Peter Cannito, CEO of space infrastructure company Redwire, has said that it could grow by as much as 42% in the 2022 financial year, amid “the beginning of a new golden age” in space commercialization.

Cannito made his remarks on the firm’s earnings call, on which he also revealed that it had generated $137.6 million in revenue during FY 2021, 237% more than the $40.8 million it brought in over FY 2020. Redwire’s rapid revenue rise was fuelled by the conversion of its substantial backlog, several new aerospace initiatives and its acquisitions, including that of microgravity printing specialist Techshot.

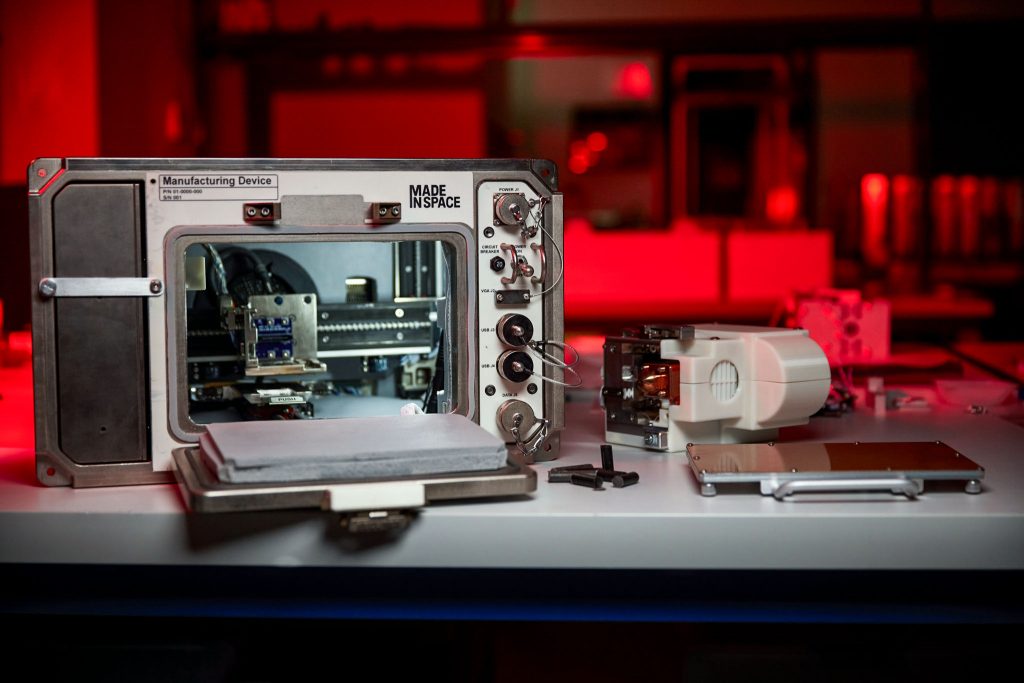

“In 2021, as a leading platform for industry consolidation, we continued our successful track record of mergers and acquisitions,” said Cannito on the call. “In the fourth quarter of 2021, we acquired Techshot, a leader in space biotechnology and advanced payloads with cutting-edge 3D in-space bioprinting capabilities. Techshot is a natural fit with our 3D printing strategy, and fits perfectly with our ‘heritage plus innovation’ strategy.’”

Redwire’s FY 2021 financials

Unlike a number of other 3D printing-related firms, Redwire doesn’t break down its financials by division. Instead, the company has opted to publish top-line figures related to its profitability and income performance, before using its earnings call to give investors an update on its activities over the past and coming financial years.

Of the $137.6 million the firm generated in FY 2021, $32.8 million of this was brought in by its newly-acquired businesses. Interestingly, when presented as if Redwire had managed to buy and integrate all these companies by the start of 2020, it adds that it would have hit $149.3 million in pro-forma revenue over the same period, reflecting the future growth potential of its acquisitions.

