Today marks the start of US trade tariffs on goods valued at $34 billion worth of imports from China. A list published by the Office of the United States Trade Representative (USTR) details the 818 tariff lines that will be subject to an additional 25% in duty.

China has responded with additional import taxes on US goods valued at a similar amount. 3D Printing Industry contacted resellers, manufacturers and other 3D printing insiders around the world for their thoughts about how the “the biggest trade war in economic history” will impact additive manufacturing.

So are the trade tariffs a threat, opportunity or a distraction?

Michael Petch, 3D Printing Industry: What are your thoughts about the recent tariff announcements?

Avi Reichental, Vice Chairman, DWS, “In a world that is connected economically in which it has been proven conclusively that an unrestricted global economy is good for everybody over a meaningful period, the role of government is to make it safer for business people and entrepreneurs to invest and grow their businesses. All these tariffs become friction in the system that should otherwise compete on its own merits.”

Shu Peng, founder of Peopoly, “It is terrible for OEMs as exporting may get taxed while imported materials may get more expensive. The uncertainty is also bad for business as it is hard to make a long-term plan.”

Christophe Mandy, Manufacturing Lead at Formlabs, “President Trump believes these increased tariffs on goods imported from overseas are necessary, not only for national security, but also to boost U.S. business interests and the economy. Unfortunately it feels as though the fallout from the Trump tariffs are having an adverse effect, which we’re seeing play out as allies announce retaliatory tariffs.

If the intent is to boost manufacturing in the U.S., the overall effect seems to be to dispersed supply chains across East Asia instead, by having component supplies continue to be sourced in China, and assembled in another low-labor-rate geography. If the intent is to punish a currency manipulator or to get China to remove tariffs on U.S. goods, there are many other parties both in the U.S. and around the world that will get harmed much more directly.

Due to the selection of goods to be dutied, smaller U.S. businesses that work in core industrial sectors are disproportionately affected. For example, mass market electronic goods such as cell phones or computer equipment aren’t on the dutiable lists, but printed circuit boards for these are. This is intended to boost demand for printed circuit board manufacturing in the U.S., but instead pushes the final assembly offshore, or to substitute Chinese printed circuit boards, a highly automated and commoditized process, for one of many other non-U.S. sources. It also affects small and medium sized businesses buying components from China rather than large multinationals with high volumes of finished goods coming from China.”

