3D printer manufacturer Velo3D (VLD) has posted its third successive quarter of revenue growth in its Q1 2022 financial results, off the back of entering volume production with its Sapphire XC 3D printing system.

Throughout Q1 2022, the firm generated $12.2 million in revenue, a significant increase on the $1.2 million it reported in Q1 2021, and a 17 percent rise from the $10.4 million it brought in during Q4 2021.

Having posted another record quarter of revenue growth, Velo3D’s shares have remained fairly stable since the results were announced this morning. For the company, its Q1 2022 financials have underlined its confidence in achieving its 2022 outlook.

“Strong execution enabled us to post our third straight quarter of revenue growth as a public company, add to our backlog, and expand our new customer footprint,” said Benny Buller, Velo3D’s CEO. “Demand for our industry-leading Sapphire systems remains high as our total backlog exiting the quarter increased more than 80 percent year over year to $55 million and now have more than 75 percent of our 2022 revenue either recognized or booked.

“When combined with our strong first quarter bookings momentum of seven systems, we now have significant visibility and increasing confidence in our ability to achieve our 2022 outlook.”

Velo3D’s Q1 2022 financials

Velo3D’s Q1 2022 financials are the third its has published since going public on the NYSE in September 2021. The firm hasn’t broken down its income by segment, but has instead attributed its growth in Q1 2022 primarily to system sales.

The company shipped eight systems in Q1 2022, with the 17 percent upturn in revenue during the quarter driven by an increase in average selling price as well as higher revenue from support services and recurring payment transactions thanks to the firm’s increasing installed base of systems.

Velo3D also entered volume production of its new Sapphire XC system in Q1 2022, which made up more than 45 percent of the firm’s total Q1 2022 revenue. Increasing customer adoption of the Sapphire XC has contributed significantly (90 percent) to the total backlog for 2022 of $55 million, and the firm plans to expand the production rate of the system in the second half of the year in order to meet demand.

Gross margin for the quarter was 0 percent, reflecting the impact of the “favorable pricing” offered to its first Sapphire XC customer on the basis that it committed to buying 10 of the systems before they’d been fully-developed. Gross margin was also impacted by higher material costs and labor overheads for the system as the company continues to ramp up production volumes throughout the year. With the completion of the launch contract, Velo3D says it remains on plan to achieve a gross margin of 30 percent in Q4 2022 in line with its full-year guidance.

The firm’s operating expenses for the quarter also rose sequentially to $28.2 million, primarily due to increased sales and marketing costs to fund the company’s global expansion plans and further R&D investment.

During the earnings call, Buller attributed Velo3D’s success in meeting its production goals for the quarter largely to the management of its supply chain and working closely with its suppliers to avoid disruptions.

“We continue to manage our supply chain to meet our production goals despite the ongoing global challenges,” he said. “Our European market expansion also remains on plan and we expect to add a significant number of new customers in this growing market by the end of the year.”

| Velo3D financials ($) | Q4 2021 | Q1 2022 | Difference (%) | Q1 2021 | Q1 2022 | Difference (%) |

| Revenue | 10.4m | 12.2m | +17 | 1.2m | 12.2m | +916 |

| Gross Margin | 16% | 0% | -100 | -33% | 0% | +33 |

| Net Loss | -14.4m | -65.3m | -353.5 | -13.5m | -65.3m | -383.7 |

| Cash & Investments | 223m | 186m | -16.6 | 16m | 186m | +1,062.5 |

Velo3D’s 2022 strategic priorities

Off the back of a strong Q1 2022 performance, Velo3D will look to increase its existing customer footprint and expand new customer adoption through further investment. The firm will continue to enlarge its presence in Europe with the expectation of strong new customer adoption throughout the course of the year.

The company will prioritize the execution of its Sapphire XC manufacturing expansion plan, and expects to achieve this through successfully managing current supply chain challenges, within which electronic components remain a priority.

In H2 2022, Velo3D plans to enter the next phase of Sapphire XC production, focusing on quality optimization, efficiency, and accumulated learning to reduce cost. Additionally, Buller said the firm expects to more than double total shipments of its Sapphire systems to 48 at the midpoint of guidance.

