Quality assurance software developer Sigma Labs (SGLB) has announced that it aims to generate $65 million per year by 2025 alongside plans to shift towards a software-only business model.

On Sigma Labs’ FY 2021 earnings call, its COO Jacob Brunsberg outlined a new monthly subscription plan, designed to enable its PrintRite3D product to be deployed “at a much larger scale.” According to Brunsberg, lowering the initial cost barrier to entry of the technology could see up to 10% of all metal 3D printing users adopting it over the next three years, sending the firm’s income soaring.

“The market has an approximate install base of about 12,000 metal systems today,” explained Brunsberg on the call. “With a growth rate of approximately 20% year-over-year, that’s greater than 2,000 new systems entering the market every year.”

“By the end of 2025, we feel it’s achievable to address more than 10% of the marketplace’s quality needs with a software-only subscription,” he added. “This would conservatively yield a year-over-year revenue of approximately $65 million.”

Sigma Labs’ FY 2021 financials

Although Sigma Labs doesn’t report its revenue by segment, it’s understood to derive the majority of its income from its PrintRite3D in-process quality assurance (IPQA) platform. As it stands, ahead of the roll-out of the firm’s subscription service, the product comes with both hardware and software modules, which provide users with real-time metal and polymer 3D printer monitoring capabilities.

Through the sales of PrintRite3D in this configuration, Sigma Labs generated $1.7 million in revenue during FY 2021, 104.5% more than it managed to bring in over FY 2020. Speaking on the company’s earnings call, its CEO Mark Ruport explained that its OEM agreements with Additive Industries and DMG MORI had “yielded some significant customers in key verticals,” driving growth through the period.

Ruport added that its install base had expanded significantly over FY 2021, thus it now includes “world class customers” like Los Alamos National Lab, Safran and the US Department of Energy, and moving forwards, he expects the partnership it announced with Aconity3D in January 2022 to bring further revenue gains over the coming year.

Delving deeper into Sigma Labs’ financials, it’s also worth noting that its gross profit rose dramatically from $200,000 in FY 2020 to $1.1 million in FY 2021. This jump in profitability was caused by a lowering of the firm’s overall manufacturing costs, enabled by a combination of certain components becoming cheaper, engineering redesigns and efficiencies achieved within its production process.

However, despite Sigma Labs’ rising gross profit, its net loss still increased 42% from $5.2 million to $7.4 million between FY 2020 and FY 2021. On the company’s earnings call, its CFO Frank Orzechowski revealed that this was down to its higher operating costs during the period, which rose from $5.9 million to $9.6 million, and some $2.7 million of this was shelled-out on staff-related expenses.

| Sigma Labs’ Financials ($) | FY 2020 | FY 2021 | Difference (%) | FY 2019 | FY 2021 | Difference (%) |

| Revenue | 0.8m | 1.7m | +104.5 | 0.4m | 1.7m | +310.4 |

| Cost of Revenue | 0.59m | 0.56m | -5.4 | 0.57m | 0.56m | -2.5 |

| Gross Profit | 0.2m | 1.1m | +406.6 | 0.2m | 1.1m | +406.6 |

| Net Loss | -5.2m | -7.4m | +42 | -6.3m | -7.4m | +18.9 |

Sigma Labs’ subscription revamp

During Sigma Labs’ earnings call, Brunsberg explained that 3D printer manufacturers are increasingly opening up to third-party integration, while subsystem providers are adding key monitoring connections to their hardware. As a result, the firm is seeing less need to retrofit machines, as they are starting to natively allow third-party agnostic connections, hence its shift to offering a software-only platform.

“Instead of selling individual hardware software systems into the retrofit market, one at a time, which is time consuming and costly, we are working towards leveraging the printer’s computing infrastructure, and embedding our software in thousands of printers from multiple manufacturers,” Ruport added on the call. “That’s what I envisioned when I joined Sigma two years ago.”

While Brunsberg said that he doesn’t expect the impact of Sigma Labs’ new business model to significantly affect its revenue until H2 2022, he suggested that it has already “resonated strongly with its customer base,” thus when it does begin to kick-in, it could begin to have a “really good impact” on revenue if this interest can be converted into sales.

Aside from its new subscription strategy, the company also announced a partnership with AMFG in the run up to the publication of its financial results. The move is expected to not only expand the footprint of both firms’ products, but provide users with a new and improved 3D printing solution that enables them to improve their print quality and efficiency when used within serial production.

“Like Sigma Labs, AMFG is committed to deep collaboration that benefits individual customers as well as the additive manufacturing industry as a whole,” said Brunsberg of the deal. “The focus has shifted in the past several years from developing technology for technology’s sake, to solving the end user’s business problem. Both of our companies are industry leaders in embracing this trend.”

“We chose to partner with AMFG because of their solid reputation in the manufacturing execution space.”

Subscription-based growth ahead?

Though Sigma Labs has stopped short of issuing guidance for FY 2022, Brunsberg has set it the ambitious goal of hitting the $65 million revenue mark by 2025. Even for those “less bullish” in their expectations of the firm, Brunsberg added that a 3% level of penetration in the metal 3D printing market, would still see it pass the $20 million milestone in the next three years, and this he considered “conservative.”

Given that Sigma Labs reinforced its coffers with a $13.3 million common stock offering in FY 2021, it finished the year with $11.7 million in working capital, giving it the financing to realize its lofty revenue goals. What’s more, the firm believes that the more accessible nature of its offering along with the increasingly open nature of new 3D printers, will create significant opportunities for it in the years ahead.

“So what should you expect for Sigma the rest of this year?” Brunsberg asked rhetorically in his closing comments. “We’re going to grow our footprint in the OEM space with additional agreements where we monetize our IP by working with OEMs to deliver a software-only solution, as they embrace open systems in the design of their next-generation printers.”

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, debriefs, and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

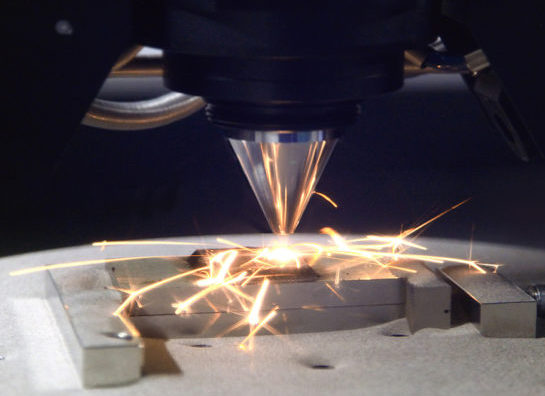

Featured image shows a part being 3D printed while being monitored using Sigma’s PrintRite3D software. Photo via Sigma Labs.