3D printing enterprise, Stratasys has reported financial results for the second quarter of 2018. Headline figures show that revenue was flat at $170.2 million, compared to $170 million for the same period in 2017.

Stratasys made a net loss of $3.6 million, an improvement on the $6.1 million figure for last year.

On a call today with investors and analysts, interim CEO Elchanan (Elan) Jaglom gave further insight into the numbers and the search for a new leader.

“Our second quarter revenue was in-line with our expectations for the period, as we saw recovery in high-end system orders in North America and in certain verticals, specifically our customers in government, aerospace, and automotive,” said Jaglom.

“We are pleased with the increased adoption we are seeing for our production-focused solutions, including our new F900 Aircraft Interiors Certification Solutions (AICS) 3D Printer and our J700 Dental 3D Printer, both of which address the unique needs of production applications in their respective verticals for aerospace and dental. We continued our positive trend of cash generation and operational discipline, while we also continue to ramp up our investments in our core FDM and PolyJet technologies, new metal additive manufacturing platform, advanced composite materials, and software and application development.”

Concerning trend in system sales

Previous revenue guidance of $670 to $700 million was reaffirmed while expected capital expenditure was revised downwards from $40 to $50 million to a new full year forecast of $30 to $40 million.

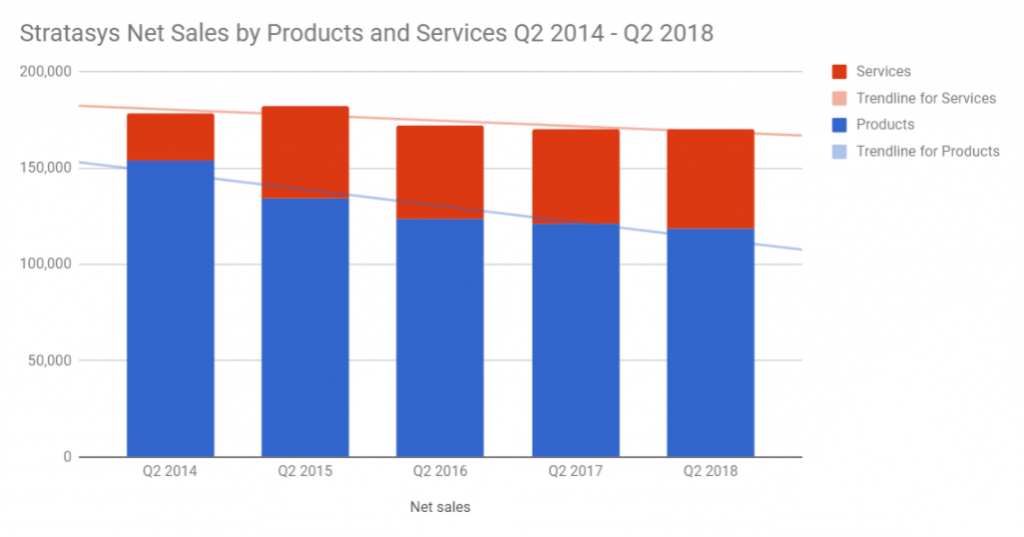

Earlier this year Stratasys reported what previous CEO Ilan Levin described as disappointing results. While product sales continue to decline, these were somewhat offset by increases in sales of services and consumables. Analysis shows gains of 10% in customer support revenue, 6% from service revenue and 5% in consumables. Product revenue fell by 2% and systems by 8%. This continues a longer trend of declining net sales for both products and services.

This should be a concern for management and investors as revenue from consumables, while reassuring that systems are not gathering dust and are in operation, does not bode well for longer term prospects.

At present, approximately half of all “big box” sales at Stratasys come from returning customers. According to Vice Chairman David Reis, who has recently returned to a more active role at the company, this type of customer is frequently a leader in their market. Having purchased one industrial 3D printing system and invested the necessary time to validate it’s usefulness, these customers will then return – deepening their investment in additive manufacturing. Stratasys anticipates that the competitors of such a customer will also make a move into 3D printing at some point.

Stratasys sees consumer reluctance to purchase their systems as a temporary anomaly, but also as a product of the increased availability of alternatives. This could be seen as a typical predicament of the early mover, and having spent considerable effort to develop and educate the market new entrants are able to reap the rewards of the time and money invested by Stratasys.

Reis believes that “market crystallization” will eventually leave three to four 3D printer manufacturers leading the industry. This is not a near term prediction. During today’s call with analysts and investors, parallels were drawn with how the desktop 3D printing market underwent a similar phase during 2013-2014 with an influx of companies and later followed by a shake out of sorts.

However, the comparison may be flawed. Entry barriers to the desktop market remain significantly lower. While APAC based enterprises have successfully replicated low cost 3D printers, putting price pressure on early movers, competition in the industrial sector comes from another place.

GE and HP have taken different routes into the 3D printing industry, one by acquisitions and the other with home grown technology. Yet both have deep pockets and an undeniable focus on the long game. Other major global manufacturing conglomerates, specifically some in the 2D printing space, are yet to play their hand.

Cash preservation, potential acquisition?

The industrial 3D printing market grew by 14% in the first quarter of of this year and is forecast to show a 21% increase in shipments for 2018. The fact that Stratasys has not been able to access this growth could be considered a concern.

One analyst, who preferred to remain anonymous, told 3D Printing Industry that Stratasys may be entering a period of cash preservation. In particular, the revised guidance on capital expenditure, a flat cash position and static R&D expenditure, points towards preparing the company for sale.

Publicly the prospect of a takeover is something that Stratasys is not pursuing. David Reis believes that the company is still very early in terms of ambition, and remaining independent is the current strategy.

More business news is available on our 3D printing data and analysis page, including freely accessible databases showing additive manufacturing investment activity.

Full details of Stratasys’ second quarter 2018 financial results are available here.

For more of the latest additive manufacturing insights subscribe to our daily 3D Printing Industry newsletter, follow us on Twitter, and like us on Facebook.

Find talent for a project, or advance your career in 3D printing. The 3D Printing Jobs board is live – registration is free for employers and job seekers.