Industrial 3D printer manufacturer Essentium’s proposed merger with Special Purpose Acquisition Company (SPAC) Atlantic Coastal Acquisition has collapsed, leaving its plans to go public hanging in the balance.

Initially agreed in December 2021, Essentium’s SPAC merger was set to be completed by the end of Q1 2022, in a move that would have seen it join forces with Atlantic Coastal to form a publicly-listed $974 million firm. However, the agreement has now fallen through, amid claims that wider economic factors have prompted Atlantic Acquisition’s investors to pull out of the deal.

“We appreciate the Atlantic Coastal team’s support and guidance throughout this process, and we are disappointed that market conditions prevented the parties from consummating this agreement,” explained Teipel. “We will continue to leverage the strength of our additive manufacturing technology and product system validated by the US Department of Defense to continue to advance additive manufacturing globally.”

While 3D Printing Industry did interview Teipel one-to-one, he wasn’t able to elaborate upon the reasons behind Essentium’s SPAC merger collapse directly. As a result, a request for further detail has been put to the firm in writing, with any additional information gained set to be added to this article in due course.

Essentium’s SPAC merger collapse

When it was announced late last year, it was anticipated that Essentium’s SPAC merger would see it raise $346 million in funding, based on an initial valuation of its stock being listed at $10.00 per share. At the time, the firm justified this appraisal based on estimates that it would generate $212 million in revenue by 2023, and called its valuation “attractive” given that it represented 4.6x this amount.

The move not only had the backing of a $40 million fully-committed common stock PIPE worth over $40 million, led by the likes of BASF, Atalaya, and Apeiron, but it had also earned the unanimous approval of both firms’ boards of directors.

Yet, despite this, the deal has now collapsed, with Atlantic Coastal announcing that it will no longer be supporting Essentium’s proposed IPO. Under the terms of the termination, if it were to fail to acquire a target company in the future, or Essentium was to gain financing via another means, Atlantic Coastal would be granted the right to receive payments, though this will only happen in ‘certain circumstances.’

Both parties have also agreed that if Essentium isn’t sold by March 8, 2023, Atlantic Coastal will be allowed to acquire a stake equal to 5% of the company, in a deal that would value it at $500 million.

Speaking to 3D Printing Industry, Teipel said he could neither confirm nor deny that the company was seeking to complete an alternative IPO prior to this date, but he did say its “key abilities remain unaffected” by the deal’s dissolution.

Why has the deal fallen through?

Although both parties have said publicly that the merger was scrapped by “mutual agreement,” in reality, it fell through because Atlantic Coastal pulled its backing for the move. A similar fate befell Bright Machines’ $1.6 billion SPAC merger in late 2021, which fell by the wayside with timing being cited as an issue, but both deals’ termination does also reflect a growing hesitancy towards such IPOs.

In Shapeways’ merger with Galileo Acquisition, for instance, it failed to attract the investor interest it had anticipated, raising $103 million in gross proceeds from the deal, far less than the $195 million it had hoped for. Likewise, Velo3D generated $274 million worth of funding via its merger with JAWS Spitfire Acquisition, just over half the $500 million it had first targeted with the move.

It could be said that these relative failures to attract investor interest come down to the “market conditions” cited by Teipel for the collapse of his firm’s deal, but some analysts have also criticized the revenue projections and valuations attached to firms in the run-up to proposed SPAC mergers, with Stanford Law School Business Professor Michael Klausner labeling them an “aberration.”

“The market is finally learning that SPACs are a bad deal for investors,” explains Klausner. “I don’t think this is due to inflation or any sort of cycle. For the past decade, SPACs have lost money for their investors, on average, every year. For targets, on the other hand, a SPAC [merger] can be a good deal. This is because the SPAC’s shareholders tend to bear the costs [of the transaction].”

Given that SPAC mergers require less disclosure from the acquired firm than traditional IPOs, it’s also possible that Essentium’s deal collapsed after Atlantic Coastal discovered something that caused it to reconsider its position. In 2019, Jabil accused Essentium employees of IP theft, so there have been questions about its technology in the past, but Teipel insists these have now been put to bed.

“So the lawsuit remains resolved… and there’s been no change with regards to Jabil,” added Teipel. “What I would say is, this team has a very strong and robust intellectual property portfolio with well over 150 patents, that are in various stages of prosecution both domestically in the United States and also internationally, across materials, machines, processes, and even certain industries.”

