The Stratasys and Desktop Metal merger has become a tabloid saga, with Nano Dimension seeking to thwart the business combination and peppering a conference call with a number of choice phrases.

During the course of an hour, Nano Dimension CEO Yoav Stern made numerous statements about the Stratasys and Desktop Metal deal, including why he believes long-term value creation via a Nano Dimension takeover of Stratasys is better for shareholders, and gave an analysis of a stalled attempt by Nano Dimension to takeover Desktop Metal.

Nano Dimension attempts to buy Desktop Metal

On the call, Stern said that Desktop Metal and Nano Dimension have been talking since November 2022, and both companies had visited each other as part of the due diligence process. Stern has said that Desktop Metal requested a purchase price of $800 million, a figure he considered overvalued the company. Stern pointed to his calculations that Desktop Metal has a gross margin of negative 3% and his belief that Desktop Metal has destroyed over $2 billion of shareholder value. Stern characterized the Stratasys and Desktop Metal merger as a “bail-out.” “They are running out of cash,” said the Nano Dimension CEO.

Stern said that the limited duration rights shareholder rights plan (aka the ‘poison pill’) announced by Desktop Metal on May 30th is not legal, and he expects it to be overturned by a court.

“We believe the court will make a decision that this poison pill is not legal, that will immediately eliminate it, and we will close the transaction on the 26th of June,” provided Nano Dimension can persuade sufficient shareholders as to the merits of their proposal.

Nano Dimension itself installed a shareholder’s rights plan that runs from February 6, 2023, to January 27, 2024, this was characterized as a poison pill by its largest shareholder. In an open letter Murchinson wrote, “poison pills are generally regarded as one of the most egregious anti-shareholder measures a company can take,” regarding the move.

Desktop Metal has been approached for comment.

“SPAC refugees” and history repeating itself?

Stern explained that during the past two years, Nano Dimension has considered at least 350 companies as potential targets for acquisition. This pool was whittled down to 50 companies where Nano Dimension began discussions. The Nano Dimension CEO described Desktop Metal as a “SPAC refugee.” “There are about five SPAC refugees in the [3D printing] industry, we spoke with all of them,” he added. In the 3D printing industry over $11 billion was invested using SPACs.

As a sidebar, it is interesting to note the parallels between the 2020/2021 SPAC boom and the reverse merger boom of 2010-2012. Reverse mergers, or reverse takeovers (RTO) are a fast-track approach to listing on an exchange. While SPAC deals create a new entity, free from past trading history or liabilities, an RTO makes use of a dormant, yet still listed, shell company. Both methods of going public sidestep the traditional investment bank backed roadshow. SPACs are viewed as a more rapid and cost-efficient way to go public. Launching its bid to go public in 2020, Desktop Metal is perceived as kicking off the 3D printing industry SPAC wave. However, Nano Dimension used a reverse merger to become listed in 2014, an approach 3D Printing Industry described as “arduous and relatively unusual” in this interview with Nano Dimension co-founder from 2016.

Stern insisted that his remarks on the call were firmly directed at two primary shareholder groups: Stratasys shareholders and Nano Dimension shareholders, both of which are critically involved in the merger proposal. The chairman explained that Nano Dimension had made multiple escalating offers for Stratasys shares, starting at $18 per share and ending at $20 per share. Stern voiced his bewilderment at Stratasys’s refusal to accept the higher offer, despite Stratasys’s share price falling to $14-$15.

Stern expressed particular indignation at Stratasys’s commitment to a breakup fee, which is his characterization of the Desktop Metal poison pill. He emphasized that the imposition of a $32 million fee by Stratasys, which would be due to Desktop Metal if Stratasys is bought by another entity, effectively reduces the value of Stratasys shares by half a dollar each.

Stern appealed to the shareholders by pointing out the all-cash premium that Nano Dimension was offering. He contended that Nano’s all-cash offer, which was a 39% premium to the weighted average price as of early March, was far more advantageous to shareholders than the dilution and loss of value implied by the Stratasys-Desktop Metal transaction.

Stern went on to highlight the financial discrepancies between the two companies, pointing out that Stratasys, despite having a larger revenue and gross margin, will essentially be absorbing a company that has shown consistent losses.

“Mr. Stratasys, you are paying for a company that is less than a third of your size. It’s losing hundreds of millions of dollars a year projected or at least multiplied this quarter by four. You’re basically mortgaging your future. It’s not your future you’re mortgaging your shareholders’ future.”

Stern portrayed Desktop Metal as an enterprise with ongoing financial issues, including negative gross margin, ongoing cash losses, and the need for continual infusions of cash that could bring down Stratasys’ own profitability. The Nano Dimension CEO argued that the merger wouldn’t address the underlying issues with Desktop Metal’s business model, making this an unwise move for Stratasys.

“[Desktop Metal and Stratasys] together is almost minus $50 million of cash flow. And the combined net cash that they have, net of debt, that Desktop Metal has is about $320 million. Losing about $50 million a quarter. In four quarters, that is $200 million dollars, guys, this company will never do any acquisitions. And we’ll spend the money trying to run itself to the ground.”

