Global manufacturing marketplace Xometry (XMTR) has forecast that its revenue will rise to as much as $400 million in FY 2022, after seeing a rapid increase in demand for its services towards the end of 2021.

Over the course of Q4 2021, the company brought in $67.1 million worth of revenue, an impressive 76.6% more than the $38 million it generated in Q4 2020.

According to Xometry’s CEO Randy Altschuler, this revenue surge was down to a 49% jump in its active buyer count, which rose from 18,846 to 28,130 in FY 2021. On the firm’s earnings call, Altschuler explained that he also saw recent growth as a result of strong demand from consumer, robotics, medical and electronics clientele, as well as the rising number of its users in-shoring to combat supply instability.

“Global events over the last two years have crippled supply chains, spurred product shortages and limited access to raw materials,” Altschuler said on the call. “Fortune 1000 companies are increasingly rethinking their supply chains and manufacturing strategies. Xometry is uniquely positioned to meet their needs through the breadth of our platform across verticals, processes and capabilities.”

Xometry’s Q4 2021 financials

Xometry doesn’t break its revenue down by division like much of the rest of the industry, and instead measures its success via its number of active buyers and sellers, as well as various profitability metrics. On the basis of the former, the firm had a very successful Q4 2021, in that its active sellers rose 43% from the 1,410 it reported in Q4 2020 to 2,010, while its number of high-spending buyers also grew.

During Xometry’s earnings call, its CFO Jim Rallo explained that 95% of its revenue had come from existing accounts in Q4 2021, and that over FY 2021, the number of those spending more than $50,000 had risen 80%, reflecting not only its “continued investment in sales and marketing,” but the “visibility and predictability” of its business model.

On the cost front, the company had a less successful FY 2021, in that it reported a net loss of $61.4 million, a 97.4% decline on the $31.1 million loss it made in FY 2020. However, this figure does include $5.7 million worth of transaction costs, $2.6 million in stock-based compensation and a $1.1 million charitable contribution expense, plus Xometry’s gross profit actually jumped 121% to $20.9 million in Q4.

Speaking on the firm’s earnings call, Altschuler said that despite seeing “manufacturing volatility” over the last two years, he thought it had done “exceptionally well” in this area due to the stability of its own supply chain, and the consistency it could offer clients.

“The vast majority of our orders are fulfilled in-country, alleviating issues related to overseas shipping delays,” explained Altschuler. “While our thoughts go out to those tragically affected by the war in Ukraine, Xometry also continues to have a strong and growing business in Europe. We do not have buyers or sellers in Ukraine or Russia, and have not experienced any business interruption.”

| Xometry Financials ($) | Q4 2020 | Q4 2021 | Difference (%) | FY 2020 | FY 2021 | Difference (%) |

| Revenue | 38m | 67.1m | +76.6 | 141.4m | 218.3m | +54.4 |

| Cost of Revenue | 28.5m | 46.2m | +62.1 | 108.1m | 161.2m | +49.1 |

| Gross Profit | 9.5m | 20.9m | +120 | 33.3m | 57.1m | +71.5 |

| Net Loss | -10.2m | -23.9m | -134.3 | -31.1m | -61.4m | -97.4 |

Xometry’s ongoing expansion

Xometry made a number of service upgrades and business moves over the course of Q4 2021 that no doubt contributed to its rapid revenue growth during the period. In October, for instance, the firm introduced version 2.0 of its app for the CAD design platform Fusion 360, which has since provided users with improved manufacturability feedback in addition to multiple part upload functionality.

During the fourth quarter, Xometry also bought waterjet and cutting service provider Big Blue Saw, MES software developer FactoryFour and most significantly, acquired Thomas for $300 million. Although the industrial sourcing and marketing firm has generated just $4.1 million for its parent company since the deal was finalized, it’s still expected to rapidly grow Xometry’s buyer and seller bases.

In addition to exposing around 1.4 million registered users to Xometry’s platform, it’s believed that Thomas’ continued integration will bolster the capabilities of ‘Xometry Everywhere.’ Set for launch in March 2022, the initiative is designed to enable customers to access the firm’s instant quoting platform on virtually any website, potentially providing a further boost to its already-rising active buyer count.

Interestingly, on Xometry’s earnings call, Rallo added that it had invested heavily in its UK and China-based offerings during Q4 2021, and he believed the latter could become an extremely lucrative market for its services moving forwards.

“Obviously, the opportunity in China is dramatic, and when you look at Europe, our office is based in Germany there, but we’re expanding the sales team in other countries,” said Rallo. “The UK is really one of our bigger sales groups now and we’re going to continue to expand in China, while again, making investments in Europe to continue to expand there.”

Forecasting further revenue growth

Despite raising $325 million via its IPO late in 2021, Xometry finalized a convertible notes offering in February 2022, which has allowed it to bring in another $278.9 million in net proceeds. Based on the firm’s strong liquidity and its aforementioned expansion plans, it’s therefore no surprise that it has projected strong growth for FY 2022 of $390-400 million, constituting a 79-83% year-on-year rise.

In his closing remarks on the earnings call, Rallo added to this by reiterating that Xometry’s integration of Thomas may be key to its future growth, but its organic offering is also set to see further increases in spending among its user base.

“Based on the timing of our product release roadmap, we expect revenue synergies [with Thomas] to commence in Q2,” concluded Rallo. “Additionally, we are seeing a notable shift towards production orders from many of our biggest customers. This shift can be seen in the strong growth in accounts with a spend of at least $50,000, and this will ramp up significantly as the year progresses.”

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, debriefs, and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

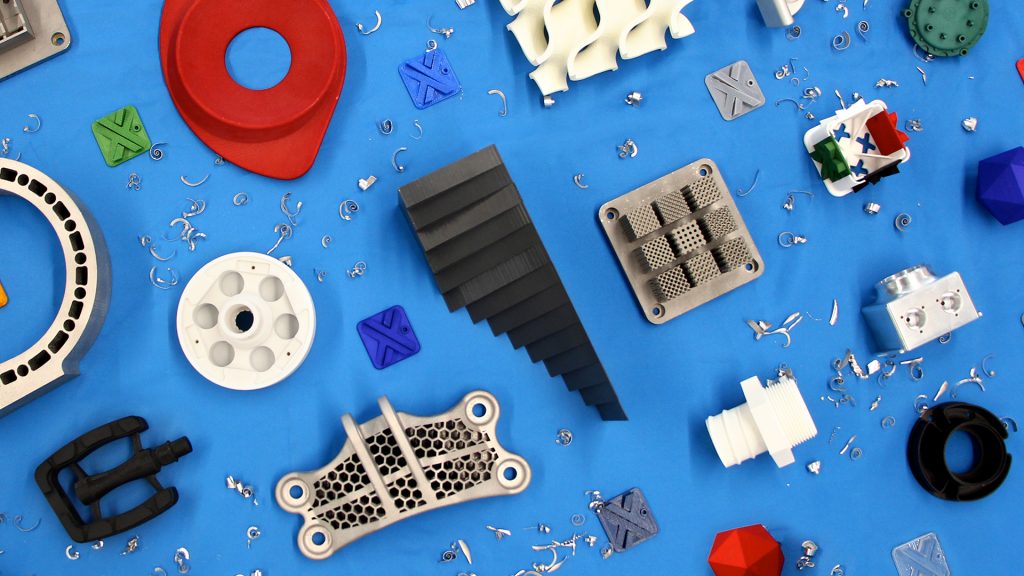

Featured image shows a set of on-demand parts created by Xometry. Image via Xometry.