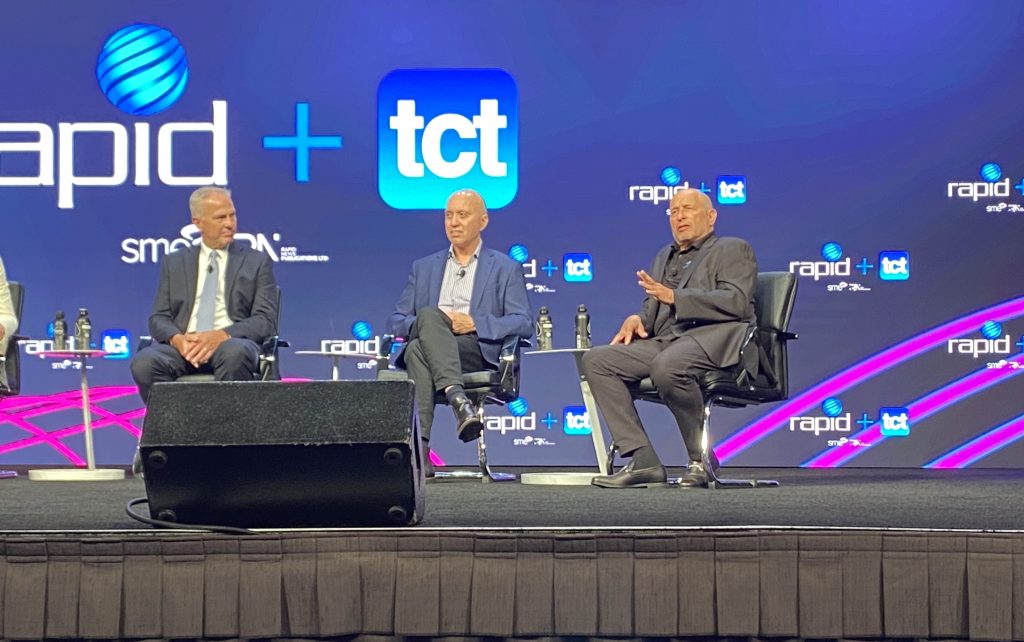

At RAPID + TCT 2024, Nano Dimension’s Chief Revenue Officer, Dale Baker, and Valentin Storz, VP of Marketing for its Additive Division, discussed the company’s growth potential within the electronics 3D printing sector.

Nano Dimension highlighted the ongoing transition of the additive manufacturing industry from prototyping to the production of high-value parts, enabled by rapid iteration and customization capabilities. Baker calculates that 5% of the $72 billion 3D printed circuit board industry is available to the company, translating to a $1.8 billion addressable market.

Another area where Nano Dimension sees value in 3D printing is overcoming supply chain challenges for the electronics sector. For example, the recently released Flight Hub platform is a “one of its kind” software that unlocks three-dimensional design for circuit boards.

Looking ahead, the Nano Dimension CRO predicts a wave of consolidation in the 3D printing industry. He advocates improving cash flow and profitability and emphasizes the need for rationalization to achieve true 3D printing scalability.

