Following the acquisition of DLP system manufacturer Origin back in December, leading 3D printer OEM Stratasys has now acquired UK-based RPS, a provider of industrial-grade SLA 3D printers.

Stratasys did not disclose the purchase price of RPS. The buyout gives Stratasys access to RPS’ entire line of Neo SLA systems, bolstering the company’s extensive technology offering which also includes FDM and Polyjet 3D printers. Stratasys expects the move to be accretive to both revenue and non-GAAP per-share earnings by Q1 2022.

“As businesses accelerate their embrace and adoption of additive manufacturing, our goal is providing our global customers with the world’s best and most complete polymer 3D printing portfolio,” stated Stratasys CEO Yoav Zeif. “We believe the Neo products are superior relative to other solutions currently available in the market due to an open choice in resins, low service requirements, and reliable and accurate builds with simple day-to-day operation.”

Carving into a $150M market

According to Stratasys, the global market for industrial SLA 3D printing sits at approximately $150M, and is expected to continue growing at a rate of 10% YOY. With only a few major players in the space, RPS has already made a name for itself with its Neo line.

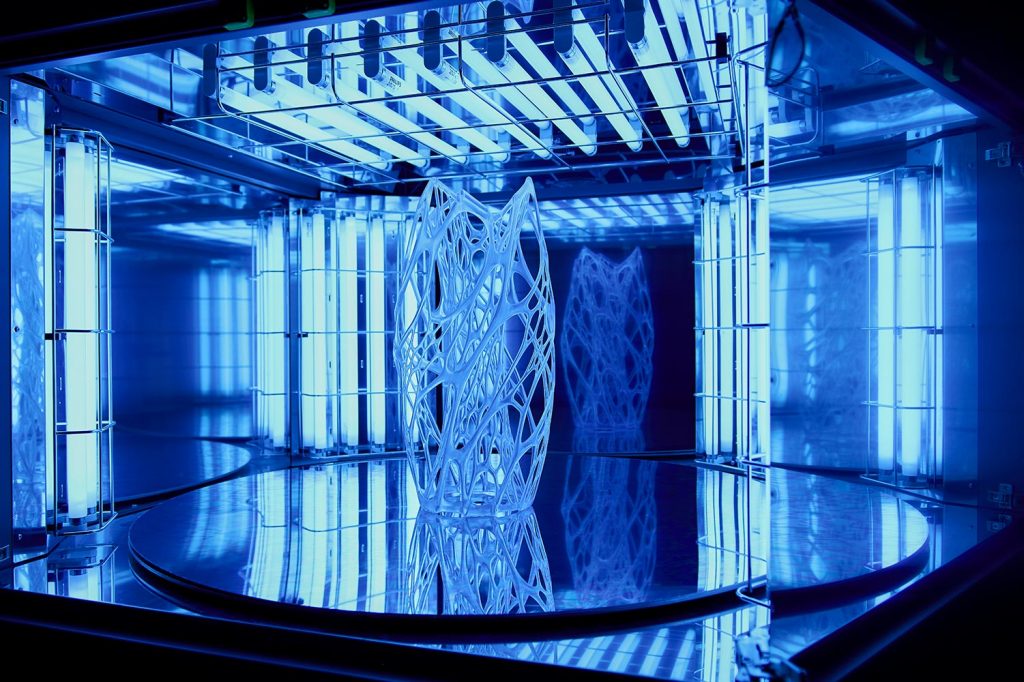

The open resin systems are defined by their large-format build volumes, with the flagship Neo800 providing up to 800 x 800 x 600mm. All Neo 3D printers also feature the company’s Titanium control software, in-built cameras, network connectivity, and mid-build print parameter customization functionality.

With access to RPS’ well-established set of customers, including British Formula 1 racing team Williams Racing, Stratasys will strengthen its position in markets such as automotive and polymer tooling. The dental sector, in particular, is expected to provide an abundance of opportunities with resin-based applications such as orthodontic clear aligner molds and anatomical models. Zeif has even stated plans to integrate the company’s cloud-based GrabCAD Print software into future RPS 3D printers.