The firm will also focus on improving the quality and reliability of its customer service by growing and developing its customer support team.

“We are continuing to cement ourselves as a differentiated technology leader in high value manufacturing,” said Buller. “Our metal additive manufacturing technology changes the way products in aerospace, energy, power and other industrial segments are designed and produced. It is used to make some of the most critical parts in these products and we are maintaining our focus on driving the vast blue ocean market opportunity we see before us.

“This success is reflected in our first quarter results as our customers are using our differentiated technology to design and build the high value metal parts they need to succeed – without compromise.”

On track to meet 2022 guidance

In his closing remarks, Buller remained “very confident” that Velo3D will deliver on its expansion plans for 2022, despite ongoing global supply chain issues. He set out an unchanged guidance of $89 million for FY 2022, aided by a visible record backlog that already accounts for 75 percent of the firm’s total 2022 revenue guidance.

According to Velo3D, its strong Q1 2022 balance sheet with $186 million in cash and investments gives the company the liquidity for ongoing technology investments and will provide the resources needed to fund its growth plans.

“Looking forward, given our first quarter execution, continued bookings growth, revenue visibility through our backlog and the successful ramp of our Sapphire XC production, we are increasingly confident in our ability to meet our 2022 revenue guidance of $89 million,” Buller concluded.

Subscribe to the 3D Printing Industry newsletter for the latest news in additive manufacturing. You can also stay connected by following us on Twitter and liking us on Facebook.

Looking for a career in additive manufacturing? Visit 3D Printing Jobs for a selection of roles in the industry.

Subscribe to our YouTube channel for the latest 3D printing video shorts, reviews, and webinar replays.

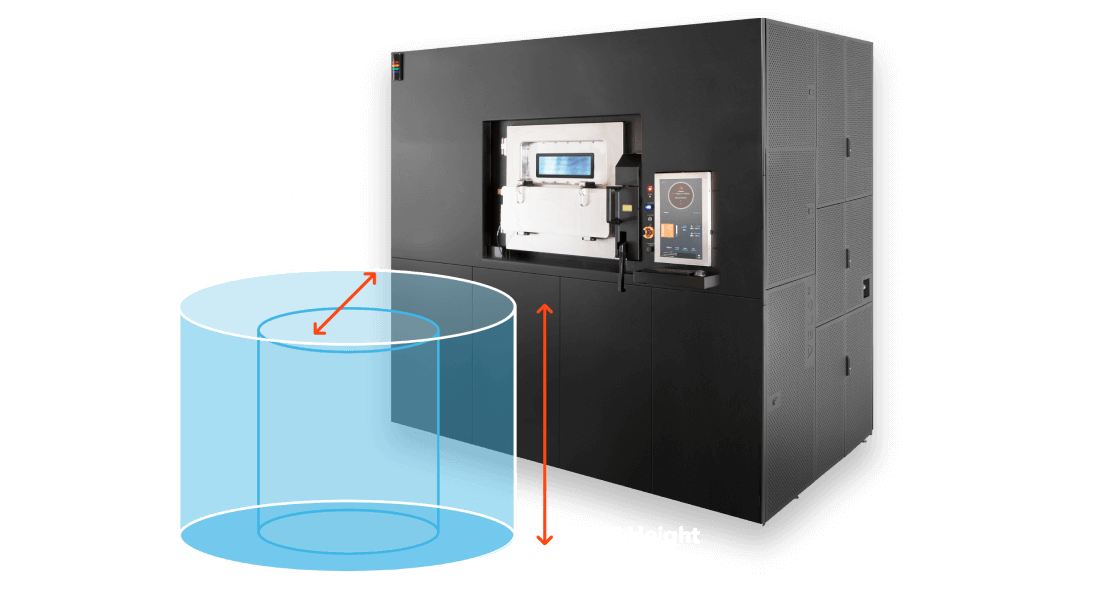

Featured image shows the Sapphire XC. Image via VELO3D.