The 3D Printing Industry Awards 2022 shortlists are now available for voting. Who will win the 2022 3DPI Awards? Have your say by casting your vote now.

Industrial 3D printer manufacturer Desktop Metal (DM) has reported an 85.4% revenue increase in its Q3 2022 financial results.

Over the quarter, Desktop Metal turned over $47.1 million, a $21.7 million rise on the $25.4 million it generated in Q3 2021, but an 18.4% fall when measured on a sequential quarterly basis. On the firm’s earnings call, its new CFO Jason Cole explained that it had missed internal revenue expectations in Q3 2022, due to “customers delaying purchases” amid an “uncertain macroeconomic backdrop.”

“The challenging macroeconomic environment created great headwinds for our business,” added Desktop Metal CEO, Ric Fulop. “We exited the first half of the year tracking towards our financial targets, with a robust pipeline of healthy customer momentum. As the third quarter progressed, in some cases, orders we expected to close were delayed. We believe this is a result of customers pausing on CapEx spend as they become cautious about the macro landscape.”

“On larger deals requiring more significant CapEx outlays, we saw customers make purchase decisions on economic concerns, which was not the case at the start of the quarter.”

Desktop Metal’s Q3 2022 financials

Despite missing its own internal forecasts, Desktop Metal’s revenue actually grew across both its core divisions in Q3 2022. In Products, the firm brought in $42.9 million, a 79.5% rise on the $23.9 million it generated in Q3 2021, while its Services grew 173.3% from $1.5 million to $4.1 million, with both these figures including income from acquisitions.

On the flipside, Desktop Metal’s cost of sales also jumped 120.5% over the same period, and it stood at $47.4 million by the end of the quarter. On the company’s earnings call, Fulop said it has “taken swift action to course correct and reduce its expense structure,” resulting in annualized cost savings of $40 million, but it has become clear that it needs to “intensify its expense reduction efforts.”

Desktop Metal’s CEO added that “reducing its cost structure improves its path to profitability,” a road it aims to have walked down by the end of 2023. With this goal in mind, Desktop Metal laid off 12% of its staff earlier this year, but while Fulop said it’s “ahead of plan” in making these efficiency savings, he also admitted that his firm could have been quicker to identify cross-over with acquisitions.

“We’ve got plenty of cost synergies from the M&A that we did,” explained Fulop. “If I can look backwards, it was a mistake [to not cut quickly]. I felt like I didn’t want to break anything apart by going too quickly as we were acquiring. I think in hindsight we should have been totally on it. When we first got our arms around them, we weren’t focused on that.”

“We are not satisfied with our execution or performance in Q3, but we’re focusing on how we navigate our current set of circumstances.”

| Revenue ($) | Q2 2022 | Q3 2022 | Difference ($) | Difference (%) | Q3 2021 | Q3 2022 | Difference ($) | Difference (%) |

| Products | 52.7m | 42.9m | -9.8m | -18.6 | 23.9m | 42.9m | +19.0m | +79.5 |

| Services | 5.0m | 4.1m | -0.9m | -18.0 | 1.5m | 4.1m | +2.6m | +173.3 |

| Total | 57.7m | 47.1m | -10.6m | -18.4 | 25.4m | 47.1m | +21.7m | +85.4 |

| Cost of Sales | 49.3m | 47.4m | -1.9m | -3.9 | 21.5m | 47.4m | +25.9m | +120.5 |

| Gross Profit/Loss | +8.4m | -0.3m | -8.7m | -96.4 | +4m | -0.3m | -4.3m | -92.5 |

Growing adoption despite headwinds

While some customers delayed purchase decisions in the face of macro concerns, Desktop Metal still managed to sell to clients operating in various sectors in Q3, ranging from Ford to Cummins and Optisys. Building on these deals, Fulop said the firm has now partnered with Align Technology, to “bring digital dentistry and workloads for printing to the mass market,” and gain access to a $30 billion market.

