Industrial 3D printer manufacturer Essentium has unveiled plans to go public via a merger with Special Purpose Acquisition Company (SPAC) Atlantic Coastal Acquisition.

Set to be completed by the end of Q1 2022, the deal will see the firms combine into a joint venture worth an estimated $974 million, that’ll be listed on Nasdaq under the ticker ‘ADTV.’ It’s anticipated that the transaction will raise the resulting enterprise $346 million, but the companies have already poured cold water onto spending speculation, by saying “proceeds are expected to primarily fund organic growth.”

“We believe that following this transaction, Essentium will be extremely well-positioned for rapid growth as it further expands its ecosystem offerings, capitalizes on its line-of-sight sales pipeline, and executes on its M&A strategy as it continues to advance AM as a public company,” Tony Eisenberg, CSO of Atlantic Coastal Acquisition said on the deal.

High Speed Extrusion technology

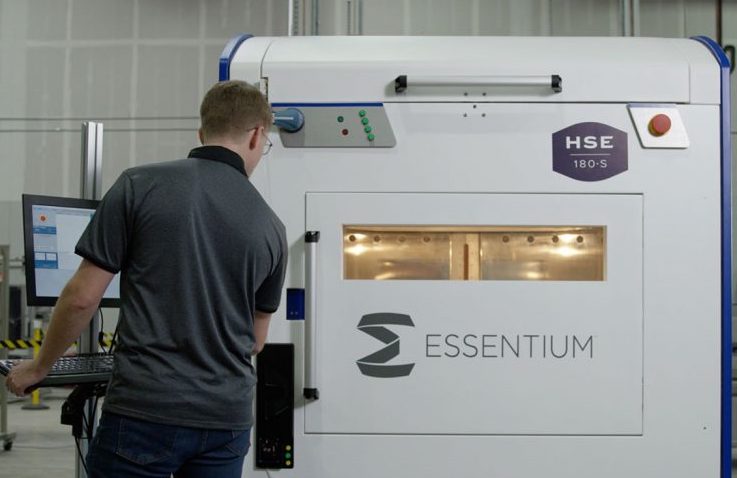

Essentium may have been around since 2013, but it didn’t launch its flagship High Speed Extrusion (HSE) technology until 2018. Designed to address the speed and strength drawbacks of traditional FFF systems, the company claims that its HSE printers are up to 15 times faster, while their in-built cameras are said to provide quicker datastreams as well, allowing users to monitor builds with high-precision.

Over the last three years, Essentium has steadily scaled its platform, first working with BASF and Materialise to introduce an open high-speed 3D printing model, then seeking to better support this with a new PEEK and nylon range that it co-created with LEHVOSS, as well as a fresh batch of high-performance filaments with aerospace, electronics and defense potential.

On the machine front, the firm has also expanded on its offering recently, by adding the HSE 240T to its existing HSE 180 Series and HSE 280i HT portfolio at Formnext 2021. Marketed as a “compact powerhouse,” the new system is designed to be small enough to fit into an SME’s factory, while still efficient enough to deliver cost and lead time benefits to those switching from traditional manufacturing.

Additionally, like many other 3D printing technologies, Essentium cites the potential of HSE to help manufacturers in-source their production as being one of its major benefits, and following its SPAC merger, the firm’s CEO Blake Teipel says that it’s now set to raise the funding necessary to truly scale the platform’s “distributed production capabilities.”

“Fundamental deficits in our existing global supply chain models are being exacerbated by escalating obstacles such as trade imbalances and the global pandemic,” said Teipel. “Today’s announcement represents a major milestone in our efforts to provide long-term, sustainable solutions for a new manufacturing paradigm that can meet these global challenges head-on.”

An upcoming $974 million IPO

Atlantic Coastal’s proposed merger with Essentium sees it value the soon-to-be-formed firm at $10.00 per share, assuming there are no redemptions by its shareholders. Given that Essentium anticipates generating $212 million by 2023, the deal could be lucrative for its shareholders, as the combined company is expected to be worth 4.6 times that amount.

Once the transaction is complete, the shareholders of both firms will roll their equity into the resulting enterprise, with Essentium’s backers retaining 64% of the stock, and Atlantic Coastal’s set to inherit 36%. For stockholders of the latter seeking to use their redemption rights over the deal, the company and Atalaya-affiliate ACM ARRT VII C LLC have agreed to conduct a joint tender offer for these shares.

Subject to limitations, this agreement will see Atalaya purchase the first 10 million shares tendered by stockholders exercising such redemption rights, while Atlantic Coastal has committed to buying the rest. Should the deal be terminated over the next two years, Atlantic Coastal has agreed to purchase Atalaya’s acquired shares at redemption price as well, adding stability to the transaction.

In terms of funding, the merger is expected to deliver up to $346 million in net proceeds to the combined company, assuming there are no redemptions or expenses related to the deal’s closure. Although Atlantic Coastal has a reported $346 million on its balance sheet, part of this capital will also be raised via a $40 million PIPE, backed by Atalaya, BASF, Apeiron, and investor Christian Angermayer.

Looking ahead, the merger may still be subject to the approval of shareholders, but the boards of both firms have unanimously approved the deal, and according to Atlantic Coastal CEO Shahraab Ahmad, the sustainability benefits of Essentium’s HSE technology should make it an ideal partner to achieve its eco-goals with moving forwards.

“We launched Atlantic Coastal with an ESG-centric focus and a mandate to partner with a company that will transform the nature of international commerce,” added Ahmad. “We believe that Essentium is exactly that partner. Blake and his experienced team have developed a deep technology moat that delivers significant recurring revenue, supporting gross margin expansion and highly attractive unit economics.”

AM’s SPAC IPO trend resurfaces

Over the last 18 months, a string of 3D printing firms have opted to go public through SPAC mergers instead of traditional IPOs, raising a huge amount of capital in the process. Prior to Essentium’s big reveal, part service provider, Fast Radius had been the most recent of these, after it unveiled plans to go public via a $995 million SPAC merger in July 2021.

On the flipside, the likes of Xometry have also decided to go public recently but chosen to do so via conventional IPOs rather than deals with SPACs. Despite not having SPAC-backing, the company was still able to raise a reported $302 million from the transaction, nearly $50 million more than it had initially anticipated.

3D printer manufacturer Formlabs, on the other hand, said that it was avoiding the temptation to cash in on the industry’s SPAC IPO trend, after it raised $150 million in May 2021. The firm’s CEO Max Lobovsky reportedly said at the time that it was “large enough and mature enough” to go public, but that it would “take its time” and make sure it was ready to excel before making such a move.

To stay up to date with the latest 3D printing news, don’t forget to subscribe to the 3D Printing Industry newsletter or follow us on Twitter or liking our page on Facebook.

For a deeper dive into additive manufacturing, you can now subscribe to our Youtube channel, featuring discussion, debriefs, and shots of 3D printing in-action.

Are you looking for a job in the additive manufacturing industry? Visit 3D Printing Jobs for a selection of roles in the industry.

Featured image shows an engineer using Essentium’s HSE 180-S 3D printer. Photo via Essentium.