UK-based engineering firm Renishaw (RSW) has reported a pre-tax profit of £120 million within its FY 2021 financial results.

During the financial year, which Renishaw reports from June 30 2020 to June 30 2021, it managed to bring in £566 million of revenue, 11% more than the £510 million it generated in FY 2020. Although the company’s 3D printing sales fell during this period, after the division underwent a ‘Fit for the Future’ resizing, its wider business flourished in H2 2021 following a post-COVID recovery within its key markets.

Since releasing its results, the firm’s shares have risen 8%, reflecting investor approval for the efficiency measures it has taken to remain profitable during the pandemic. This rise also represents a minor share price recovery, given that Renishaw’s stock has fallen 20% since its owners tried and failed to find a buyer for their majority stake earlier this year.

“There has been a good recovery for our business,” said Will Lee, CEO of Renishaw. “During the second half of the year, we started to see a recovery in some of our key markets, and we ended the year dealing with the demands of a record order book and supplying our customers in the face of global supply chain challenges.”

Renishaw’s FY 2021 results

Renishaw reports its revenue across two segments: Manufacturing Technologies and Analytical Instruments and Healthcare, with the former including any sales gained from its metrology and 3D printing offerings. However, while the firm’s Manufacturing division grew from £475 million in FY 2020 to £526 million in FY 2021, this was due to rising tooling and encoder sales rather than 3D printing growth.

Although Renishaw doesn’t report directly on its 3D printing financials, it has admitted to seeing “lower additive manufacturing sales” in FY 2021, following its ‘Fit for the Future’ efficiency campaign. During the initiative, which began in 2020, the firm has sought to refocus on productivity, reduce its cost base and prioritize significant design projects, while resizing and restructuring its 3D printing division.

As a result, the firm says its additive manufacturing sales were “in line with expectations,” despite the division’s poor showing compared to the rest of its business. The dip itself was somewhat down to a decline in demand for the RenAM 500Q, especially within aerospace, but given its upcoming Flex system launch, Renishaw says it’s now “well-placed to benefit” from a wider market recovery.

Elsewhere, Renishaw’s Analytical Instruments and Healthcare Devices division also thrived during a FY 2021 in which it generated £39 million, 12% more than the £35 million reported last year. In particular, the segment benefited from growth within the firm’s spectroscopy and neurological businesses, with the latter bringing in record sales during FY 2021, as hospitals began to restart elective surgeries.

| Revenue (£) | FY 2019 | FY 2021 | Difference (%) | FY 2020 | FY 2021 | Difference (%) |

| Manufacturing Technologies | 533m | 526m | -1 | 475m | 526m | +11 |

| Analytical Instruments and Healthcare | 41m | 39m | -5 | 35m | 39m | +12 |

| Total Revenue | 574m | 566m | -1 | 510m | 566m | +11 |

An AM R&D-loaded FY 2021

Renishaw’s 3D printing revenue may have dipped during FY 2021, but it still managed to seek out and explore new applications and R&D opportunities for its additive technologies during the period. In March 2021, for instance, the firm gained £26 million of UK government funding for its ‘LAMDA’ project, in which it’s attempting to develop a metal 3D printer capable of mass-producing small aircraft parts.

Over the year, the company also partnered with Domin in an attempt to 3D print more sustainable servo valves for those in the fluid power sector, worked with Hyde Aero Products to additive manufacture Class II helicopter door handles, and installed one of its RenAM 500 Flex machines at the facility of long-term partner, the Digital Manufacturing Centre.

In terms of Renishaw’s strong wider profitability, this can somewhat be accounted for by its decision to insulate its business from Brexit last year, by expanding its EU presence and making the Euro its anchor currency. According to the company, this has allowed it to reduce any shipping delays since Brexit came into effect on January 1 2021, and “minimize their impact on customer service.”

In anticipation of potential supply chain disruption during FY 2021, the firm also upped its inventory spending from £106 million to £114 million, in a move that now appears to have paid dividends, while overall reductions in its manufacturing technologies cost base have allowed it to more than double its pre-tax profit from £49 million to £120 million.

Renishaw’s FY 2022 outlook

Alongside Renishaw’s financials, its Chairman Sir David McMurtry has restated that the attempts of himself and fellow majority shareholder John Deer to sell their stake in the firm have now concluded, after they failed to receive an offer that “met the interests of all stakeholders,” thus they both “remain committed” to the company.

Looking to FY 2022, the firm’s CEO Will Lee has highlighted its strong cash balance of £215 million on June 30 2021 as well as its record order book, as being encouraging signs for the financial year ahead. Lee also says that Renishaw has “started with a strong first quarter,” and identified “external market growth drivers” like digitization and rising in-house production, as opportunities for it to grow moving forwards.

“We expect demand from the semiconductor and electronics sectors to remain strong, and that there will continue to be a recovery in the machine tool and coordinate measuring machine markets,” adds Lee. “In our analytical instruments and medical devices markets, we have seen confidence return and capital expenditure projects released. The Board continues to be confident in our long-term prospects.”

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, debriefs, and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

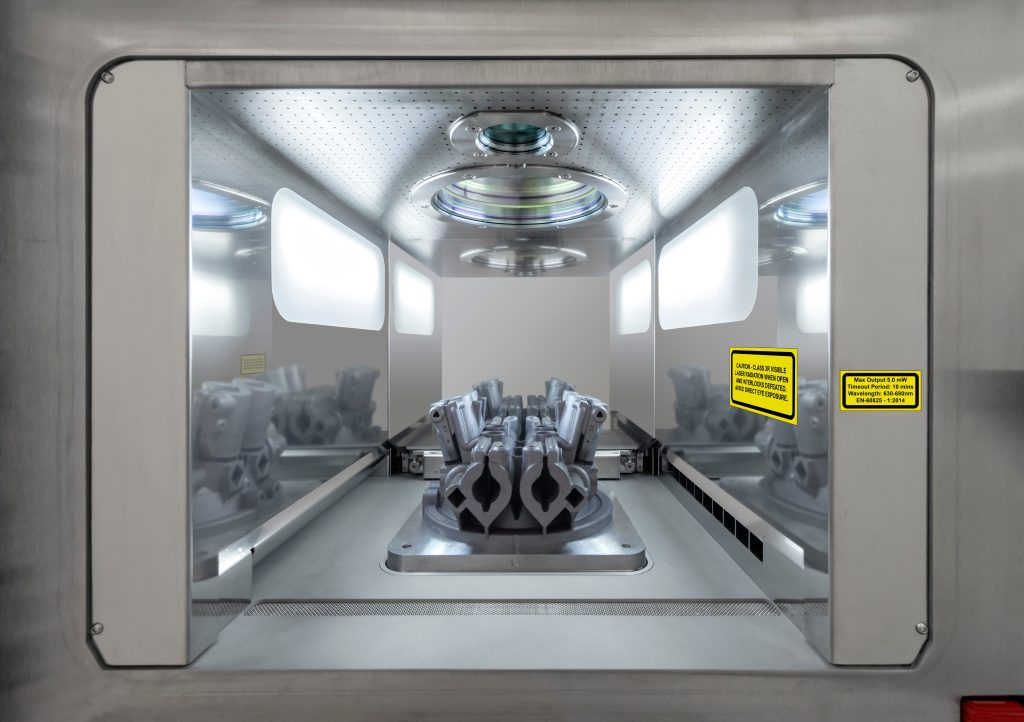

Featured image shows a BAE Systems engineer using a Renishaw 3D printer. Photo via Renishaw.