Global manufacturing marketplace Xometry has launched a $252 million Initial Public Offering (IPO) on the NASDAQ Global Select Market.

Listed under the ticker ‘XMTR,’ the company has priced its stock at $44.00 per share, higher than the $38 to $42 range it originally submitted to the U.S. Securities and Exchange Commission (SEC). Between now and July 2 2021, 6,875,000 shares of Class A common stock in Xometry will be available for public purchase, with a further 1,031,250 being offered directly to the IPO’s underwriters at a flat rate.

During early trading, the firm’s shares appeared to have already captured the imagination of investors, rising 64% to $72.03 over the first three hours.

Xometry’s road to going public

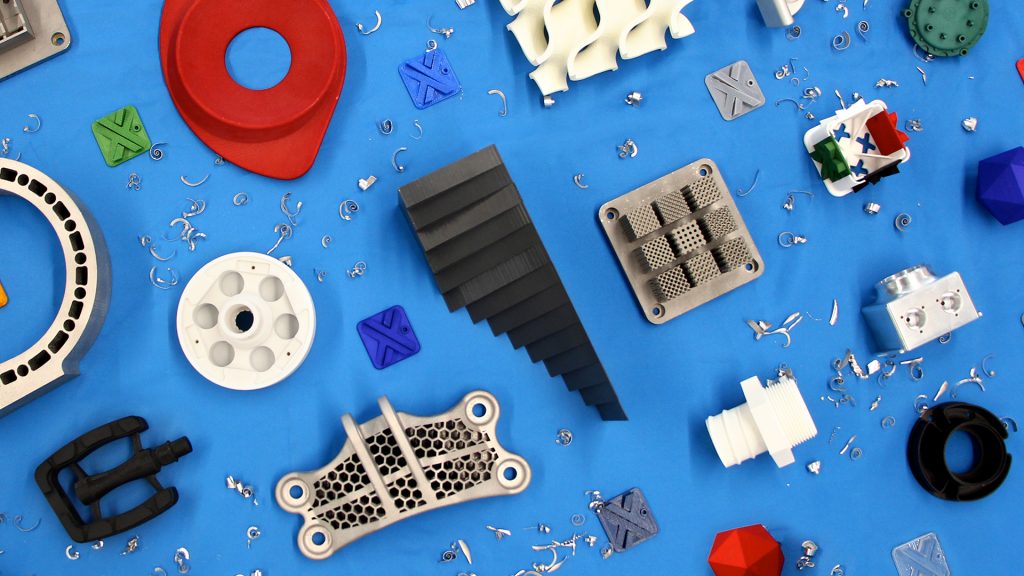

Established in 2013, Xometry offers CNC machining, 3D printing, injection molding and design services via its algorithm-driven platform, which directs clients to the optimal solution for a given production task. Thanks to substantial external investment, the firm has been able to steadily iterate on its offering by adding new products and services, and prior to its IPO, it had raised $193 million in funding.

Over the last three years, the company’s growth has been accelerated by backing from GE Ventures, BMW i Ventures and Highland Capital Partners, which provided it with a $38 million cash injection, before the Foundry Group made a $25 million investment, and Greenspring Associates contributed a further $50 million in funding.

Using this backing, Xometry has been able to expand into Europe with the acquisition of fellow service provider Shift, and push for further profitability with the launch of its own credit card. The company’s rapid recent expansion has been recognized by Deloitte’s Technology Fast 500 list in North America, on which it’s credited with having grown 949% from 2016-19.

Although Xometry has yet to outline any spending priorities for any proceeds from its IPO, it reportedly intends to use the cash as working capital and to service its debt which stood at $15.8 million as of March 2021, and according to its SEC filing, it has no agreements or commitments in place to make any imminent acquisitions.

Launching a quick-fire IPO

Xometry only filed a registration statement with the SEC to register its securities earlier this month, yet it has already got its IPO approved, and floated its shares publicly for the first time. Having been signed-off on June 29 2021, the offering is now being made by means of a prospectus, led by J.P. Morgan, UBS and Goldman Sachs, with copies of the final prospectus set to be available via the latter.

Elsewhere, Citigroup, BofA Securities, William Blair and RBC Capital Markets are all acting as book-running managers for the IPO, while C.L. King & Associates and Loop Capital Markets are set to co-manage the offering.

Xometry has granted the underwriters of its IPO the opportunity to purchase 1.03 million shares on top of its initial offering, but they will have just 30 days to take up this option, while the stock will be sold at its launch price of $44.00 regardless of market trading, minus underwriting discounts and commissions.

Through the IPO, the company is reported to have set out to raise an initial $100 million, but it revised this upwards in an amended filing with the SEC on June 28 2021 to $252.4 million, and if underwriters choose to exercise their option to buy their allotment of shares at $40 per piece, this total could rise to around $290.9 million.

In terms of earnings, Xometry doesn’t yet publish its full financials, but it reportedly saw its revenue jump from $80.2 million in 2019 to $141 million in 2020, amid its expansion into Europe and Asia. As a result, it’s possible that the firm will now capture the attention of traders on the wider public market, although only time will tell if this comes to pass.

3D printing firms: ripe for picking?

Xometry is not the only on-demand manufacturing marketplace intent on going public, and the performance of its stock will set a strong benchmark for rival Shapeways to meet ahead of its IPO later this year. The company announced a $605M merger with Galileo Acquisition in April 2021, through which it aims to raise $195 million, and expand to achieve annual revenue growth of 95% by 2022.

Much like Shapeways, a number of other 3D printing companies have chosen to go public via SPAC mergers rather than IPOs over the last 12 months, in a $13 billion industry-wide trend. At present, Desktop Metal is the first and only additive manufacturing firm to have gone public in this way, via a $2.5 billion deal completed in December 2020.

Since then, the company’s shares have fallen from $24.77 to $12.53, and it spent a huge $182 million on investing activities during Q1 2021 alone. As a result, it remains to be seen whether Xometry’s shares perform any better or if it intends to ramp up its expansion.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper-dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, de-briefs and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows a projected message from NASDAQ welcoming Xometry to its stock exchange. Image via Xometry.