Read all the news from RAPID + TCT 2024

The State of Additive Manufacturing in the Electronics Sector

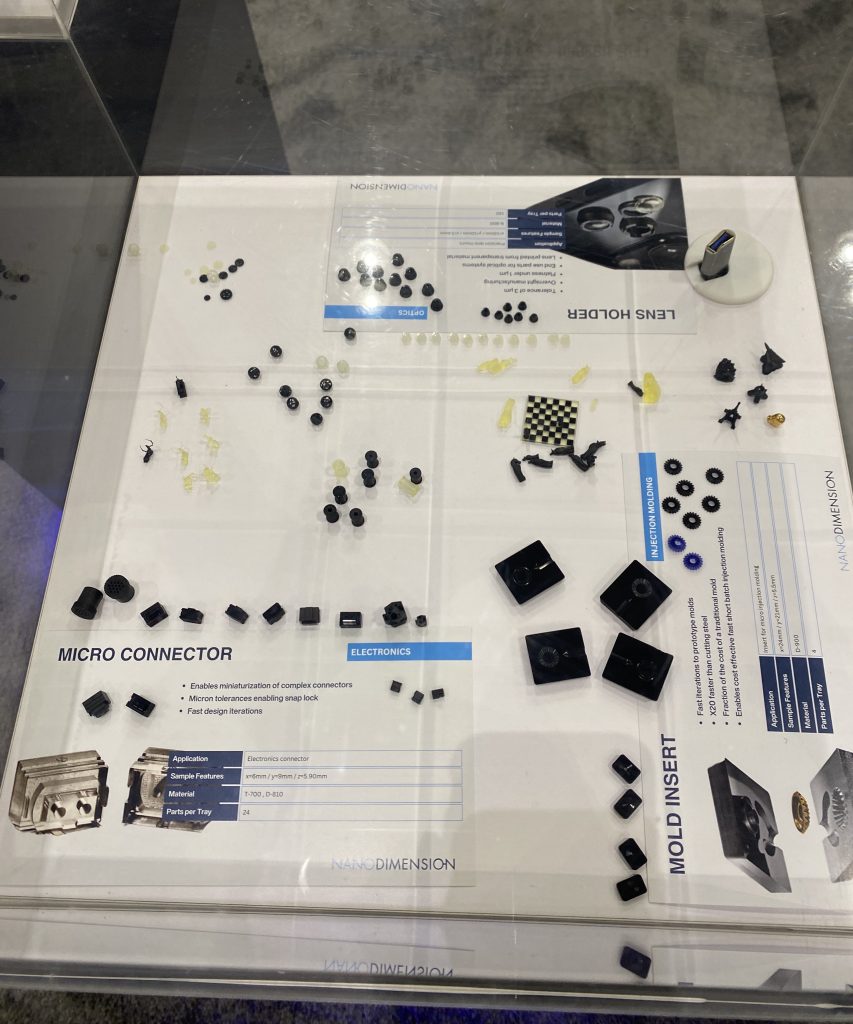

According to Baker, the 3D printed electronics industry is still in its early stages. There is potential to scale from “early-stage prototyping to low-volume production” of around 5,000 components monthly. Baker believes 3D printing is unlikely to achieve mass production for millions of products in this sector. Instead, the technology excels where flexibility and rapid iteration of high-value parts are crucial. “If you’re producing millions of parts per month, by definition, those parts are low value,” explained Baker.

He also highlighted the strategic importance of robust supply chains in the electronics sector. The decline of printed circuit board (PCB) factories in the US and Europe poses a significant risk to manufacturers. Retaining domestic production capabilities on these continents is essential to mitigating supply vulnerabilities and supporting economic growth.

Government initiatives like the US CHIPS and Science Act and the Inflation Reduction Act support these reshoring efforts. Although Baker hinted at the company’s involvement with government projects, he remained tight-lipped about the specifics. However, he suggested that future announcements may be forthcoming.

Competing in the global 3D printing market

Baker argued that Nano Dimension is well positioned within global additive manufacturing, claiming there “are no others like us in the 3D printing space.”

Nano Dimension’s CRO highlighted the firm’s robust financial health, purporting to possess one billion dollars in cash on the balance sheet. This stability reportedly sets them apart in an industry where many competitors struggle with cash burn and capital raises.

The growth of 3D printing companies in China, Russia, the Philippines, and Malaysia was identified as making traditional labor cost advantages less relevant. Baker believes technological superiority will instead determine the future market leaders in additive manufacturing. “It really comes down to whose technology works better, the surface finish, and dimensional tolerances,” he added.

