3D design software developer Autodesk (ADSK) has projected double-digit growth for the coming financial year after reporting a 16% rise in revenue during Q4 2022.

Autodesk’s revenue results, which are unusually published across financial years, show that in the three months up to January 31, 2022, it generated $1.21 billion, a 16% increase on the $1.04 billion it brought in throughout Q4 2021.

According to Autodesk’s CFO Debbie Clifford, this improvement was primarily driven by “robust renewal rates, strong growth in subscriptions and rapidly expanding digital sales,” with its AutoCAD program performing particularly well during Q4 2022, bringing in $345 million, 20% more than the $287 million it attracted over Q4 2021.

“By delivering greater value to our customers through the cloud and leading them to new ways of working, we are building enduring partnerships and shared growth,” said Andrew Anagnost, President and CEO of Autodesk. “With consistent investment in technology and talent, and the evolution of our business model and customer experience, I’m excited and optimistic about Autodesk’s future.”

Autodesk’s Q4 2022 financials

Autodesk still reports its financials under its traditional Subscription and Maintenance Plan segments, but as of FY 2021, it has also begun splitting its earnings into ‘Design’ and ‘Make’ divisions. The company’s Design arm, including its maintenance, product subscriptions and EBAs, as well as its AutoCAD sales, generated $1.05 billion in Q4 2022, a 17% rise on the $899 million reported in Q4 2021.

While Design continues to account for the majority of Autodesk’s income, its growth during the quarter was actually slightly outpaced by that of Make, which saw a 21% increase in revenue over the same period. On the firm’s earnings call, Anagnost credited this rise to the success of its Autodesk Construction Cloud (ACC) business, which is reported across both Design and Make, and saw “robust growth.”

As usual, when split into Subscription and Maintenance Plan revenue streams, the vast majority of Autodesk’s income came from the former in Q4 2022, which generated $1.12 billion, an 18% increase on the $950 million reported in Q4 2021, something Anagnost has attributed to its shift from multiuser to named user licenses and upfront to annual billing plans.

When viewed more broadly, on an international scale, the company’s EMEA-based business continued to see growth during Q4 2022, bringing in $475 million. However, Autodesk’s expansion in the region was outpaced by that of its operations in the United States, which grew from $343 million to $402 million between Q4 2021 and 2022, a phenomenon likely due to variations in global macroeconomic conditions.

| Financials ($) | Q4 2021 | Q4 2022 | Difference (%) | Q4 2020 | Q4 2022 | Difference (%) |

| Subscription Plan | 950m | 1.12bn | +18 | 777m | 1.12bn | +44 |

| Maintenance Plan | 30m | 23m | -23 | 80m | 23m | -71 |

| Design | 899m | 1.05bn | +17 | N/A | 1.05bn | – |

| Make | 82m | 99m | +21 | N/A | 99m | – |

| Total Revenue | 1.04bn | 1.21bn | +16 | 899m | 1.21bn | +35 |

Recurring revenue-driven growth

During Autodesk’s earnings call, Clifford made it clear that due to its license-based business model, recurring revenue remains key to its success. With this in mind, her disclosure that the firm’s product subscription renewal rates hit “record highs” over the course of Q4 2022, with its net retention rate staying between 100 and 110%, goes some way to explaining how it managed to have such a successful quarter.

In October 2021, Autodesk launched Netfabb 2022, its 3D printing, design and simulation platform that now includes the entry-level version of Fusion 360. At the time, Autodesk said that it had worked with EOS, Mimaki and Stratasys to optimize its integration with their systems, and this may well have aided the software’s adoption, as Fusion 360’s commercial subscribers grew steadily over Q4 to 189,000.

On Autodesk’s earnings call, Clifford credited this rise in demand to the program’s new extensions, with significant interest also being shown in its upcoming simulation and design add-ons, among engineering students in particular. In a related application, she noted how Lawrence Equipment was providing pupils at Pasadena City College with Fusion 360 access, to help train its future workforce.

