Industrial 3D printing giants Stratasys and Desktop Metal have provided additional detail on their “landmark” intention to merge. On a call with investors, CEO’s Yoav Zeif and Ric Fulop provided additional insight into why the merger of Desktop Metal and Stratasys will create value. The combined entity is expected to provide a comprehensive portfolio of 3D printing technologies and services spanning from polymer to metal, sand, and ceramic solutions, catering to a diverse range of industry verticals.

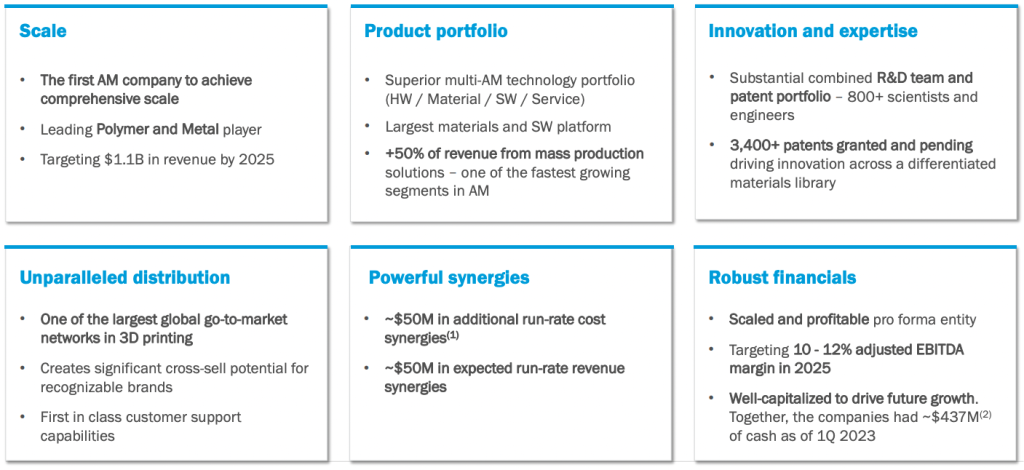

“The combination of our companies would significantly accelerate our growth trajectories, creating a uniquely scaled industrial additive manufacturing company,” announced Dr. Yoav Zeif, CEO of Stratasys. He highlighted the synergies and value proposition of the merger, stating that “together, we will have a diversified and wholesome product portfolio and one of the largest global go-to-market networks in 3D printing.”

Zief stated the merger promises a blending of strengths, expertise, and complementary technologies, with Stratasys, a leader in polymer 3D printing, bringing its exceptional influence in the aerospace, automotive, consumer products, healthcare, and dental verticals. Desktop Metal, known for its leadership in the mass production of metal, sand, ceramic, and restorative dental 3D printing solutions, complements Stratasys.

In addition to the technological advantages, the deal is also expected to bring substantial financial benefits, driving growth and delivering significant value for shareholders. This combination is estimated to unlock an opportunity to realize approximately $50 million in annual run-rate cost synergies and approximately $50 million in annual run-rate revenue synergies across the business by 2025. Consequently, Zeif predicts, “Combined, we expect to deliver approximately 10% to 12% of adjusted EBITDA margin in 2025.”

The merging of Stratasys and Desktop Metal is hoped to be a carefully calculated fusion of two forces in additive manufacturing. It’s a pairing that promises to generate a powerful, dynamic, and influential industry entity that could transform the face of 3D printing on a global scale.

The merger, structured as a stock-for-stock transaction valued at approximately $1.8 billion, will result in Stratasys shareholders owning approximately 59% of the combined company and Desktop Metal stockholders owning about 41% on a fully diluted basis. Some more vocal users of stock message boards have expressed dissatisfaction with the merger, expressing the view that Desktop Metal could achieve greater returns by continuing on its solo path.

After the close of the transaction, expected to occur in Q4 2023, Zeif will continue to serve as the CEO of the combined company, while Ric Fulop, Chairman and CEO of Desktop Metal, will serve as the chairman of the board. As Zeif pointed out, “this combination will enable us to expand use cases, grow revenue, and enhance profitability.”