Desktop Metal also announced a multifaceted collaboration with Siemens, through which its users will be able to take advantage of Siemens’ simulation and factory planning tools, as well as an extension of its existing collaboration with Henkel.

Unveiled during Q3, this wider partnership has seen Loctite 3D IND405 Black and Loctite 3D 3843 qualified for the Xtreme 8K, a machine marketed as the world’s largest Digital Light Processing (DLP) 3D printer. Featuring a high level of stiffness, strength and durability, the materials are said to be ideal for manufacturing end-use parts and consumer goods, in a way that could boost the system’s appeal.

Lowering guidance but staying positive

In light of the order delays it encountered in late-Q3, Desktop Metal has lowered its FY 2022 guidance from around $260 million to between $200 million and $210 million, with Q4 revenue forecast to be $51- $62 million, 78-87% annual growth.

However, despite the challenges posed by macroeconomic uncertainty, Fulop was buoyant on the firm’s earnings call about the 3D printing industry’s growth potential. Over the next decade, Desktop Metal’s CEO predicted that the sector can still become worth over $100 billion, due to an upcoming market rebound, as well as the cost efficiencies unlocked by part digitization and design freedom in 3D printing.

“The durability of these benefits remains incredibly strong,” said Fulop. “We’ve also had three similar periods where the market has stalled, coinciding with recessions. The last time this happened in a meaningful way pre-COVID, was 2008 to 2009 when the market contracted 3% on an annualized basis. In the decade that followed, the market rebounded significantly compounding 27% growth.”

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

While you’re here, why not subscribe to our Youtube channel? featuring discussion, debriefs, video shorts and webinar replays.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

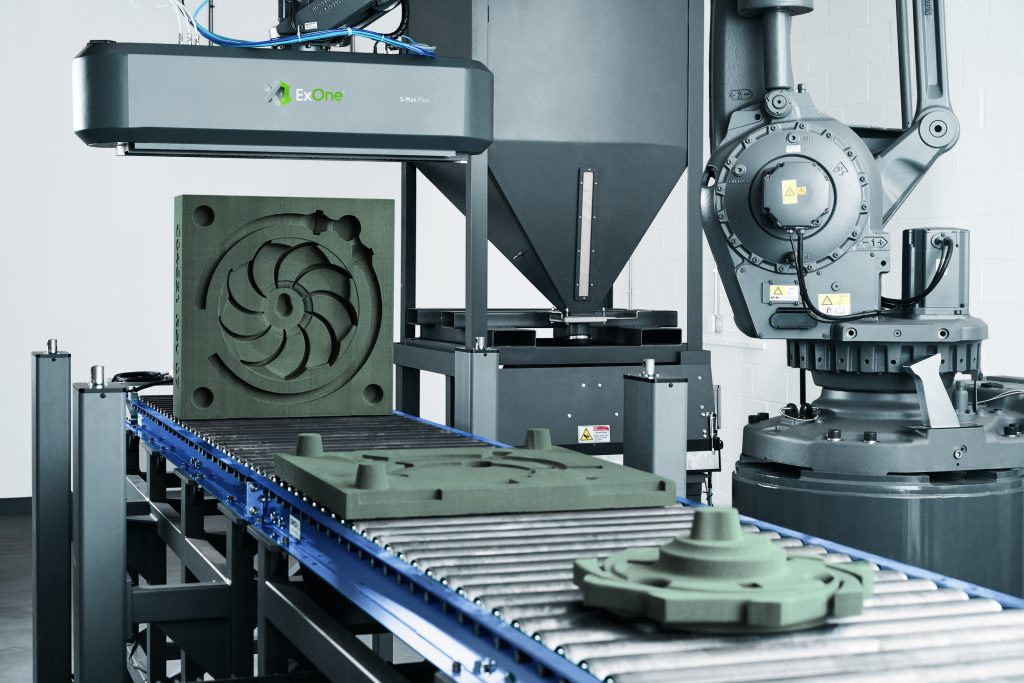

Featured image shows Desktop Metal’s ExOne S-Max Flex 3D printer. Photo via Desktop Metal.