Industrial 3D printer manufacturer Desktop Metal (DM) has announced a 123.2% quarter-on-quarter revenue rise within its Q4 2021 financials.

Over the course of Q4 2021, Desktop Metal brought in $56.7 million, a marked increase on the $25.4 million it generated in Q3 2021. On the firm’s earnings call, its CEO Ric Fulop explained how it saw “growth across all its additive manufacturing brands and technologies” during the quarter, but this was particularly the case with its metal offering, which ultimately grew 163% organically from FY 2020 to FY 2021.

During the call, Fulop also outlined plans for Desktop Metal to reach $260 million in revenue throughout FY 2022, while its CFO James Haley revealed that by the end of FY 2023, it aims to break even with its adjusted EBITDA. These lofty revenue and earnings projections appear to have gone down well with investors, as in the hours since they were published, the firm’s shares have risen by as much as 18%.

“2021 was a revolutionary year for Desktop Metal,” added Fulop. “I could not be prouder of what this team has accomplished in our first year as a public company. We made huge progress, both organically and inorganically towards positioning the company to achieve a double-digit share of the additive [manufacturing] market by the end of the decade.”

Desktop Metal’s Q4/FY 2021 results

Due to delays related to the consolidation of ExOne’s results into its own, Desktop Metal has emphasized that its figures are provisional for now, but they do provide a solid idea of its financial performance. Having lowered its expectations in Q3, citing global shipping delays, the firm went on to land bang in the middle of its revised $92-102 million FY 2021 guidance, excluding any revenue from ExOne.

Compared to the $16.5 million the company reported in FY 2020, this $97 million figure represents a 488% rise, something Fulop attributed to the “triple-digit organic revenue growth” it achieved in FY 2021. Specifically, Desktop Metal’s CEO credited its wider portfolio for its rapid revenue increase, adding that its material and systems offerings grew 12 and 14 times over between FY 2020 and FY 2021.

In terms of its Q4 2021 performance, the firm’s sales mix continued to be dominated by its Products division, which brought in $54.2 million, 126.7% more than the $23.9 million it reported in Q3 2021, and while its Services generated less revenue by comparison at $2.5 million, the segment still managed to achieve impressive growth of 66.7% over the same period.

Although Fulop didn’t directly reference Product sales drivers during Desktop Metal’s call, he did note the traction that its ETEC and Desktop Health offerings, including its newly-launched Einstein range of 3D printers, have begun to gain in the dental and healthcare markets, thus enabling the company to “establish a brand supporting thousands of dental labs and practices” across FY 2021.

On the company’s call, Haley also went to great lengths to address spending, and outlined a plan to “drive operational efficiencies” during FY 2022. Having bought a string of firms already, he stopped short of saying that Desktop Metal’s acquisition days were over, instead he said it would now only “invest in opportunities with the potential for both outsized growth and operating margin expansion.”

| Financials ($) | Q3 2021 | Q4 2021 | Difference (%) | FY 2020 | FY 2021 | Difference (%) |

| Products | 23.9m | 54.2m | +126.7 | 13.7m | 106m | +673.7 |

| Services | 1.5m | 2.5m | +66.7 | 2.8m | 6.4m | +128.5 |

| Total Revenue | 25.4m | 56.7m | +123.2 | 16.5m | 112.4m | +581.2 |

| Cost of Sales | 21.5m | 44.1m | +105.1 | 31.5m | 94.1m | +198.7 |

| Gross Profit/Loss | +4m | +12.9m | +222.5 | -15m | +18.3m | +222 |

Desktop Metal’s growth-drivers

Fulop boasted on Desktop Metal’s call that, across FY 2021, it was the “fastest-growing publicly-traded additive manufacturing company,” before going on to explain how both organic and inorganic growth had enabled it to achieve this.

Through its acquisition of ETEC (formerly known as EnvisionTEC) and Adaptive3D, Fulop said the company had “opened the aperture of its materials portfolio,” allowing it to “address a more diverse set of applications and end-to-end markets,” and sounded out the potential of these technologies within the polymer-based industrial manufacturing space.

Desktop Metal also expanded its binder jetting portfolio via its $575 million acquisition of ExOne in FY 2021, and ahead of the call, it revealed that some of ExOne’s systems have been rebranded. Moving forwards, the InnoventX, X25Pro and X160Pro will be known as the ‘X-Series,’ while their owners are now set to be supported by Desktop Metal’s team of engineers.