Nano Dimension showcases Flight Hub software at RAPID + TCT 2024

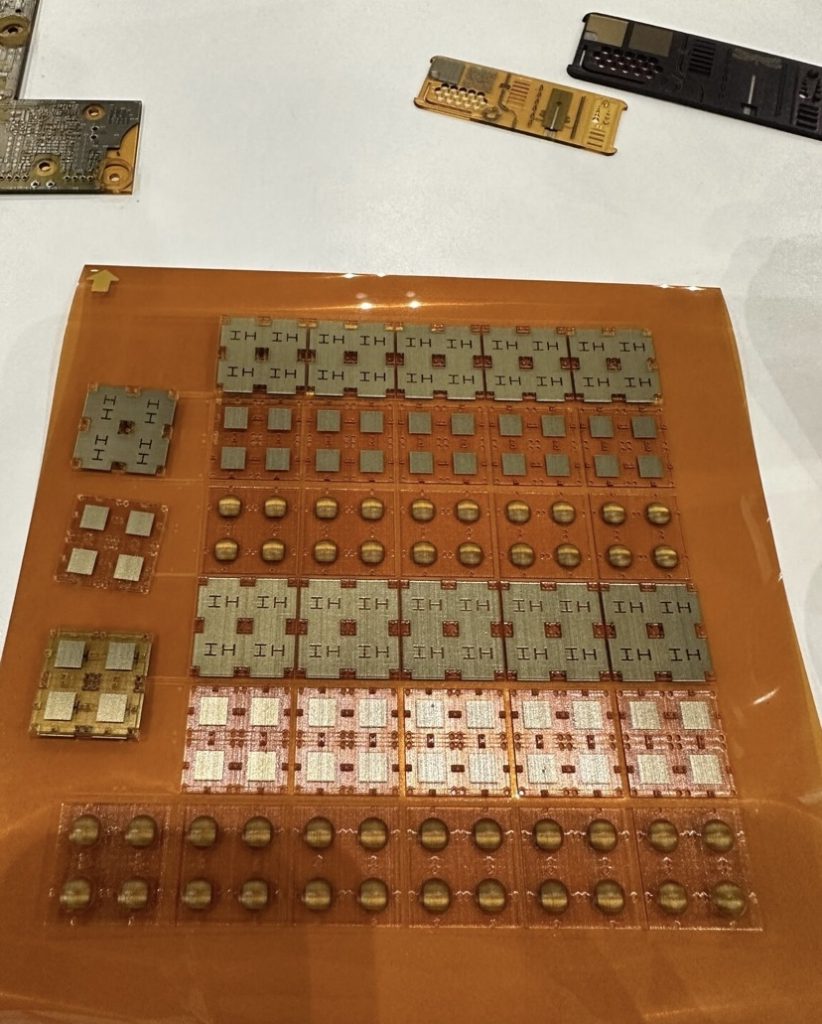

During RAPID + TCT 2024, Nano Dimension showcased its Flight Hub software. Announced earlier this year, this platform is a “middleware” that supports electronic design automation (EDA) tools for 3D printing electronics.

According to Storz, Flight Hub is a “one of its kind” software. Baker calls Flight Hub a “blue ocean product,” meaning it occupies a market space with no direct competitors.

Flight Hub can load files from any CAD system, mechanical or electronic, and perform comprehensive design rule checks. According to Storz, this reduces the preparation time for electronics 3D printing from two to five days to 30 minutes.

Additionally, Flight Hub includes a component designer, enabling users to design and 3D print components like capacitors or inductors directly onto circuit boards. “With Flight Hub, I design a component, load it through our standard IPC interface, and the program interprets it, placing it inside the board,” explained Storz.

Electronic designers have traditionally been confined to two-dimensional capabilities, relying on vertical connections between multiple layers. However, FlightHub offers three-dimensional design freedom. Baker argued designing in 3D enables more compact components and efficient use of space. For instance, Flight Hub users can create much smaller antennas than conventional design methods, without sacrificing quality.

Is consolidation the future of 3D printing?

As highlighted by previous reporting, the consolidation curve, or endgame curve, is a useful, but often missed, tool to understand the future direction of the 3D printing industry. The theory goes, that industry moves through four distinct phases of consolidation, from “opening” to “balance and alliance”.

To understand which stage of consolidation the 3D printing industry is at, an assessment of both market size and the market share of key operators is necessary. By this metric, the 3D printing industry has a significant way to go, given that the top three companies control, at best, 20% of the market. The 3D printing industry is at the opening stage of the consolidation curve. This model suggests that competition is likely to be based on accruing revenue and market share, potentially at the detriment of profits. Certainly, it is clear, to most, that by accepted accounting rules, no listed company is profitable.

Baker envisions significant consolidation in the future of 3D printing. He anticipates a reduction from around 400 companies to 10 or 15 dominant players. “Consolidation will allow for synergies in marketing, sales, communication, and customer interface,” he explained.

This echoes the sentiment of Nano Dimension’s CEO, Yoav Stern. During the opening keynote panel at RAPID + TCT 2024, Stern argued that “scalability will only come from consolidation.”

Nano Dimension’s long-term efforts to acquire Stratasys reflect this consolidation-based mentality. These efforts date back to July 2022, when it purchased 12.12% of Stratasys’ ordinary shares. In, March 2023 Nano Dimension submitted a failed $1.1 billion cash offer for Stratasys. The company has since made revised acquisition proposals ranging from $19.55, $20.05, and $25.00 per share in cash, all of which were rejected.

How can additive manufacturing advance along the consolidation curve? According to Baker, the answer lies in rationalization. He believes good technologies are becoming entangled within broader organizational structures, causing significant cash flow burn. Therefore, companies must identify which technologies possess profitability potential, and prioritize accordingly.

Register now for AMAA 2024 to hear insights from industry experts on additive manufacturing in aerospace, space, and defense.

Want to help select the winners of the 2024 3D Printing Industry Awards? Join the Expert Committee today.

What does the future of 3D printing hold?

What near-term 3D printing trends have been highlighted by industry experts?

Subscribe to the 3D Printing Industry newsletter to keep up to date with the latest 3D printing news.

You can also follow us on Twitter, like our Facebook page, and subscribe to the 3D Printing Industry Youtube channel to access more exclusive content.