A Seismic Shift in the Industrial Additive Manufacturing Market Landscape

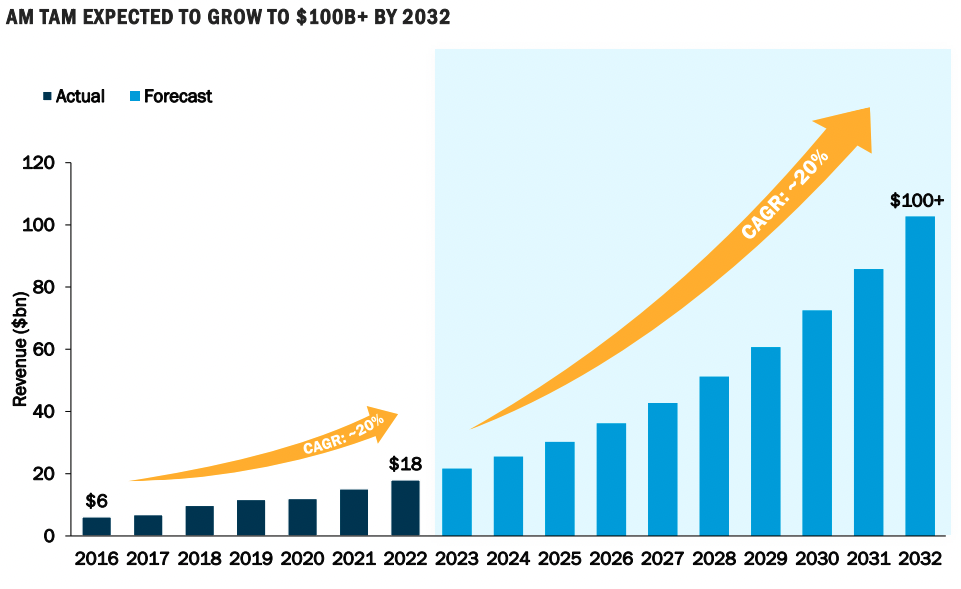

Ric Fulop, CEO of Desktop Metal, underscored the enormity of the opportunity during the conference call. The merger of Stratasys and Desktop Metal is forecasted to address a swiftly expanding market that’s projected to exceed $100 billion by 2032. The combined entity will serve the entire manufacturing lifecycle – a feat comparable to a Swiss Army knife with a tool for every job, from designing to prototyping, tooling to mass production, and aftermarket operations.

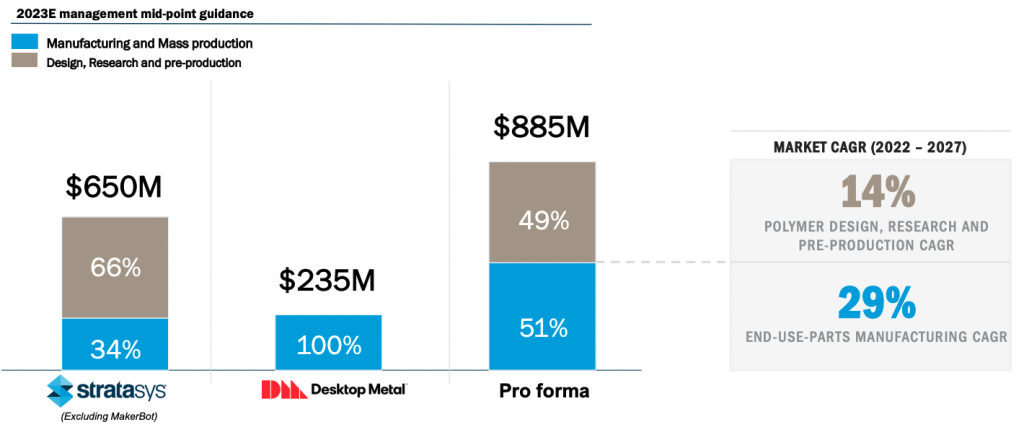

The revenue mix of the combined entity is expected to shift towards high-growth verticals across a broad product portfolio, promising over half of the pro forma combined company’s revenue to stem from end-use parts manufacturing and mass production. This segment is a powerhouse in the additive manufacturing space, expected to boast a compound annual growth rate (CAGR) of more than 29% through 2027.

