Industrial 3D printer manufacturer Desktop Metal’s (DM’s) revenue rose by 286% during Q1 2022, according to its latest financial results.

During the quarter, new product launches and the revenue contributed by recent acquisitions enabled Desktop Metal to bring in $43.7 million, a substantial increase on the $11.3 million it reported in Q1 2021. In light of this “strong start to the year,” CEO Ric Fulop told analysts on the firm’s earnings call that it was “reaffirming” its FY 2022 guidance of $260 million, which if realized, would constitute growth of 131%.

However, despite the company appearing to remain true to its previous outlook, its shares fell 65% in the two days after its results were published. This could be seen as an investor response to Desktop Metal’s current high rate of cash burn, as its operating losses spiraled up to $69.5 million in Q1 2022, and it has since announced a $100 million convertible senior notes offering, designed to bolster its coffers.

“We are off to a great start to 2022,” said Fulop. “We continue to capture market share and rapidly grow revenue at scale. With several exciting product launches to kick off the year, and demand as strong as ever for our broad portfolio of AM 2.0 solutions, we are well-positioned for outsized growth and margin expansion through the balance of 2022.”

Desktop Metal’s Q1 2022 results

Desktop Metal reports its financials across two main segments: Products and Services, with the former generating $39.5 million in Q1 2022, 284% more than it managed in Q1 2021. While Products remain the firm’s main revenue-driver, its Services income more than tripled as well, to $4.2 million over the same period, reflecting the accelerated rate of growth taking place in this area of its business.

During Desktop Metal’s earnings call, its CFO James Haley explained that its wider growth was driven by acquisition contributions, complimented by “modest growth” across its offering, particularly in metal and dental. On the flipside, the company’s gains were partially offset by the “weaker than anticipated” performance of its photopolymer products as it revamped its portfolio with the launch of the Einstein.

Additionally, Fulop revealed that the business had achieved “continuous market penetration” in key verticals throughout the first quarter, in areas like automotive, electronics, dental and healthcare. In order to realize the “outsized turbo growth opportunities” this expansion represents, Desktop Metal’s CEO said it’s engaged with “several key players,” with which it has made “technical and commercial strides.”

When the call turned to expenditure, however, Fulop admitted that his company “fell short” in Q1 2022, as it reported a net loss of $69.9 million, an 18.3% increase on the $59 million loss it accrued during Q1 2021. In tandem, the firm’s EBITDA also fell to -$41.6 million over this period, but Fulop said these figures were affected by seasonality, and claimed that it remains on a “path to profitability.”

“We remain focused on the previously detailed strategic initiatives to optimize operating expenses in order to meet our commitment on adjusted EBITDA,” added Fulop. “As we make progress on these initiatives as well as continuing revenue growth, we expect to realize improved absorption and operating leverage, which will lead to significant improvement in adjusted EBITDA through the end of the year.”

| Revenue ($) | Q1 2021 | Q1 2022 | Difference (%) | Q4 2021 | Q1 2022 | Difference (%) |

| Products | 10.3m | 39.5m | +283.5 | 54.2m | 39.5m | -27.1 |

| Services | 1m | 4.2m | +320 | 2.5m | 4.2m | +68 |

| Total | 11.3m | 43.7m | +286.3 | 56.7m | 43.7m | -22.9 |

| Cost of Sales | 11.9m | 45m | +278.2 | 44.1m | 45m | +2 |

| Gross Profit/Loss | -0.6m | -1.3m | -116.7 | +12.9m | -1.3m | -110.1 |

Q1: an expansion coming to fruition?