Essentium confirms staff layoff

While Atlantic Coastal has already announced that it “will seek an alternative business combination,” Essentium’s IPO has been somewhat left in the lurch by the failure of its SPAC merger. The deal’s collapse has no doubt affected the firm’s run rate, as it has missed out on a significant funding opportunity, and some of its employees recently took to Linkedin to announce a “widespread layoff” of its staff.

Speaking to 3D Printing Industry, Teipel confirmed that this was indeed the case, with around 40% of its workforce being laid off towards the end of January. What’s more, even though Essentium’s CEO argued that sometimes “promising, high-growth companies face headwinds,” and that the move wouldn’t affect the firm’s “ability to operate,” he couldn’t say for sure that further layoffs won’t be needed.

“We had to make a difficult decision to adjust our team size at the end of January,” added Teipel. “We have done everything we can to make sure that it’s kind of ‘one and done,’ but you never know what the future holds. The goal here though, is to make sure that we have an absolutely amazing group, so that we can move forwards and support our clients.”

Are SPAC mergers falling out of fashion?

During the last 18 months alone, the number of 3D printing firms choosing to go public via SPAC mergers has shot up, with more than $16 billion worth of these deals being agreed upon. Becoming publicly listed in this way is known to provide benefits compared to doing so via normal IPOs, particularly when it comes to the pace at which they can be conducted, as they’re often finalized within a matter of months.

This streamlined process also means that SPAC mergers require companies to spend less on legal fees and financial consulting, making them cheaper to conduct, while they often provide access to lucrative funding opportunities from in the form of PIPEs, a similarly rapid form of investment that has thus far, seen private investors pledge to pour more than $2.9 billion into 3D printing-related businesses.

However, in our SPAC analysis last year, experts such as John Howe of the University of Missouri predicted that spiking interest in these deals had become a “hobby or distraction” during lockdown and that there “would be less of this” as things opened up. Is the collapse of Essentium’s deal a sign that Howe’s forcecast may be coming true?

UPDATE: In response to written questions submitted by 3D Printing Industry, Essentium had the following to say:

3DPI: In the press release about the collapse of Essentium’s merger with SPAC Atlantic Coastal, you mention that the deal fell through due to “market conditions.” Could you elaborate on what you mean by that please?

Essentium: Unfavorable market conditions were impacting our ability to achieve certain business targets. Together with Atlantic Coastal Acquisition Corp, we agreed to terminate the transaction.

3DPI: How has the deal’s collapse affected your run rate?

Essentium: The mutual decision to part ways with Atlantic Coastal has afforded us the ability to be laser-focused on our core business objectives – which are continuing to deliver world-class 3D printing platforms, industrial-grade materials, and support to our customers.

3DPI: A number of analysts have raised concerns that the valuation of firms acquired via SPAC mergers are unrealistically high. Earlier this month, Carson Block even labelled them “uninvestable.” Was valuation a factor in the collapse of your deal?

Essentium: It is not our role to comment on valuations of other businesses. Our priority is to focus on our market, customers, employees, and investors.

3DPI: Following the collapse of your SPAC merger, are you planning to pursue another IPO?

Essentium: Our goal right now is to remain laser-focused on our core business objectives – which are continuing to deliver world-class 3D printing platforms, materials, and support to our customers.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, debriefs, and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

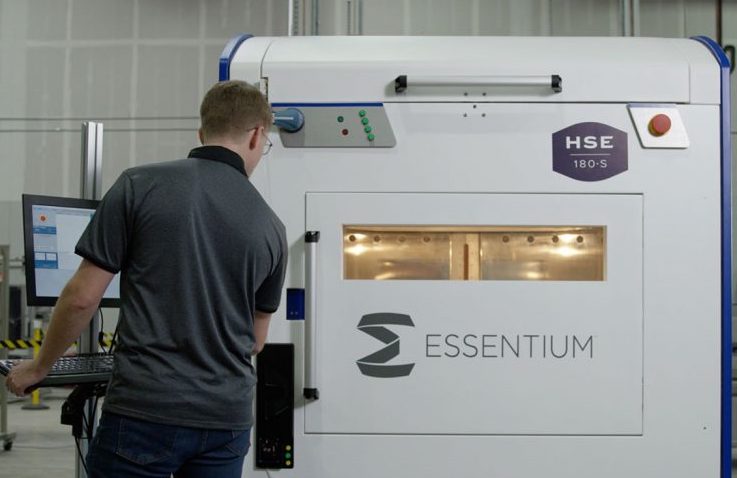

Featured image shows an engineer using Essentium’s HSE 180-S 3D printer. Photo via Essentium.