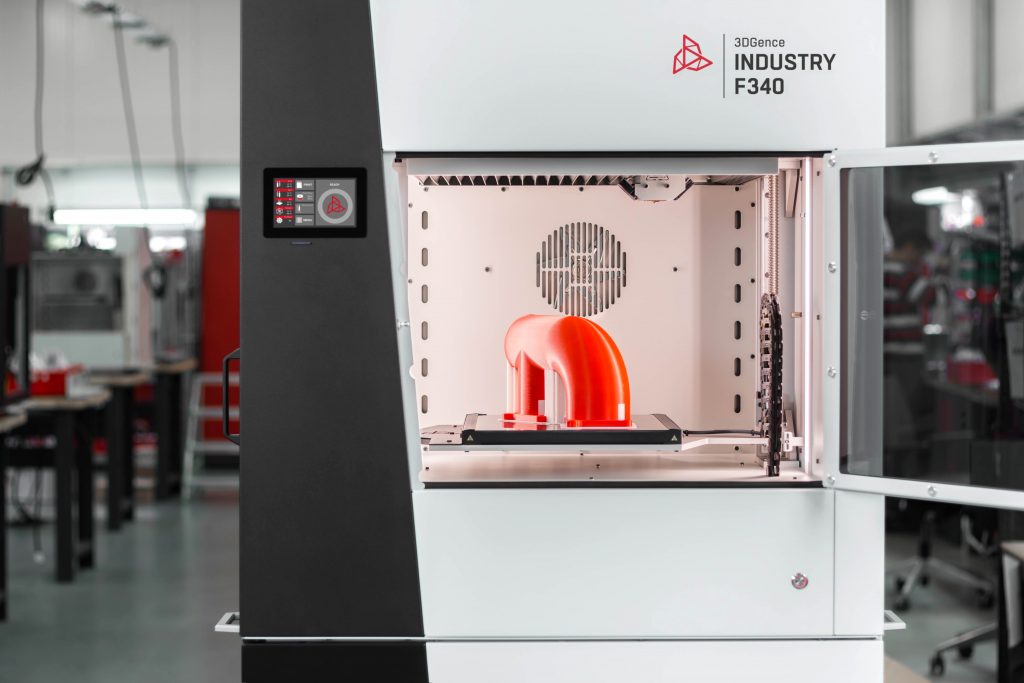

Mateusz Sidorowicz, Marketing Manager, 3DGence, “First of all, we thought that they are unnecessary and will block technology transfer between regions. Not only 3D printing will be influenced by that and many companies will lose a solid share of customers. At the end of the day the customers will be influenced by less diverse products on the market to choose from.”

Michael Petch, 3D Printing Industry: What is your appraisal of how such tariffs will affect your supply chain and business?

Avi Reichental, Vice Chairman, DWS, ““I think that China is a very important 3D printing marketplace – both as a supplier of increasing importance and for their strategic contributions. China is one of the countries that has invested the most in 3D printing in the last five years. They are taking it very seriously as an exponential technology that is critical to their future. It won’t be a positive development to customers who are looking to use Chinese systems elsewhere and for suppliers who are looking at the opportunity to supply their systems into the Chinese market which increasingly is consuming greater quantities of imported 3D printers. So overall, it’s not good for the ecosystem.”

Shu Peng, founder of Peopoly, “The supply Chain is less affected in the short term, but uncertainty usually leads to higher prices for parts and materials. Regarding exporting, US is the big question mark in the scheme of things. Imagine you have to ship surface, and by the time your goods arrived in the US, the tariff may jump by 25%.”

Dr Ben Redwood, VP Supply Chain at 3D Hubs, “3D Hubs is unaffected as the vast majority of our 3D printing orders are produced locally by a Manufacturing Partner in the same country as the customer.”

Christophe Mandy, Manufacturing Lead at Formlabs, “The tariffs mostly affect three categories: electronic components, machinery equipment and components, and measuring equipment. All of these are important in the production of our printers and other products. The “parts and accessories” type of tariffs on all three categories above are especially cumbersome. But our supply chain is global, components come from Europe, Asia and the U.S., and finished goods are assembled in Europe, Asia and the U.S., as well. The tariffs are an inconvenience that requires us to adjust how we do business and source, by expanding the range of low-cost/high automation geographies from which we source. In most cases, components are either a commodity, for which there are many other sources outside of the U.S. or a specialized component, where it’s just not possible to manufacture elsewhere than where we currently source, primarily because of how new, immature and cutting edge the industry still is.”

Mateusz Sidorowicz, Marketing Manager, 3DGence, “It will be very difficult for companies that have production facilities in US or EU. Due to that regulation many manufactures from EU or US will have to make a decision; create and external manufacturing site in other regions to avoid the tariffs or to shut down the business because they will be not able to compete. It can also affect the price of the product as components used for 3d printers production may increase in prices.

Michael Petch, 3D Printing Industry: For the wider 3D printing industry, how should the tariffs be viewed?

Avi Reichental, Vice Chairman, DWS, “Industries like 3D printing and additive manufacturing thrive on the free and open trade of goods across borders and continents. We only have to remind ourselves that the best ideas and products might not come from our own backyard. If we are truly interested in promoting the best technologies and creating the most efficient designs, manufacturing processes and workflows, we have to create an environment which is safe and open to accessing and purchasing the best solutions regardless of borders and governments. If it’s not presenting a direct threat to the national security of any nation, we should enable the free and open exchange of goods that are uninhibited by artificial barriers.”

Shu Peng, founder of Peopoly, “It should be viewed as detrimental for the overall industry. There are very few [companies] if any who make all their parts in a single country. This can stunt the momentum that has been building for the last few years.”

