) | Difference (%) | Q2 2022 | Q3 2022 | Difference (€) | Difference (%) |

| Systems | 9.7m | 9.2m | -0.5m | -5.1 | 11.1m | 9.2m | -1.9m | -17.1 |

| Products | 6.7m | 8m | +1.3m | +19.7 | 7.9m | 8m | 0.1m | +1.3 |

| Revenue | 16.4m | 17.2m | +0.8m | +4.9 | 18.9m | 17.2m | -1.7m | -9.0 |

Prodways’ Q2 2022 financials

Since Prodways was spun-out by Groupe Gorgé in late 2021, the company has reported its financials independently from its parent firm. That said, the business still reports its figures under the same Systems and Products categories, the latter of which was its fastest-growing in Q3 2022, generating €8 million, 19.7% more than the €6.7 million it managed in Q3 2021.

According to Prodways, the growth of its Products division, which includes its on-demand manufacturing services and integrated medical activities, was primarily driven externally, as just 8% of this was organic. In Germany and France in particular, the company says its activity in this space is “accelerating and continuing its positive momentum,” when it comes to winning new clients and netting large orders.

Demand for the firm’s offering in medical is also reportedly rising. Thanks in part to Prodways’ acquisition of Auditech, which has contributed revenue since July 1, 2022, its audiology income rose 45% over the quarter. With the further integration of this business, the firm anticipates being able to identify and act on “industrial synergies” that reduce delivery times and result in improved productivity.

By contrast, the revenue generated by Prodways’ Systems segment declined 5.1% from the €9.7 million it reported in Q3 2021, to €9.2 million. This, the company says, was due to a shift in deliveries, in addition to increased material consumption and a change in the seasonality of its software income. When adjusted for seasonal effects, the firm adds that its revenue rose 14% for the first nine months of 2022, an increase driven by machine and material sales, as well as overall software activity.

What next for Prodways?

Prodways raised its FY guidance after seeing record sales in H1 2022, and despite its revenue growth slowing down in Q3 2022, it’s still maintaining its outlook for the year. The company’s confidence in its guidance of “around 15% growth” on the €70.6 million it brought in during FY 2021, and an EBITDA of 15-20%, is based on multiple anticipated sales drivers.

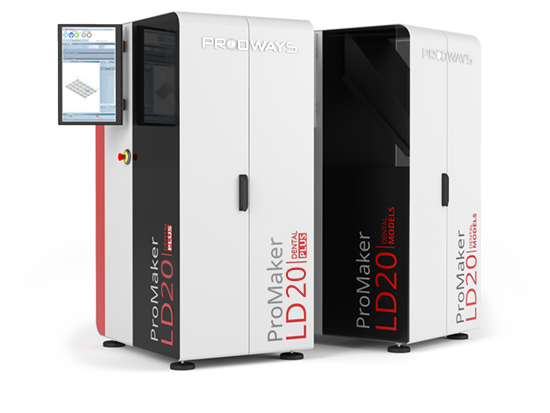

Chief among these are the ten MovingLight 3D printers that Prodways expects to deliver in the fourth quarter of 2022. While half these orders were placed by existing customers widening their production base, the others are set to be shipped to clients, including dental laboratories engaged in crown, bridge, implant or surgical guide 3D printing.

As Prodways’ own base has grown, so has its market for materials, and its Absolute Aligner is reported to be selling very well. This bodes well for the firm’s dental demand, with several of its existing customers also said to be planning an increase their consumption of 3D materials in 2023, to meet their respective orthodontic manufacturing needs.

With many oral prostheses still manufactured via traditional techniques, Prodways adds that “interest is starting to materialize with orders for printers from several dental laboratories.” What’s more, it now believes trends such as lab consolidation, in-sourcing, the quality of its machines compared to desktop counterparts and digital dentistry’s increasing affordability, will continue driving demand.

“The MovingLight technology, having proven itself in the field of orthodontics, now benefits from a good reputation with this type of customer, who will use it in the manufacturing processes of other types of products (crowns, bridges, surgical guides, removable dental prostheses, etc.),” Prodways adds in its statement. “This market could represent a significant new field of application for Prodways and constitute a growth driver beyond the clear aligners market.”

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

While you’re here, why not subscribe to our Youtube channel? featuring discussion, debriefs, video shorts and webinar replays.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows a batch of Prodways 3D printed dental aligners.