Market insights firm CONTEXT has published a report indicating that the COVID-19 lockdown-driven sales boom seen in consumer-centric 3D printers could be over.

In its Q1 2022 report, CONTEXT found that while shipments of the low-cost systems it calls ‘personal and kit & hobby printers’ were up on pre-pandemic levels, they were down 25% and 47% on Q1 2021. By contrast, the company says shipments of the highest-end 3D printers were “on the rise and accelerating” in the quarter, reflecting a “total reversal” of the trends seen during 2020’s COVID-19 lockdowns.

Reversing COVID-19 lockdown trends

As CONTEXT reported in 2020, the pandemic triggered a boom in desktop 3D printing shipments, which soared by 24% between Q1 and Q2 2020 alone. One possible explanation for the variance was the use 3D printers in this category during the first COVID-19 lockdown for many Western countries, a period in which designers and makers sought to contribute their skills and expertise in the fight against the impact of the disease.

Although CONTEXT’s latest analysis doesn’t directly reference PPE, the technology was used extensively in an attempt to address equipment shortages, particularly during the pandemic’s early stages. In the case of manufacturers, the likes of PrintParts and PostProcess 3D printed testing swabs to meet US demand, while Photocentric 3D printed PPE for the NHS, as part of a multi-million part contract.

However, this effort wasn’t just spearheaded by manufacturers, and engineers have also developed 3D printed masks, swabs, ventilator parts and other PPE over the last two years. Such equipment has been produced so widely that the FDA has even issued updated medical 3D printing guidance, to ensure they remain clinically-compliant, and it’s in this environment that desktop 3D printing thrived.

As the situation around COVID-19 PPE has stabilized, the demand for 3D printed alternatives has also dipped, and this trend is reflected in CONTEXT’s Q1 2022 report. In its analysis, the firm says that shipments of low-end machines, those it categorizes as being sub-$2,500 or self-assembled, were “significantly down” on Q1 2021, but it adds that this decline wasn’t apparent in all applications.

The education market, in particular, continues to benefit from strong government support, with the likes of Zortrax and MakerBot recently gaining from such initiatives. Although the report makes it clear that these installations haven’t impacted sales just yet, it suggests that such subsidies and programs could “offer a shot in the arm,” and “give hope to a market struggling to find a new accelerant.”

Rising demand for higher-end 3D printers

On the flipside, while CONTEXT’s report identifies a decline in demand for low-end 3D printers, it shows that shipments of “almost all types” of industrial systems worth $100,000 or more grew in Q1 2022. In this category, binder jet machines enjoyed the most growth, with shipments rising 113% over Q1 2021. The firm calculates that the technology only represents 8% of the metal 3D printing market, but suggests that the likes of GE and HP with its Metal Jetting process, could change this in future.

When it comes to volume, the report identifies UnionTech as the leader in the highest-end industrial segment, although it did experience a 6% dip in shipments between Q1 2021 and 2022. This decline, according to CONTEXT, was caused in part by China’s ‘Zero Covid’ policy, which has seen many major cities locked down, and it says the country’s growth is now “likely to be further stymied in Q2 2022.”

In the $2,500-$20,000 professional printer category, meanwhile, the company’s report shows that Ultimaker and Formlabs systems accounted for 55% of all those shipped in Q1 2022. CONTEXT found that Raise3D and SprintRay experienced better growth in this area during the period, but its report also emphasizes the significance of “market leaders” in the division’s performance, with Ultimaker and MakerBot’s merger now expected to be followed by an ‘expansion of their portfolio.’