“We executed on the M&A strategy we articulated when we went public,” Fulop added on the earnings call. “These transactions all varied in size and strategic purpose, but were geared towards increasing our share of the additive manufacturing market in the long-term, and positioning the company for leadership in the mass-production of end-use parts.”

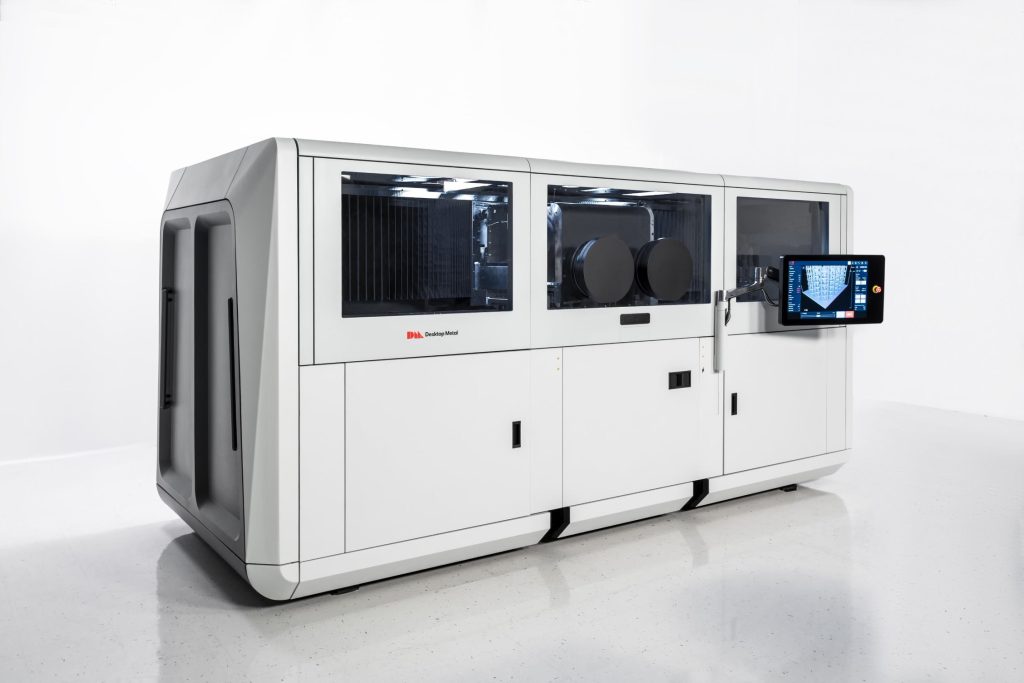

Similarly, Fulop hailed the sale of Desktop Metal’s first P-50 system to Stanley Black & Decker, as a vital first step in its future growth strategy, claiming that it’s up to 100 times faster than legacy LPBF systems, and he even went so far as to compare its launch to those of iconic products by Tesla, IBM and Apple in years gone by.

“Our careful investments of time and capital will yield a major competitive moat,” claimed Fulop. “Groundbreaking products such as the Tesla Model three, Apple Macintosh and IBM 368 required multi-year development efforts, but in each case, these products leapfrogged competitive offerings and ushered in a new era for their respective companies and industries. Like these other products, the P-50 represents a watershed moment for additive manufacturing.”

Pushing for profitability in FY 2022

Despite revealing that Desktop Metal deactivated all software accounts, support and customer systems in Russia via twitter last week, Fulop made no mention of the conflict in Ukraine on the earnings call. Instead, the CEO suggested that global supply issues are creating an opportunity for 3D printing firms to offer clients a means of in-sourcing production, and outlined strong FY 2022 guidance.

Across the coming financial year, Desktop Metal expects to generate $260 million worth of revenue, a figure which if realized, would constitute 131.3% growth. In his closing remarks, Fulop explained how an “incredibly strong pipeline” of products, a backlog of demand from “major corporations” for the P-50 and major upselling opportunities, will be the keys to turning this revenue goal into a reality.

“We’re entering 2022 with considerable tailwinds toward another year of record growth including continued momentum from the best quarter in company history, robust customer demand and favorable market conditions,” concluded Fulop. “We believe our strategic priorities in 2022 will ensure continued success toward achieving our goal of double-digit share of the over $100 billion additive manufacturing market by the end of the decade.”

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, debriefs, and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows Desktop Metal’s Production System. Image via Desktop Metal.