When it comes to revenue-drivers, the firm’s financial report points to the completion of multiple contracts, including the delivery of six coarse sun sensors and a fine sun sensor assembly to NASA. Moving forwards, it has been selected as a partner by Virgin Orbit and Terran Orbital as well, the latter of which is planning an ‘Industry 4.0’ production facility, providing Redwire with a solid project backlog.

In line with the higher earnings provided by its purchases, the company’s cost of sales also rose between FY 2020 and FY 2021, from $32.7 million to $108.2 million. However, Redwire has stated that this is “consistent with the growth of its business,” and highlighted how these costs actually fell as a share of its revenue over the period from 80% to 79%.

Likewise, the firm’s selling, general and admin expenses went up from $65.6 million in FY 2020 to $78.7 million in FY 2021, with the latter figure representing 57% of its overall revenue. According to Redwire, this jump in spending was due to costs associated with the new start-up business ventures it supported during the period, in addition to those incurred by its now-complete $615 million SPAC merger.

| Redwire Financials ($) | FY 2020 | FY 2021 | Difference (%) |

| Revenue | 40.8m | 137.6m | +237 |

| Cost of Sales | 32.7m | 108.2m | +231 |

| Gross Margin | 8.1m | 29.4m | +262 |

| Net Loss | 14.4m | 61.5m | +328 |

A ‘heritage plus innovation’ strategy

On Redwire’s earnings call, Cannito provided an insight into how its acquisition-heavy approach over the last two years ties into its broader goals. By combining its own business with over 50 years’ experience of delivering on space infrastructure projects, with the innovative technologies of those companies it has bought, the firm’s CEO said that it has taken a “heritage plus innovation” approach.

In doing so, Cannito said that Redwire can become “the leading designer, developer and supplier of highly-engineered components, systems, subsystems and software critical to the future of space,” to both national security and commercial clientele.

With regards to 3D printing, specifically, this strategy has been borne out in the success of its related businesses over the 2021 financial year. In July, the company successfully showcased the capabilities of its Hybrid Architecture Laboratory Operational Environment for US national defence applications, before launching the Redwire Regolith Printer to the International Space Station a month later.

On the subject of space stations, Cannito also made reference to the Orbital Reef on Redwire’s earnings call, saying that he’s “proud to be a part of” and support the first commercially-run base in-orbit. It’s anticipated that as part of the mission, the firm will use the technologies of its Made In Space subsidiary, to contribute to the mission’s microgravity R&D and manufacturing activities.

Having now acquired Techshot as well, a company with bioprinting expertise that previously worked with nScrypt to build a 3D BioFabrication Facility, Cannito added that he sees great potential in this area of Redwire’s business. In fact, looking ahead to FY 2022, the CEO said Techshot has “significant scaling opportunities,” and that it could yet be “foundational to the future of space commercialization.”

Projecting growth in the ‘golden age’

As we progress into FY 2022, Redwire is projecting revenue of $165 million to $195 million, which if borne out, would constitute growth of between 20% and 42%. That being said, the firm does admit that it encountered delays to the way contracts were awarded, as well as supply chain disruption related to the Omicron COVID-19 wave well into Q4 2021, so this trend could ultimately continue into FY 2022.

Additionally, even though Redwire ended the year with $20.5 million in cash, its CFO Bill Read emphasized on its earnings call that this does not give it the resources to achieve its “strategic objectives.” With this in mind, Read said the firm would “balance debt and equity to fuel future growth,” but given its $272 million backlog, he and Cannito were steadfast in their belief that its aims could still be realized.

“With launch costs continuing to decline, we anticipate an unprecedented expansion of space infrastructure,” concluded Cannito. “Redwire’s foundational technologies such as power generation, 3D printing, deployable structures, sensors, avionics, advanced payloads, space biotechnology and digital engineering, are the building blocks necessary for the future space economy.”

“The opportunity of what we are building at Redwire is enormous and we are continuing to gain momentum in the marketplace.”

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, debriefs, and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image depicts a satellite in low earth orbit (LEO). Image via Made In Space.