3D Systems has reported a decrease in revenue of 8% for the first quarter of 2019.

While the financial results are unlikely to bring joy to most shareholders, option trading analysis suggests at least one party may benefit from this weak performance.

A short introduction to options

Trading in options can be done for a variety of reasons, for example hedging risk or as a speculative move. At the fundamental level, an options contract is an agreement between two parties to buy or sell an asset – frequently shares in a company. Options are categorized as a derivative, in that it is unnecessary to own the asset (e.g the company stock) the option is based upon.

An options contract giving the right to sell an asset is referred to as a put, while the term call is used to describe the right to buy an asset. Option contracts may be either sold or bought. During the creation of an options contract both parties will agree to a number of terms including the term of the option and the strike price.

The term refers to the date when the option expires. The strike price is the value at which the option may be exercised.

A speculative investor who anticipates a price movement in companies share price can use options to increase potential returns. This is because the cost of an option is many times below that of individual shares.

For example, an individual or enterprise expecting a future rise in a companies share price – possibly due to securing a large order, regulatory approval of a new product or maybe a takeover by another company – can act on this theory by purchasing call options.

If the current share price is $10 and expected to rise to $15 following the favourable news, such an investor might buy call options with a strike price of $12. If the theory is correct and the share price does indeed rise to $15 then that investor will profit by $3 (less the cost of the option) on each call option purchased.

It is also possible profit from a decrease in share price.

Put options on 3D Systems

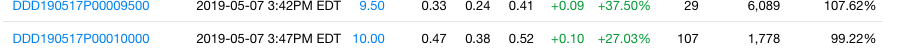

In the case of 3D Systems it appears that trading in put options is an approach currently active. Specifically the trade below made before Tuesday 7th May, and before the company announced disappointing financial results.

The data shows 6,089 open put options with a strike price of $9.50, expiring on May 17th. Immediately before the financial results were announced, 3D Systems’ share price was approximately one dollar higher at $10.50. Last Friday shares were trading above $11.

Each option contract represents 100 shares, so the open contracts for the May 17th/$9.50 x-price relate to 608,900 shares.

Average daily trading volume in 3D Systems’ shares is approximately 1.5 million shares – marking this trade as one of unusually high volume. The cost of the put options can be calculated as almost $140k – a sizeable investment to make and one many people would be unwilling to risk without some degree of certainty.

Pre-market trading shows that the share price of 3D Systems has fallen to $8.90. If this price is sustained when markets open this morning then the value of the put options will be in the region of $350,000 after trading costs – not bad for less than a week’s work.

Subscribe to the free 3D Printing Industry newsletter for all the latest additive manufacturing news.

You can also stay connected by following us on Twitter and liking us on Facebook. Looking for a career in the industry? Visit 3D Printing Jobs for new opportunities in your area.

Voting is still open for 2019 3D Printing Industry Awards.