David Storey, Director of RPS, adds, “We developed the Neo line to raise the industry standard for the next generation of large-frame industrial stereolithography 3D printers. I’m looking forward to continuing to develop this best-in-class technology with the Stratasys team as we bring our products to a broadened global audience.”

What does this acquisition mean for the V650 Flex?

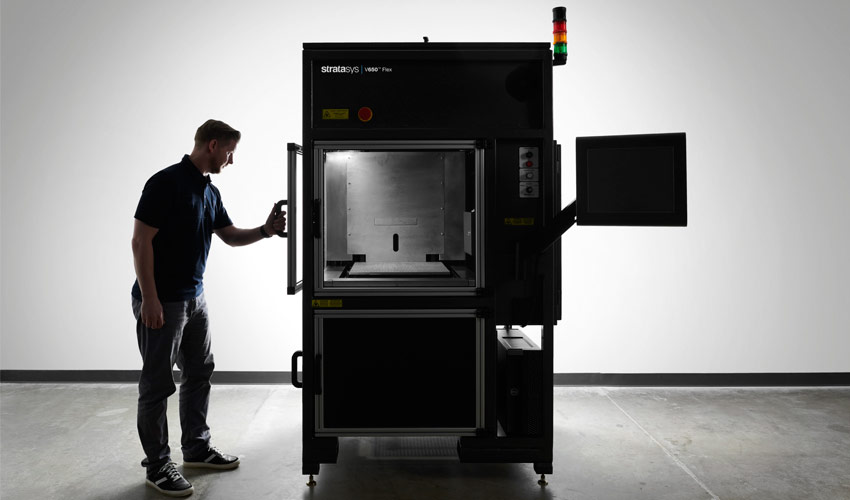

Back in 2019, Stratasys unveiled its first commercial venture into SLA 3D printing, the large-format SLA 3D printer called the V650 Flex. Naturally, the acquisition has raised concerns over the future development of the printer, with RPS’ technology seemingly making it redundant.

When asked about the future of the V650 Flex, Stratasys told 3D Printing Industry: “We acquired RPS and the Neo product line to be our best-in-class industrial stereolithography solution that we will take to market globally. The Neo products by RPS will eventually replace the V650 as we expand our ability to address the demand we see in the market.”

Stratasys will continue to sell, service, and support the machine for at least seven more years. Stratasys will also endeavour to provide its customers with an easy and cost-effective transition to a Neo 3D printer when the time comes.

The Stratasys news is the latest in a long line of acquisition stories in the 3D printing industry. Just last month, metal 3D printer manufacturer Desktop Metal signed a $300M definitive agreement to acquire DLP system OEM EnvisionTEC. The cash-plus-stock deal, which completed yesterday, means EnvisionTEC has become a wholly-owned subsidiary of the publicly-listed Desktop Metal, and represents Desktop’s first move into the DLP market.

The acquisition has also enabled Desktop metal to absorb EnvisionTEC’s entire distributor network, taking the firm from just 80 partners to over 200 partners. EnvisionTEC’s customer base of 1,000+ orthodontic users is set to provide the company with a ready-made foothold in the ever-growing dental market.

Elsewhere, on-demand digital manufacturing bureau Protolabs also recently acquired online manufacturing platform 3D Hubs for a total of $280M. The move is set to create what the companies claim to be “the world’s most comprehensive” digital manufacturing offer for custom parts, as Protolabs will be given access to 3D Hubs’ global network of 240 manufacturing partners.

Subscribe to the 3D Printing Industry newsletter for the latest news in additive manufacturing. You can also stay connected by following us on Twitter and liking us on Facebook.

Looking for a career in additive manufacturing? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows a resin part being cured in a Neo UV800 post-processing station. Photo via RPS.