Moving forwards, Anagnost added that the firm’s cloud-based offering would be key to its future growth, with Autodesk University increasingly providing services in this way, and Fusion 360 being the “leading edge of this transition.” Likewise, Autodesk’s CEO emphasized that its Prodsmart and CIMCO acquisitions will now enable it to “digitize and connect shop floor processes and manufacturing” as well.

“All of our technology investments, be it in 3D or BIM, enable workflows in the cloud in generative design, in make and in newer verticals like water and construction,” explained Anagnost. “All of them connect siloed adjacent workflows in the cloud and lead our customers to new, more efficient and sustainable ways of working.”

Growth in the face of turbulence

With Autodesk’s revenue continuing to grow during Q4 2022, and it observing a “pullback in its share price,” it took the opportunity to buy back $613 million worth of stock, according to Clifford, taking its FY 2022 spending in this area to $1 billion, but she also maintains that it’s committed to “organically and inorganically to driving growth” moving forwards.

Looking ahead, Clifford told analysts on the firm’s earnings call that it continues to see the supply chain, labor and COVID-related challenges it alluded to in Q3 2022, and these have informed its guidance. That being said, she still set an outlook of $5.02 billion to $5.12 billion for FY 2023, which would represent 14-17% growth, citing the “structural growth drivers” that continue to underpin its long-term strategy.

“Robust renewal rates, strong growth in subscriptions, and rapidly expanding digital sales resulted in record fourth quarter and full-year revenue, non-GAAP operating margins and free cash flow,” concluded Clifford. “Our strong momentum and competitive performance in FY22 set us up well for FY23.”

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, debriefs, and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

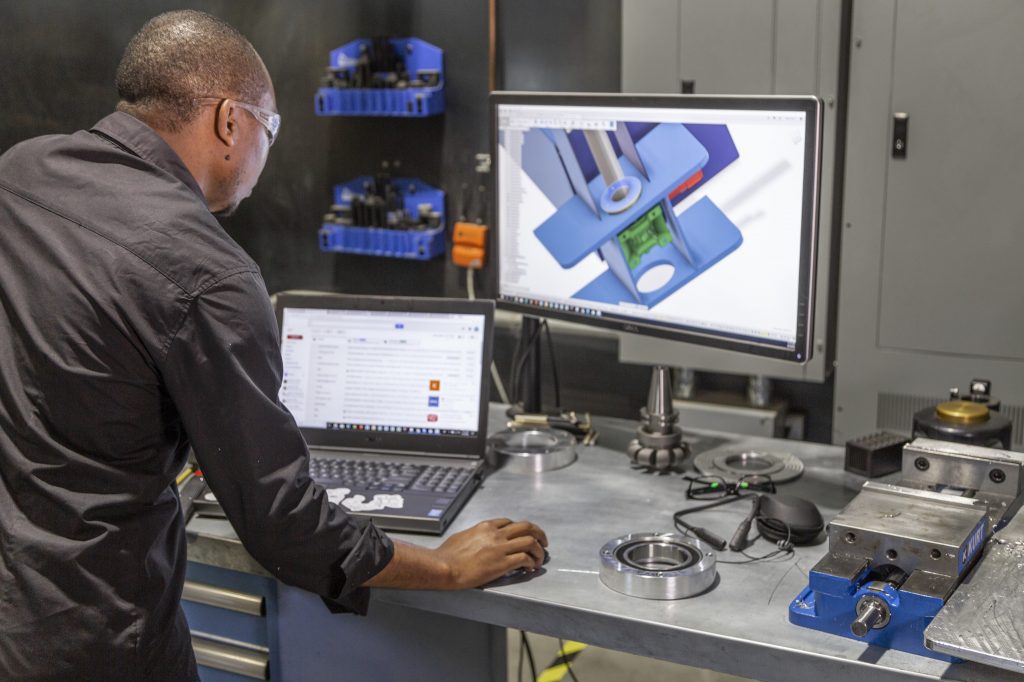

Featured image shows an engineer using Autodesk’s Fusion 360 software. Photo via Autodesk.