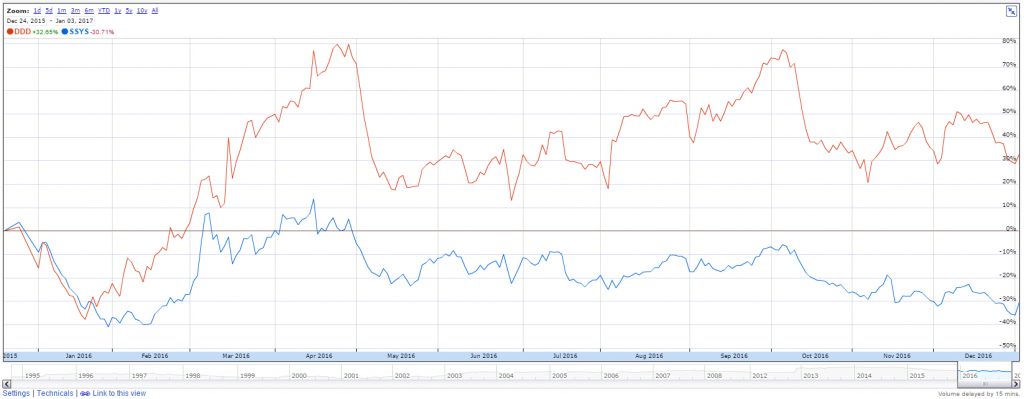

Stratasys stock (NASDAQ:SSYS) has significantly under-performed in 2016. The 3D printing manufacturer’s share price decreased by 30% during 2016, while rival 3D Systems (NYSE:DDD) stock went up by over 50%. Today the company’s market valuation is almost half that of 3D Systems. Two main reasons should explain this poor performance in 2016: a lack of clear direction and the absence of a leading core business.

A lack of clear direction

The acquisition strategy between 2010 and 2013 led to the creation of a large asset group, without any strong focus on innovation. In the years 2014-2016, Stratasys tried to integrate the acquired businesses while key founders and executives were leaving the boat. The company failed to attract new talents. In 2016, Stratasys appointed Ilan Levin as CEO to replace David Reis. Fresh ideas and decisive traction won’t come from Ilan a 3D Printing veteran with over 15 years on the board of Stratasys. Last week, Erez Simha the CFO/COO replaced with Lilach Payorski, who previously held the position of SVP Corporate finance.

3D Printing is moving at fast speed. Well funded Start-ups and spin-offs from large groups such as HP and Xerox are becoming serious competitors for Stratasys. Growth is only achievable for companies that can satisfy a growing demand from customers. A group who now have a much larger choice to purchase 3D printers and 3D printing services from.

In 2016, Stratasys failed to take decisive options and to clarify its business model. Hopes in early 2016 propped up the share price. Since then disappointing sales and more importantly a lack of clear direction explain the significant under performance since mid 2016.

The absence of a leading core business

3D Systems adopted a similar acquisition spree between 2010 and 2013. But the management decided in 2015 to narrow its focus on the professional markets. furthermore the company has grown significantly its healthcare segment, which represented 27% of the revenues in the third quarter 2016, as opposed to 22% in the same quarter one year ago. Overall in Q3/2016 3D Systems delivered a 5% revenues growth while Stratasys revenues decreased by 7% year on year. 3D systems performance in the third quarter has been supported by a strong growth in the healthcare segment of over 23% year on year.

The lack of clear strategy and engine of growth at Stratasys led to the poor performance recorded in 2016. Investors have lost faith in the capacity of the management (the old one and the “new” one) to elaborate an ambitious strategy to innovate and compete in a fast growing market.

What to expect in 2017?

By the end of 2015 and early 2016, investors were expecting big changes at Stratasys, led by an army of activist hedge funds. The early excitement didn’t last long. Twelve months after, at end 2016 the activists have left the boat, the management has been replaced with Stratasys veterans, revenues are heading down and competitors are taking market share. To change its destiny Stratasys needs some dramatic change of direction. I doubt it will come from some activist investors nor from the management. Only a possible suitor could shake the tree and extract value. In the meantime the share price could maintain its downward direction to the low $10.

Time is of the essence: the longer it takes for an external shock to come, the less value will remain in the intangible assets (nearly $600M at end September 2016).

Featured image shows Stratasys booth demo at Formnext 2016. Photo by Michael Petch.