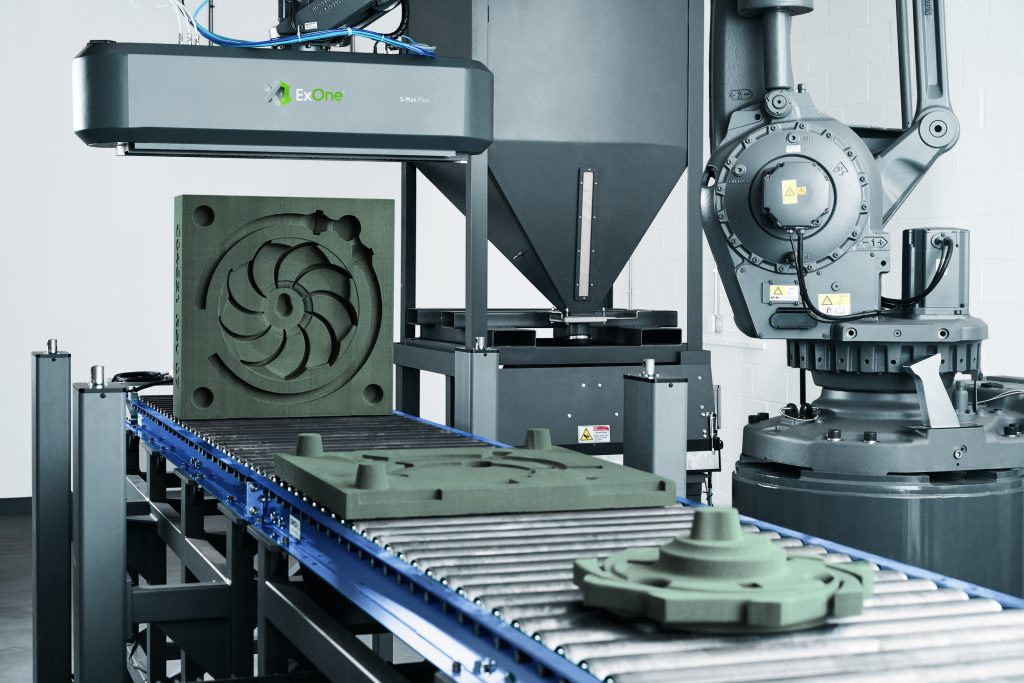

Later in the earnings call, Fulop emphasized that since Desktop Metal went public on the NYSE, it has “established a foundation” on which it can “rapidly scale.” In particular, the CEO highlighted how following its $575 million acquisition of ExOne, it has been able to utilize the expertise gained from doing so to expand its digital casting offering, launching the new S-Max Flex 3D printer during April 2022.

Its release may have been too late to boost Desktop Metal’s Q1 2021 revenue prospects, but it’s anticipated that the machine, ExOne’s lowest-priced to-date, will make S-Max 3D printing accessible to a wider range of foundries than ever before.

Over the quarter, the company also released several case studies, which prove that its ever-expanding portfolio is enabling it to address a wider range of applications. While PGV Industries now 3D prints oil and gas parts via Desktop Metal systems, the Ultra Safe Nuclear Corporation has adopted two X-Series machines, with the intention of using 3D printing in the design of novel nuclear reactor fuels.

“We are also now well diversified and able to capitalize on growth drivers across many industries,” explained Fulop. “We are starting to see our vision come together to be the dominant player in 3D printing for mass production, as we progress towards our goal of capturing a double-digit share of the over $100 billion additive manufacturing market by the end of the decade.”

Desktop Metal’s ‘path to profitability’

In addition to reaffirming Desktop Metal’s revenue guidance, Haley committed it to achieving non-GAAP gross margins of more than 30% for the full year of 2022. The firm’s CFO said it was confident of doing so due to the higher than expected sales volumes seen in Q1, as well as an anticipated shift towards a more favorable product mix, and recent product launches with “more mature margin profiles.”

On the expenditure front, Haley added that Desktop Metal’s operating expenses were higher than planned in the last quarter, but this was due to one-off costs related to the Einstein and P-50 series launches. With these expenses covered, and the company engaged in internal efficiency initiatives, he forecast that it’ll now be able to “realize improved absorption” and “improve its adjusted EBITDA.”

“Managing our cash flow and working capital remains an important focus and we expect to demonstrate progress throughout this year,” concluded Fulop. “Overall, it was a great start to 2022. Revenue growth was at the top of our market and we are confident with the demand we are seeing across the broad product portfolio to deliver top-line growth and margin expansion throughout the balance of 2022.”

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, debriefs, and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows Desktop Metal’s new ExOne S-Max Flex 3D printer. Photo via Desktop Metal.