In the words of Fulop, “We’re going to build an even more resilient offering with a diversified customer base across industries and applications to drive long-term sustainable growth.” This commitment, akin to constructing a resilient fortress capable of withstanding the challenges and fluctuations of market dynamics, signifies a positive future for the stakeholders of both companies, according to Fulop.

The amalgamation of these two industry titans promises to create an expansive and complementary suite of offerings that will make waves in the additive manufacturing landscape. With Desktop Metal’s expansion into mass production across a wide range of materials – including metals, polymers, ceramics, sand, carbon fiber, and wood – the new entity will position itself at the forefront of innovation.

Fulop also highlighted the potential for growth in dental restorative mass production, emphasizing the company’s strategic partnerships, leading materials, and world-class team. Given the $35 billion growth opportunity in dental mass production, this is a promising field.

Significant opportunities also lie in metal, carbides, and ceramics. “We have the industry’s leading global position in binder jet. That’s the fastest 3D printing process for materials like metals, technical ceramics, and carbides, and we have the largest and growing customer base in this segment, with over 1,200 customers,” Fulop added. This standing puts the company at the helm of high-volume mass production in the metal additive manufacturing space.

The combined entity’s capabilities aren’t limited to production; they extend to distribution as well. Stratasys and Desktop Metal’s union will offer significant benefits for stakeholders, thanks to an extensive global go-to-market network, enhanced market access, and globally recognized brands. This worldwide footprint is supported by more than 400 support personnel and application engineers, ensuring a robust customer support structure.

Fulop noted the powerful combined R&D engine driving innovation, stating, “Together, our companies invested nearly half a billion dollars in cumulative R&D spend in the past four years. That’s a significant investment for innovation, and it’s going to remain a key area for us going forward.”

He concluded, “As a combined company, we’re going to have one of the largest and most experienced R&D and engineering teams in this entire industry,” setting the stage for an era of rapid innovation and potential market disruption in the additive manufacturing industry.

Yoav Zeif, the CEO of Stratasys, and Ric Fulop, the CEO of Desktop Metal, outlined the expected financial benefits of the merger between their two companies. They projected $50 million in annual run rate cost synergies by 2025, achievable through optimized sourcing strategies, improved technology infrastructure, and the consolidation of shared internal infrastructures.

The CEOs also presented a promising financial outlook, expecting the combined company to generate $1.1 billion in 2025 revenue with a 10% to 12% adjusted EBITDA margin. This amalgamation has the potential to create a financially robust enterprise equipped with significant cash resources, enhancing its ability to fuel future growth.

As the conversation continued, both leaders expressed their confidence that the merger would be advantageous for their shareholders, employees, and customers. This merger is seen as a way to capture the value of additive manufacturing (AM) for mass production, foster cost, and revenue synergies, and establish an attractive financial profile.

When asked about the broader impact of the merger on the additive industry, Zeif emphasized that this merger is about “transformation” and “reshaping the industry.” He argued that the current additive manufacturing industry lacks the ability to deliver quality, cost-effective parts, and real workflow. However, with the merger, the strengths of Stratasys and Desktop Metal can be combined to address these issues.

The CEOs were also confident about the opportunities for technology sharing and collaboration across their teams. They highlighted the potential for advancing material technologies and software synergies. They ended the call by reinforcing their enthusiasm for the merger, seeing it as an opportunity for accelerated innovation and improved go-to-market strategies.

The impending merger between Stratasys and Desktop Metal is expected to yield substantial benefits, not just for the two companies but also for the wider additive manufacturing industry. The merging of resources and capabilities promises to address industry shortcomings, promote innovation, and drive significant growth in the years to come. As the plans for this merger progress, all eyes will undoubtedly be on this transformative move in the additive manufacturing sector.

What does the future of 3D printing hold?

What engineering challenges will need to be tackled in the additive manufacturing sector in the coming decade?

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter, or like our page on Facebook.

While you’re here, why not subscribe to our Youtube channel? Featuring discussion, debriefs, video shorts, and webinar replays.Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.