The 3D printing and additive manufacturing industry is growing at a healthy rate according to the latest report released by CONTEXT, a global research firm with headquarters in London. Compared to prior year figures, the first half of 2016 shows an increase of 14% in sales across the world.

However, according to the findings of CONTEXT performance across the two main categories, Personal/Desktop and Professional/Industrial, is quite different. While the former increased sales by 15%, Industrial/Professional declined by 15%. Describing the emerging difference between both categories Chris Connery VP for Global Analysis at CONTEXT said “There is little crossover between brands, channels and sometimes even end markets. While linked by the term ‘3D Printing’, the two markets are clearly distinct.”

3D printers for everyone

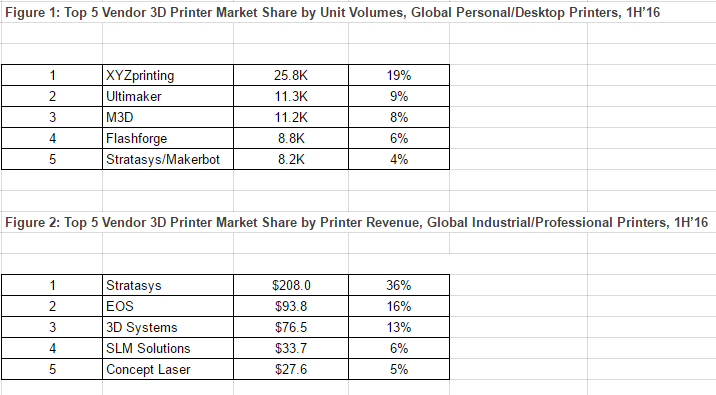

In the realm of Personal/Desktop use printers, hobbyists and enthusiasts remained the largest market segment, ahead of the education and engineering segments. In terms of market share by companies XYZprinting led with a 19% share followed by Ultimaker who took 9% of the market share according to the CONTEXT research. Other leading companies such as M3D and Flashforge also increased sales when compared to the same period for 2015.

According to the research, sales in this sector are expected to grow +35% in unit shipment by the end of the year. XYZprinting and a group of crowdsourced projects will contribute to this growth, as will an increasing number of companies offering entry level sub $300 3D printers.

The Pro level

In the Professional/Industrial market there was a decline of -15% in unit shipments, although revenues did grow 3% throughout the same period. This category accounts for 78% of the global 3D printer and AM industry due to the elevated price points, especially in the niche of Metal 3D printing. Interestingly enough, this same niche had a unit shipment increase of 17% in H1’16.

With GE Aviation’s recent announcement of its plans to acquire SLM Solutions and Arcam AB for $1.4 billion, the metal 3D printing sector continues to provide excitement for investors and may still see further merger activity as others seek to gain a foothold. Not only is GE planning to enhance its automotive, aviation and aerospace manufacturing capabilities with this technology, they are opening up new markets by selling metal AM equipment in a bid to become the market leader.

As the 3D printing industry continues to mature, CONTEXT see relative newcomers to the field such as HP, Carbon and Ricoh applying competitive pressure to the established lead of Stratasys and 3D Systems, who saw a decrease in their unit shipments. “With Stratasys and 3D Systems swapping out management and realigning strategies, competitive pressures are acting as a catalyst for future growth, with both of these top companies showcasing future technology advances prominently,” commented Connery.

Where is this leading?

As noted by Connery, with the exception of the metal additive manufacturing printers, most 3D printers are still centered around prototype development. “The next step for the industry is to focus on the ‘M’ side of the AM market. As the plastics side of the market begins to shift focus toward end-part production in 2017 and beyond, in line with the metal side which has already turned this corner, this market really will begin to accelerate.”

With the sales results in for H1’16 and CONTEXT’s projected figures for the year it appears that the 3D Printing and AM industry is in the process of further consolidation. Metal 3D printing is increasingly becoming a key component within the industry by demonstrating uses beyond prototyping, specifically within the medical, aviation and automotive industries. GE and HP’s recent advances onto the field demonstrates a growing interest by the larger consolidated technology firms, and could potentially lead to a shake-out or wave of acquisition across the sector. Recent activity by hedge funds also points towards continued growth, although whether this activity is necessarily beneficial to all is a contested point.