Stern went on to argue that neither Stratasys nor Desktop Metal has been able to meet its own revenue projections, indicating that there are larger issues with their business models and raising concerns about the wisdom of the merger.

“Stratasys announced in 2015 there’ll be a billion dollars, which was based on Q4 2014. Results. In Q4 2022, they announced to be a billion dollars in 2026. And now, a month later, after they spoke with Desktop Metal, well, there’ll be $1.1 billion in 2025. Guys, the market has changed. This is not where we were in 2021, the market is moving back into profitability return on investment.”

“The market now wants us to be together with you,” said Stern.

Investors question Nano Dimension on its bid for Stratasys

Richard Smith of Smith Capital queried the expiration date of the tender offer, which, according to Yoav Stern, is the 26th of June. Dan Reich from SAB asked about the value for long-term Stratasys shareholders provided by the proposed combination. Stern provided a strategy involving buying shares back at a lower price.

Ryuta Makino from Gabelli Funds asked about revenue and cost synergies between Nano Dimension and Stratasys and about EBITDA and gross margin targets for 2025. Stern explained that synergies can only be realized after a complete merger, which is not currently possible. He hinted at a projected EBITDA of around $170 million by 2025 under the assumption of a full merger. Makino also asked about the decision to take control of 53 to 55% of the company, which Stern explained was to ensure majority ownership even when accounting for potential dilution from employees exercising their options.

A private investor asked for clarification on Desktop Metal’s financial situation, with Stern presenting data suggesting the company is in a precarious financial position, running low on cash reserve.

In his closing remarks, Stern encouraged shareholders to continue reaching out with their queries. “Over the last six months, I’m personally responding to questions of shareholders… we’re devoting a lot of time to speak with shareholders and we’ll be happy to answer more questions as they come.”

Questions, and more statements, are undoubtedly incoming. Yet to comment on the past week’s activity, which included a detailed timeline of Stratasys and Desktop Metal merger and the announcement of the takeover bid by Stratasys, is Murchinson.

3D Printing Industry will, of course, have the latest news, subscribe to our free newsletter to stay up to date.

What does the future of 3D printing hold?

What engineering challenges will need to be tackled in the additive manufacturing sector in the coming decade?

You can also follow us on Twitter, or like our page on Facebook.

While you’re here, why not subscribe to our Youtube channel? Featuring discussion, debriefs, video shorts, and webinar replays. Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

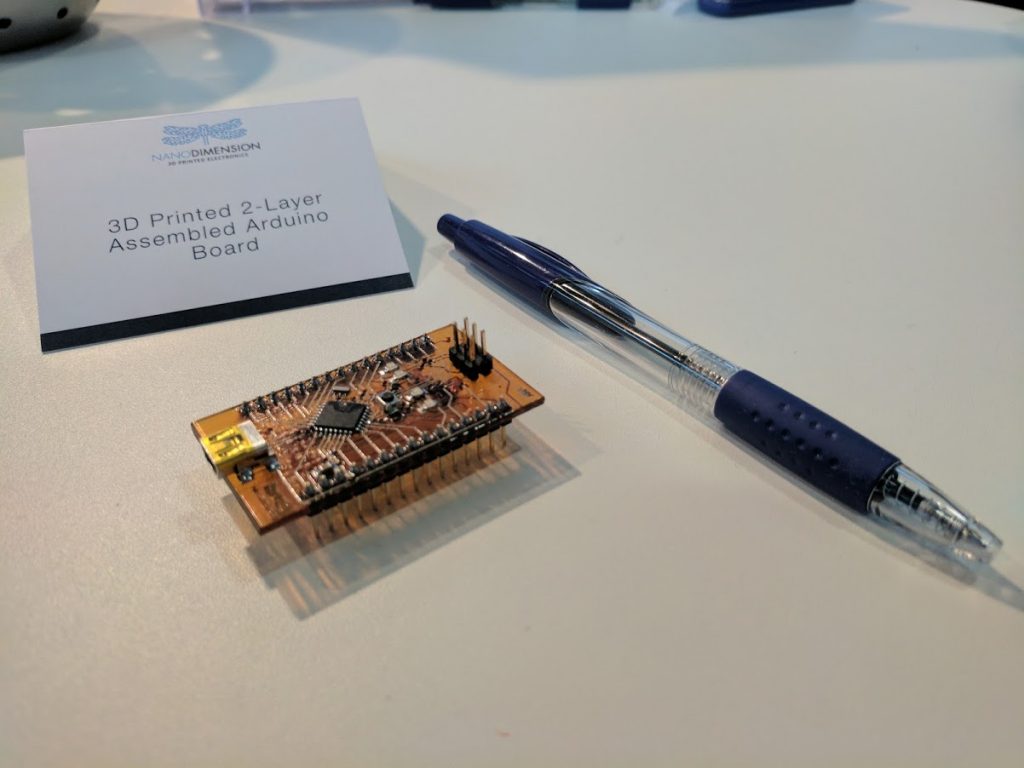

Featured image shows Nano Dimension 3D printed electronics. Photo by Michael Petch.