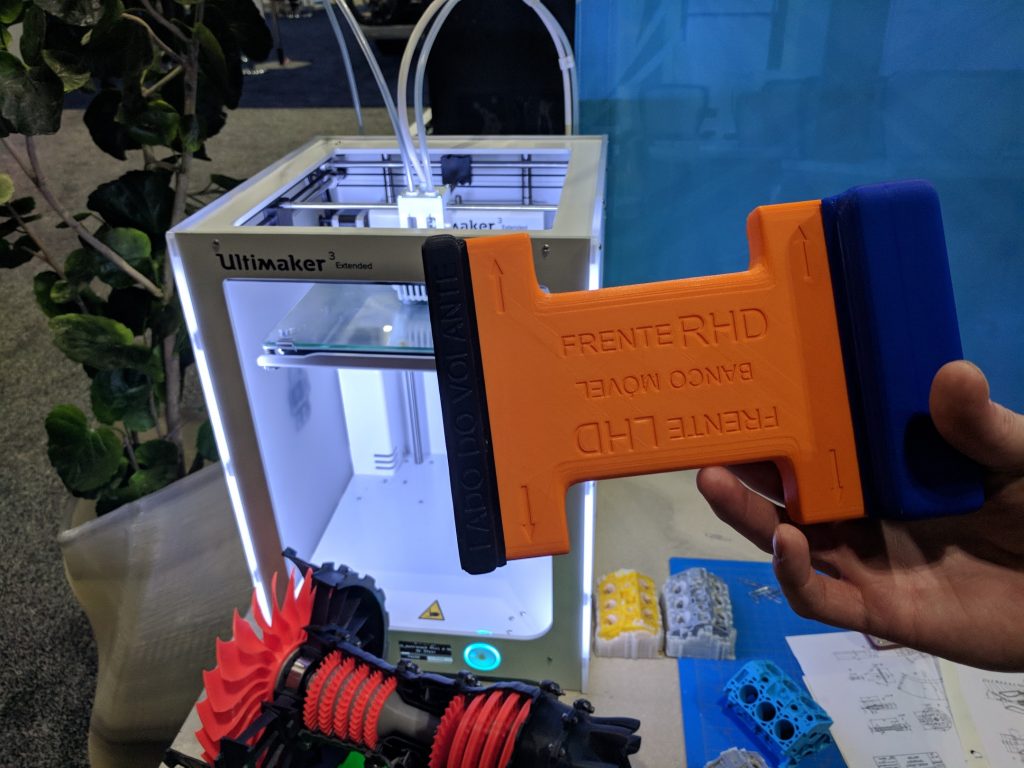

Dr Ben Redwood, VP Supply Chain at 3D Hubs, “3D printing is a unique form of manufacturing. Many of the 3D printing technologies are now moving towards being less about the skill of the operators, with many able to safely produce parts in an office or workplace. This has really put manufacturing back in the hands of the customer. Now more people are printing parts themselves or using localised networks like 3D Hubs, meaning tariffs do not play an important role in the decision-making process when compared to traditional methods of manufacturing.”

Christophe Mandy, Manufacturing Lead at Formlabs, “3D printing as a category is still very new, and harmonized tariff codes don’t explicitly call out the industry. Determining what harmonized codes our current and future products fall under has always been a nontrivial proposition, and these tariffs continue to make that murky. The 3D printing industry is also core to expanding manufacturing in the U.S.: the future of manufacturing involves 3D printing, the way to bring products currently manufactured abroad to the U.S. often involves some additive process. Imposing a tariff on this industry, or any of the other newer manufacturing developments is likely counterproductive.

Mateusz Sidorowicz, Marketing Manager, 3DGence, “As a major problem for the whole industry. There are not many huge companies in 3D printing world that can afford to hold the prices or move production site. Due to that, the products will again become not affordable and the market education will be slowed down a lot.

In our opinion the more printers are on the market the faster market education is moving forward. More educated customers – more sales for everyone. The barrier to expand to new markets for smaller companies may prove impossible to overcome.”

