German machine tool manufacturer TRUMPF has reported that its FY 2021/22 revenue rose by 20% within its preliminary results for the period.

According to its initial calculations, TRUMPF expects to have generated €4.2 billion in the year up to June 30, 2022, a significant increase on the €3.5 billion it brought in during FY 2020/21. However, the firm’s sales were also hampered by difficult macroeconomic conditions, and despite an anticipated rise in its order backlog, supply chain issues are now restricting its ability to replenish machine stock.

“The global disruption to supply chains clearly affected our sales,” explains TRUMPF CEO Nicola Leibinger-Kammüller. “Despite a high order backlog, we ended up making fewer machines and laser systems than we could have done due to the ongoing shortages in semiconductor and electronic components.”

TRUMPF’s FY 2021/22 financials

TRUMPF is a family-owned firm based in the town of Ditzingen near Stuttgart. As such, the firm doesn’t have to publish its financials in the same way that listed companies do, but it does often release top-line figures to give the industry an idea of how it’s performing. In its latest preliminary results, TRUMPF has revealed that it expects to have brought in €4.2 billion, 8% more than its FY 2021/22 projection.

This increase was primarily driven by the growth of the company’s ASML subsidiary. The business, which is best known as a developer of extreme ultraviolet lithography, a process used to pattern microchips in high volumes, performed so well that it made the Netherlands TRUMPF’s biggest FY 2021/22 revenue driver at €840 million.

While Germany is traditionally the company’s largest revenue generator, its business there fell to third in this area during the period, bringing in €580 million, which was flat against FY 2020/21 and 11.5% less than the €655 million reported by its US division. That said, TRUMPF now has a total projected order backlog of €5.6 billion, 42% more than the €3.9 billion it reported in the same period last year.

| Financials (€) | FY 2020/21 | FY 2021/22 | Difference (%) | FY 2019/20 | FY 2021/22 | Difference (%) |

| Sales Revenue | 3.5bn | 4.2bn | +20 | 3.5bn | 4.2bn | +20 |

| Order Intake | 3.9bn | 5.6bn | +43.6 | 3.3bn | 5.6bn | +69.7 |

| Largest Market | 580m (Ger) | The Netherlands (840m) | +44.8 | 610m (Ger) | The Netherlands (840m) | +37.7 |

2021/22: a year of 3D printing expansion

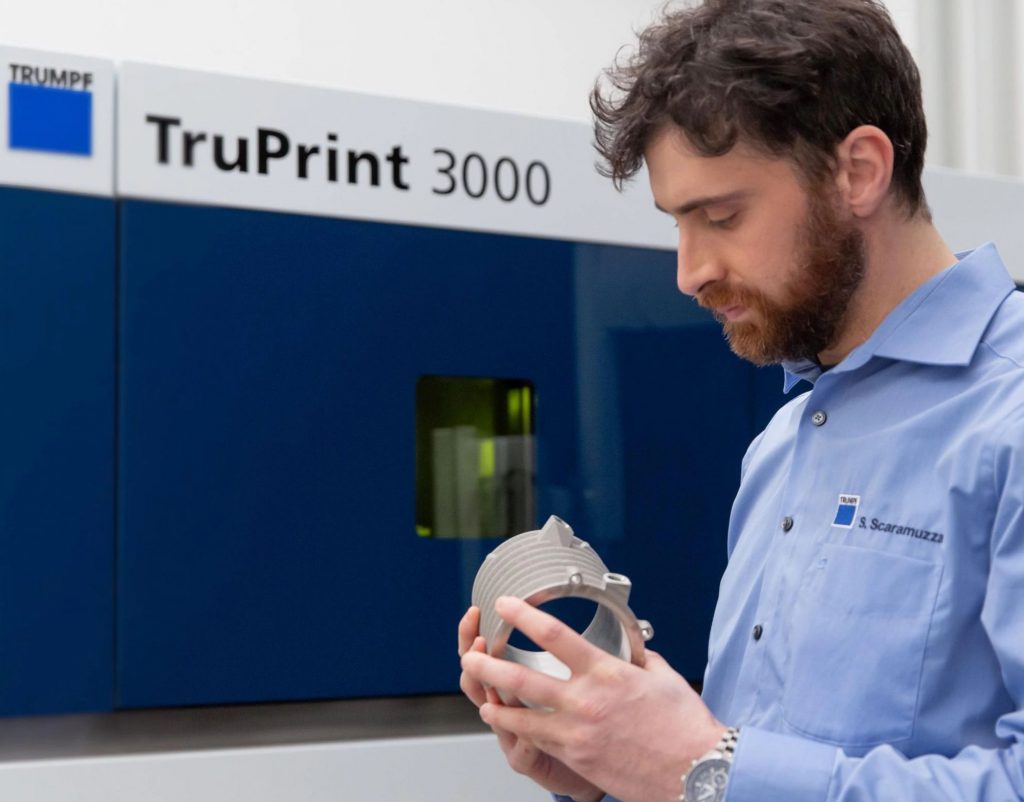

Beyond the sales success of its ASML subsidiary, TRUMPF has given little indication of the key drivers behind its rapid revenue growth during FY 2021/22. However, on the additive manufacturing side of its business, there’s evidence to show the firm is expanding its offering, which revolves around its TruPrint 3D printers, into new areas.

During FY 2021/22, TRUMPF took control of the joint 3D printing venture it set up with SISMA, which developed the Laser Metal Fusion (LMF) technology that powers many of its systems. In doing so, the company acquired SISMA’s LMF portfolio and Italian 3D printing facility, assets it has used to better address the industrial, dental and medical sectors.

At Rapid+TCT 2022, TRUMPF also announced that it had qualified Equispheres’ aluminum powders for use with its TruPrint 3000 series machines. At the time, the qualification process was said to have established that Equispheres’ AlSi10Mg powders enable a 33% faster throughput than standard aluminum with a ‘productivity’ parameter set, allowing users to accelerate their part production.

Elsewhere, on the research front, the firm revealed earlier this year that it had begun working with the Fraunhofer Institute for Laser Technology (ILT) with the aim of advancing Laser Metal Deposition 3D printing. In order to facilitate the technology’s transfer into industry, the companies are attempting to develop ‘application-adapted’ processes that improve its speed, productivity and material compatibility.

Holding back on guidance for FY 2022/23

Unlike its preliminary figures for FY 2020/21, TRUMPF hasn’t issued guidance alongside its FY 2021/22 numbers for the coming year. This is likely due to the disruption caused by the COVID-19 pandemic and Russia’s ongoing war in Ukraine. Due to the uncertainty caused by such events, the firm expects sourcing certain electronic parts to remain difficult during FY 2022/23.

“The strong economic momentum we’re seeing in the US and across Europe is encouraging, and we’re now benefiting from a growing demand for e-mobility solutions and for technology in other areas,” added Leibinger-Kammüller. “We’re entering the new fiscal year with robust order books, but the disruptions and uncertainty in global supply chains are likely to continue for some time.”

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, debriefs, and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows TRUMPF’s North American HQ. Photo via TRUMPF.