When 3D Systems Corporation (NYSE:DDD) CEO Vyomesh “VJ” Joshi met earlier today with analysts and investors he was, as usual upbeat about the future of 3D printing and his company. However, investors hoping to get rich overnight might not share the same time horizons. Since taking the helm at 3D Systems, VJ has brought in a new level of senior management and began to target cost-savings across the business. A key word in his strategy is focus.

As always VJ took time to answer a long list of questions from analysts keen to understand the business and the call lasted over an hour. VJ says that 3D Systems are at inflection point in AM, and believe the company has the infrastructure to “make 3D printing real.” While recent share price performance has been decidedly average, as often pointed out on 3DPI this is rarely a useful metric to appraise a company.

For VJ “A key priority is reducing cost of sales,” however making changes in the cost structure are actions that will not become evident until 2017. During today’s call significant growth was promised, but this will be a long term journey.

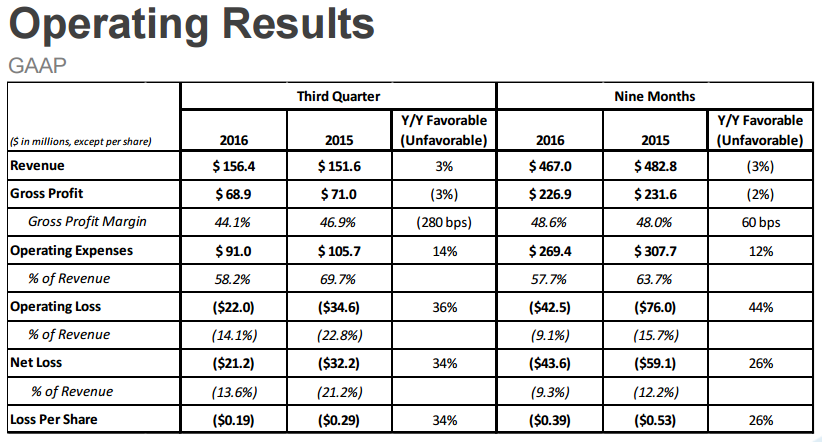

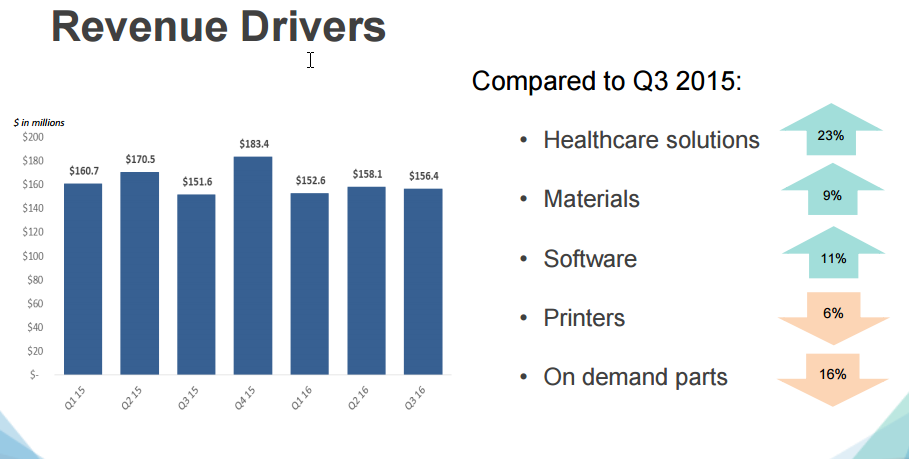

Highlights from the Q3 results show an increase in revenue to $156.4 million, from $151.6 million for the same period in 2015. Operating expenses have reduced to $91.0 million and operations generated a loss of $22 million versus $34.6 million for Q3’15.

Key Verticals

In one one of the most actively watched areas of 3D printing, metal the company did not provide the level of granular detail some analysts wanted. 3D systems do not break down revenue to the level of material type, but VJ said that GE’s entry into the metal space, “validates” the technology. One analyst suggested that metals might constitute less than 10% of revenue at 3D Systems, however the CEO would not be drawn on providing a number.

The two key verticals in metals are medical and healthcare. For the healthcare vertical VJ is keen to replicate this model, and its success in the other sectors 3D Systems operate in.

CFO John McMullen characterized the recent quarter as a “careful” approach. Information about cost reduction efforts will be forthcoming in 2017, also investments in IT will be announced. These efforts around cost structure are just getting started according to the company.

Update on Figure 4

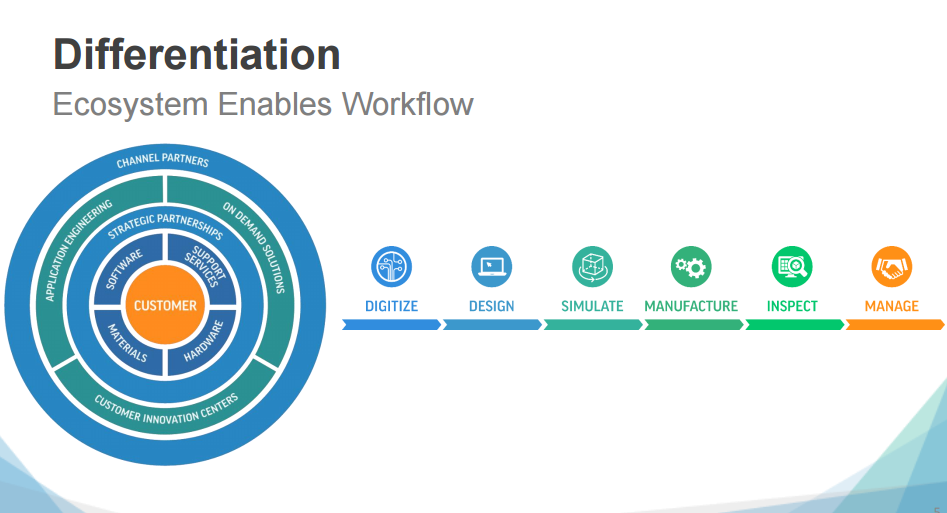

During the most recent reporting period 3D Systems have continued to rationalize their product portfolio and, as illustrated by the Figure 4 modular system, are looking at ways to recombine their wealth of IP in new ways.