Michael Petch, 3D Printing Industry: On a longer time horizon, what are your thoughts about how industrial 3D printing and additive manufacturing might benefit end-user manufacturers? For example in distributed manufacturing scenarios.

Avi Reichental, Vice Chairman, DWS, “There is a preponderance of evidence that the basic additive manufacturing technologies are poised to break the historical speed and performance barriers that have kept them traditionally more in the rapid prototyping and low volume manufacturing bracket. My prediction is that over the next two or three years, we will see additive manufacturing on the production floor with all the benefits of traditional manufacturing. It will disrupt many different portions of manufacturing – not just in aerospace but also in automotive and consumer goods, including but not limited to processes that will rival today’s high-volume injection molding manufacturing. The real benefits will come from combining multiple parts together into single assemblies, lightweighting them, and delivering them in a way that is topology optimized, performance enhanced and cost competitive.”

Dr Ben Redwood, VP Supply Chain at 3D Hubs, “Distributed manufacturing networks like 3D Hubs are making it easier for engineers/designers and sourcing departments to locate and order parts from local industrial suppliers. The benefits of using distributed manufacturing for end-user manufacturers is two-fold, you get price competitive quotes from suppliers with instant capacity and the parts are produced near the end user meaning average turnaround times are significantly reduced. As technologies like SLA, SLS and HP’s MJF become more widely adopted thanks to access to affordable machines, coverage will increase on a national level which removes the potential concerns around tariffs.”

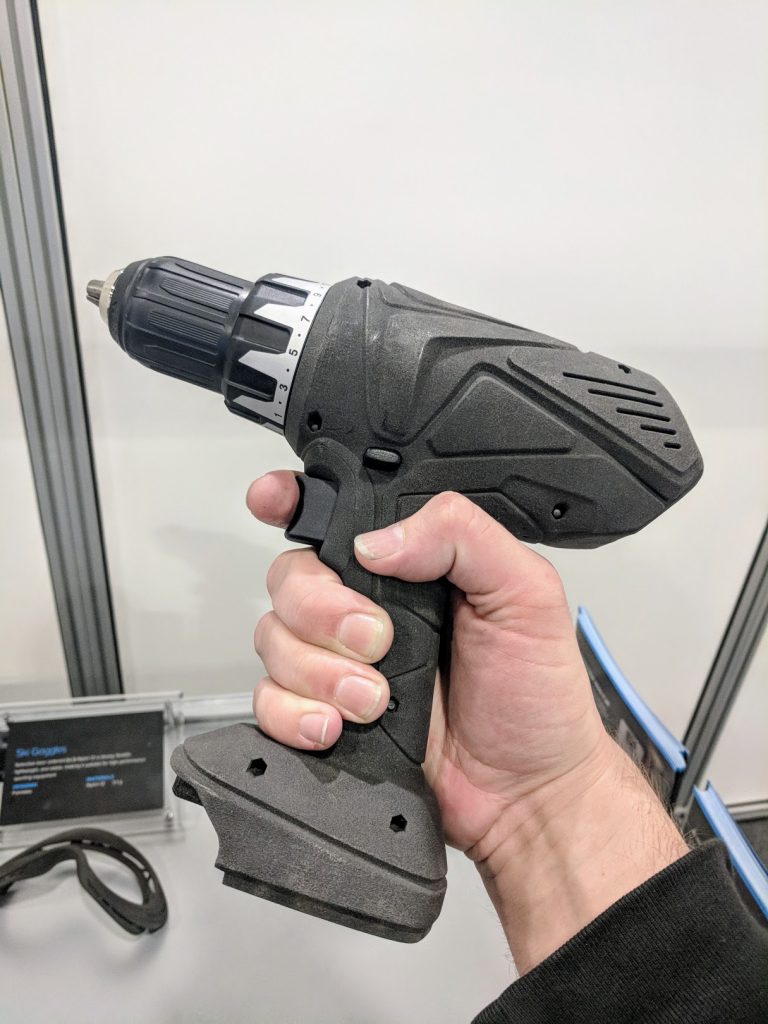

Christophe Mandy, Manufacturing Lead at Formlabs, “The longer term promise of mass customization or distributed manufacturing may be affected by whether a global trade war takes root. The role additive manufacturing would play in localized manufacturing will grow as more end use products that are highly customized come to market. In the interim, additive manufacturing benefits end user manufacturers in two key ways: creating and rapidly iterating on production of jigs, fixtures, tools and other production equipment, and economically production of parts in volumes that fit between the moulding range (with higher fixed costs) and the milling range (with higher variable costs).