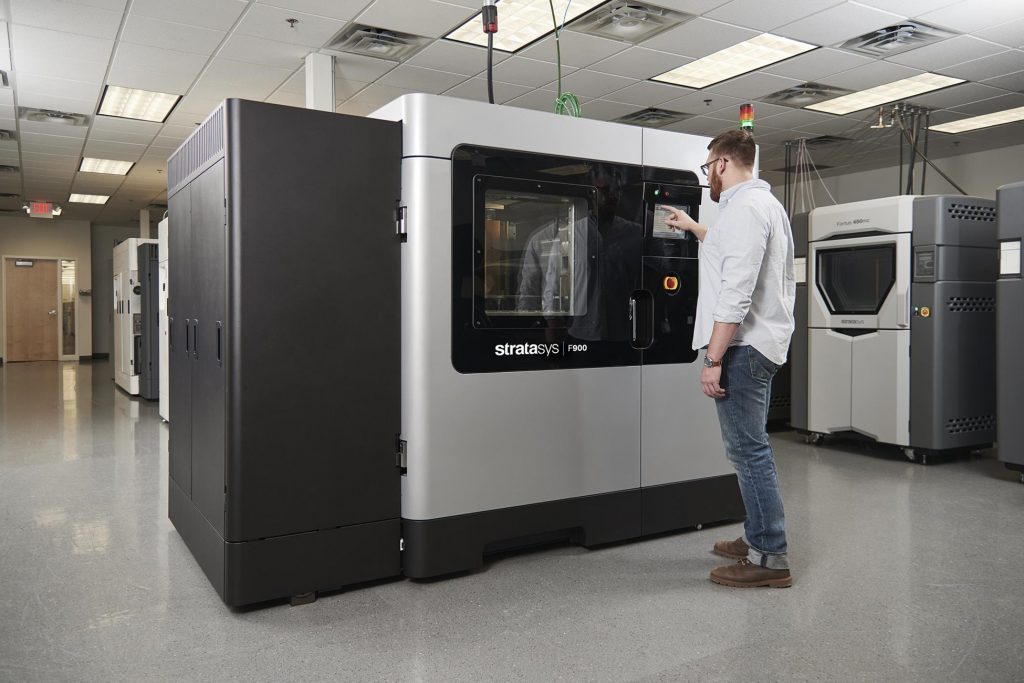

Lastly, in terms of designer 3D printers, which CONTEXT categorizes as those sold for $20,000 to $100,000, it found that each of the top ten firms for shipments in the segment had seen growth between Q1 and Q2 2022. 3D Systems saw its MultiJet Printing shipments rise 53% over this period, while Stratasys shipped 44% more PolyJet machines. Interestingly, the report highlights existing product lines as being the primary driver of the 19% growth achieved in the segment during Q1 2022, although sales generated via acquisitions were also credited with playing a part.

Moving forwards, CONTEXT expects industries such as aerospace and dentistry to remain key to the growth of industrial system manufacturers, with their shipments projected to rise 24% in FY 2022. In the longer-term, the firm’s report adds that 3D printing’s continued incursions into volume production, as well as its viability as an in-sourcing tool, could drive it to a 5-year compound annual growth rate of 28%.

Chris Connery, Head of Global Analysis at CONTEXT, concludes that “in spite of headwinds from factors including global inflation, a slowdown in China’s economy related to current COVID mitigation efforts, looming fears of regional recessions, and the ongoing Russian incursion into Ukraine, manufacturers of industrial 3D printers remain bullish in their collective outlook for 2022.”

Mapping 3D printing’s trajectory

Of course, CONTEXT isn’t the only firm that specializes in gathering market insights, and plenty of others have also published reports forecasting that 3D printing is in line to achieve significant growth. Wohlers Associates, which was bought by ASTM International last year, revealed in its 2022 State of 3D Printing Report that the industry has bounced back from the pandemic, and grew by 19.5% in 2021.

AMPOWER’s latest 3D printing report, on the other hand, has projected that the 3D printing market will grow at a yearly rate of 18.2% over the next four years. This expansion, the firm anticipates, will be driven in large part by metal 3D printing, which it tips to grow at a rate of more than 25% until 2026, compared to the 14.4% growth rate expected of polymer technologies.

Every now and then, wider international organizations also contribute their views on where additive manufacturing is headed as an advanced technology. In February 2022, for instance, the World Economic Forum claimed 3D printing could achieve a major leap in the near future, but only if it can overcome its adoption roadblocks.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, debriefs, and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

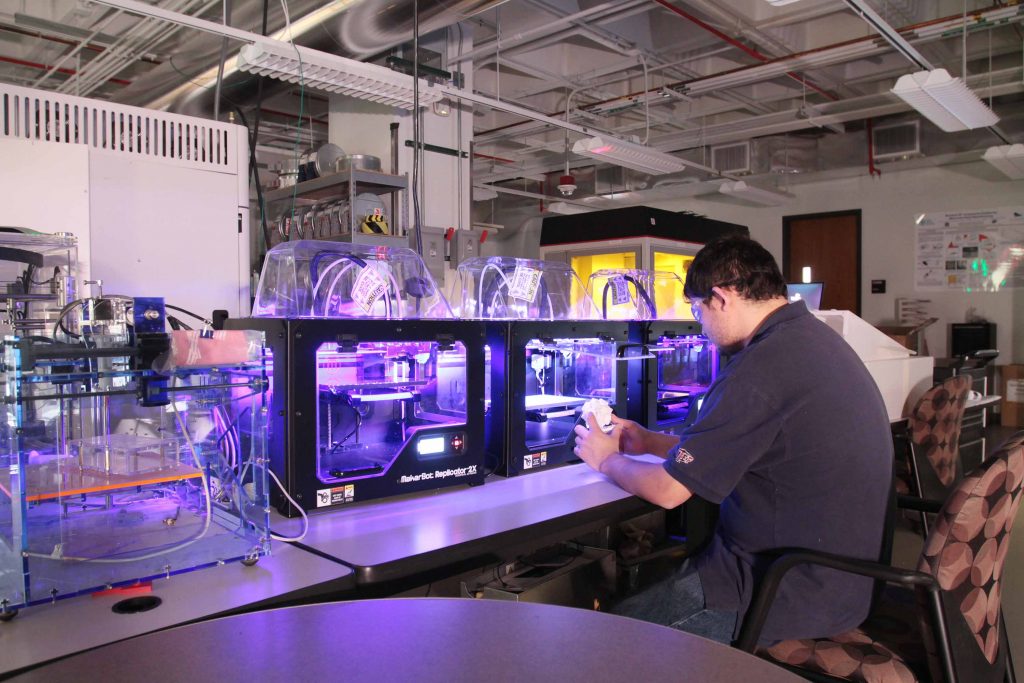

Featured image shows a desktop 3D printer farm at UTEP’s Keck Center. Photo via UTEP/Keck.