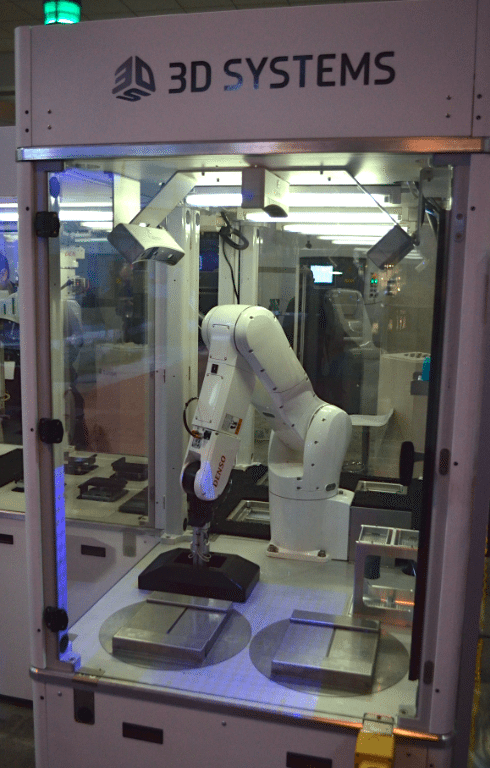

Troy Jensen at Piper Jaffray asked about Figure 4, and was keen to learn when will it be available. On today’s call there were, “No specifics on the release, but since IMTS we have seen significant interest.” As previously reported by 3DPI the Figure 4 modular system is an interesting combination of several of 3D Systems existing technologies. Using 3D printing of photopolymers in a high-throughput system operated by robotic arms enables a wider range of materials to be used in the process, especially in comparison to resins that are required to have a long shelf life.

On the call today VJ said, “The technology for plastics is now in place to move from prototyping to production” and that 3D Systems need to work with customers to evaluate modular requirements. Assessing how many customers are interested in Figure 4, and how many customers are signed up, will be discussed during the Q4 earnings call.

Strategic revenue segments

Revenue increased year-on-year, but drilling down into the numbers shows that this was not supported by all business segments. Specifically, the segments Printers and On Demand Parts reported a fall, by 6% and 16% respectively. However, this should not be taken as a cause for concern according to VJ.

Speaking about On Demand Parts, and alluding to companies such as Proto Labs and whether 3D Systems need to revisit their marketing plan in light of the 16% decrease in this area, VJ explained that this is a very strategic part of the business. It is reasonable to consider On Demand Parts as something of a loss leader in this regard, although the company may not necessarily use this term themselves.

3D Systems anticipate that customers who are introduced to 3D printing technology via their on demand services will eventually see the benefit and value AM can bring to their business. Therefore, while revenue might be down there are no plans to bring this important piece of the master plan to an end.

VJ explained that further segmentation will take place in the On Demand Parts business unit. Customers will be grouped as either “high-touch” or as requiring less interaction to complete orders. In the high-touch category, long term projects with a lot of interaction between 3D Systems employees will build long term relationships, and add to the bottom line of the company.

“We will give customers training and also a sales playbook,” said VJ and this will be part of the more aggressive strategy mentioned today.

Entering 2017 with aggression

With the restructuring of management, as detailed at IMTS 2016 in September, substantially complete and efforts underway to reduce costs VJ made frequent reference to the next phase in this latest chapter of the company. A key term in this area was aggression.

Whether this means that 3D Systems will price their 3D printers, materials, services and software with more aggression or whether this means something else remains to seen. “Stay tuned!” said VJ and 3DPI certainly will, as 2017 is shaping up to be an exciting year, even before 2016 is over.

Supporting this long term plan will be investment in R&D, “The vertical approach requires investment. As we build it out we’re going to see traction.” Asking about R&D specifics, a run rate of $20 million was mentioned by analyst Kenneth Wong. Investment will also take place in IT infrastructure will announcements around specifics of a 12-18 month project coming up in 2017, although speculated as being related in part to an ERP system.

An important aspect of the IT investment will be around the “cash process” according to John McMullen, CFO. “We will be talking about this over 2017, as it is a big deal for the company,” the former Kodak executive advised on today’s call.

“Innovation is our bloodline” explained VJ and the areas of Application Engineering and Materials “will allow us to build a new stream” and are very important going forward.

Expectations for Q4 are high, “a typically strong sequential quarter for us” added McMullen.

3D Printing Materials

On materials side, 3D Systems are looking to partner with companies who are working with “materials at an atomic level.” This could be hint that acquisitions of materials companies with an appropriate portfolio might be a target. Or, most likely, the approach will take a similar form to the partnership with software company PTC, also previously announced at IMTS.

3D printing materials is an area where all the major players are keen to stake out territory. To give only two examples, in an increasingly crowded field, Arcam AB have continued to expand production in the metal powder segment with AP&C and Carbon are likely to have a number of interesting materials on the horizon given the substantial investments made in the company.

Also active in the materials area is HP, in particular through a partnership with German chemical company BASF and their stated plans to develop “open materials.” However on today’s call VJ said he does not agree with the open materials term used by HP, “all they are saying is that you can work with multiple vendors.”

Today’s results were seemingly well received by investors, as the company’s share price jumped by more than a dollar, a 10% increase, in early trading.