Mateusz Sidorowicz, Marketing Manager, 3DGence, “Through our client we already see how it’s going. Several projects with global companies are already in motion.

Just one example of that – imagine that you are working on an upgrade for an existing product. The update is crucial for safety reasons. You can develop and print the object in your HQ and then send validated gcode to all your facilities around the globe and implement the upgrade in no time. In the world where the road to market is getting shorter and shorter distributed manufacturing will be crucial to achieve success.”

Additive Manufacturing analysts and experts comment

3D Printing Industry also discussed the impact of trade tariffs on the 3D printing industry with a number of other experts. Vinson Chien, Director at XYZPrinting said, “XYZprinting printer is not manufactured in China so we are good. We see many 3D printers are imported from China and use the wrong HTS code to avoid the import duty, which is definitely wrong and take advantages from US. It may be a good chance to review all the importers with a fair competition.”

Kevin Pope, COO of MatterHackers, said “In the short term, we anticipate these tariffs driving up consumer costs, which has the unfortunate effect of making 3D printing less accessible and runs counter to MatterHackers’ goals as a company. The impact will be felt directly in the case of 3D printer materials (The targeted HTSUS code 3916.90.30 is used for importing certain filaments) and indirectly in the case of 3D printers themselves which, even when domestically produced, invariably rely on globally sourced components.

The long term effect is difficult to predict, but even a 25% increase in the tariff on impacted goods does little to close the gap in the fundamental cost structure differences between the U.S. and China when it comes to labor, so it’s hard to see the supply equation changing dramatically. Case in point – our initial evaluation of the tariff’s impact on MatterHackers’ catalog has revealed no obvious instances where it was now cheaper to use a U.S. supplier on a currently imported item.”

Chris Connery of Context, “Our quick assessment is that while the US is indeed the largest region for consumption of both Industrial and Personal 3D Printers, there is only marginal risk (with this round of tariffs) for the total Desktop 3D Printer market and less possibly for the Industrial 3D Printer market but we need more detailed analysis.

Part of the challenge is that the 3D Printer market is so small and fragmented that we find that different vendors import products into the US under different codes. [For example] machining companies might use one code while IT companies use another; and while we collectively refer to the market under the same “3D Printer” banner metal 3D Printers are typically classified differently than Polymer printers so many different codes for importing products). Most industrial printers do not originate from China so not much exposure there we don’t imagine, except for various Chinese companies working their way into the US market.

This is quite different than the Personal 3D Printer market which follows more of the OEM supply chain as is see in the IT market where a lot of product is produced in China (on an OEM basis). But for Personal 3D Printers while they may come from Chinese vendors, they are actually produced in other regions [for example] Thailand.

In either instance, the AM3DP market is too small for the US government to worry about but might be the unintended victim of tariffs intended for other areas.”

A chilling effect

In this article we have gathered the responses from a reasonable number of experts. However it must be mentioned that a substantially larger number of enterprises were unwilling to comment publicly on this “highly charged” issue. This in itself could be seen as a worrying “chilling effect” as enterprises seek to avoid any potential backlash in an increasingly politically polarised environment. Please contact us if you would like to share your thoughts about the trade tariffs (or other news), on or off the record.

For all the latest 3D printing news, subscribe to the 3D Printing Industry newsletter. Also, follow us on Twitter, and like us on Facebook.

Make your next additive manufacturing career move or hire new talent. Search and post 3D Printing Jobs on our free jobs service.

Featured image shows U.S. President Donald Trump waving next to Chinese President Xi Jinping.